Share This Page

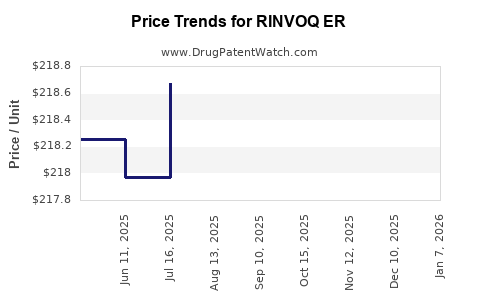

Drug Price Trends for RINVOQ ER

✉ Email this page to a colleague

Average Pharmacy Cost for RINVOQ ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RINVOQ ER 45 MG TABLET | 00074-1043-28 | 438.13636 | EACH | 2025-12-17 |

| RINVOQ ER 15 MG TABLET | 00074-2306-30 | 218.29280 | EACH | 2025-12-17 |

| RINVOQ ER 30 MG TABLET | 00074-2310-30 | 217.92897 | EACH | 2025-12-17 |

| RINVOQ ER 15 MG TABLET | 00074-2306-30 | 218.49102 | EACH | 2025-11-19 |

| RINVOQ ER 30 MG TABLET | 00074-2310-30 | 218.47284 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RINVOQ ER (Upadacitinib Extended-Release)

Introduction

RINVOQ ER (upadacitinib extended-release) is an oral Janus kinase (JAK) inhibitor developed by AbbVie, approved for the treatment of moderate to severe rheumatoid arthritis (RA), psoriatic arthritis, atopic dermatitis, and other inflammatory conditions. As a pivotal player within the evolving immunomodulatory therapeutic landscape, RINVOQ ER’s market performance and pricing trajectory are influenced by demand dynamics, competitive forces, regulatory trends, and healthcare policy shifts.

This analysis offers a comprehensive view of the current market landscape, competitive positioning, pricing strategies, and future price projections for RINVOQ ER, providing actionable insights for industry stakeholders.

Market Overview

Therapeutic Segment and Market Size

RINVOQ ER operates within the biologic and targeted synthetic DMARDs (disease-modifying antirheumatic drugs) space, targeting autoimmune and inflammatory disorders. The global RA market alone is projected to reach USD 32 billion by 2027, with JAK inhibitors accounting for a significant segment owing to their oral administration advantage over injectable biologics.

The expansion of indications—a trend driven by compelling clinical trial evidence—further broadens the market. For example, RINVOQ ER received FDA approval in 2021 for atopic dermatitis, augmenting its addressable market and aligning with a growing demand for oral alternatives to biologics.

Competitive Landscape

RINVOQ ER faces competition mainly from:

- Other JAK inhibitors: Pfizer’s Xeljanz (tofacitinib), Eli Lilly’s Olumiant (baricitinib), and AbbVie’s own Rinvoq (oral upadacitinib standard formulation).

- Biologic agents: Humira (adalimumab), Enbrel (etanercept), and newer biologics from Lilly and Janssen.

- Emerging therapies: Janus kinase and TYK2 inhibitors, as well as biosimilars, are poised to influence market dynamics.

Rinvoq has shown superior efficacy in certain patient populations, which, combined with its dosing convenience, has helped carve a premium position.

Market Penetration and Adoption Trends

Current Market Penetration

Since its FDA approval in August 2021, RINVOQ ER has experienced rapid adoption, particularly among patients seeking oral administration and those refractory to biologics. Real-world data suggest a rising prescription rate, driven by increasing physician familiarity and expanding indications.

Regulatory and Reimbursement Landscape

Insurance coverage and pricing negotiations heavily influence market access. RINVOQ ER benefits from strategic partnerships with payers to facilitate formulary placement, though pricing negotiations remain pivotal in determining its competitive position.

Patient and Physician Preference

Physicians favor RINVOQ ER for its convenient once-daily dosing and favorable safety profile relative to other JAK inhibitors. Patient preferences for oral over injectable treatments bolster its demand trajectory.

Pricing Strategies and Current Price Point

Current Pricing

As of early 2023, the wholesale acquisition cost (WAC) for RINVOQ ER is approximately USD 3,200 to USD 3,500 per month per patient, aligning with similar JAK inhibitors. This pricing is characterized by a premium, justified by clinical efficacy, safety profile, and convenience.

Pricing Factors

- Value-based negotiations: AbbVie emphasizes clinical benefit and cost-effectiveness to secure favorable reimbursement.

- Market competition: Price competition with Xeljanz and Olumiant influences incremental pricing adjustments.

- Indication-specific pricing: Different indications may have differential pricing based on clinical efficacy and payer negotiations.

Future Price Projections

Factors Influencing Price Trends

-

Market Adoption & Expansion

Increasing prescriptions for RA, atopic dermatitis, and other indications drive revenue, allowing for potential price stabilization or modest increases. -

Competitive Pressures

The introduction of biosimilars for biologics and potential generic formulations of JAK inhibitors may pressure prices downward. -

Regulatory & Policy Changes

Heightened focus on drug affordability, value-based pricing models, and international reference pricing may modulate future pricing strategies. -

Patent and Exclusivity Milestones

Patents for RINVOQ ER are expected to expire by 2030, opening the door for biosimilar competition and significant price erosion.

Projected Price Trends

Based on current market dynamics and comparable drug patterns, RINVOQ ER’s monthly pricing could see:

- Short-term (1-2 years): Stable or slight increases (~3-5%) driven by expanded indications and higher market penetration.

- Mid-term (3-5 years): Possible stabilization or reduction (~10-15%) as biosimilars and generics enter the market and reimbursement negotiations tighten.

- Long-term (beyond 5 years): Significant price reductions (~30-50%) anticipated post-patent expiry with biosimilar substitutions and increased generic competition.

Market Forecast and Revenue Projections

AbbVie's strategic focus on expanding indications and capturing broader therapeutic markets should foster steady revenue growth initially. However, as biosimilar competition intensifies post-2030, pricing reductions will likely curb profit margins.

Assuming initial annual revenues of approximately USD 2 billion, with a compound annual growth rate (CAGR) of 10% over the next three years, revenues could reach USD 2.6 billion by 2026. After biosimilar entry, revenues may plateau or decline sharply without new indications.

Conclusion

RINVOQ ER’s current market position benefits from its clinical efficacy, favorable safety profile, and oral dosing convenience. Price trajectories will be driven by competitive pressures, biosimilar developments, and policy reforms aimed at drug affordability. Stakeholders should monitor evolving reimbursement environments and biosimilar landscape shifts to optimize commercial strategies.

Key Takeaways

- RINVOQ ER commands a premium price driven by clinical benefits, with current WAC around USD 3,200–USD 3,500/month.

- Market expansion into multiple indications, including atopic dermatitis, supports revenue growth, tempered by increasing competition.

- Price stability is expected in the short term, with potential reductions post-patent expiration and biosimilar proliferation.

- Payer negotiations and policy reforms may influence future pricing, emphasizing value-based and international pricing considerations.

- Long-term sustainability will depend on innovation pipeline, including new indications and possible biosimilar entries.

FAQs

1. How does RINVOQ ER compare price-wise to other JAK inhibitors?

RINVOQ ER's price is comparable or slightly higher than other JAK inhibitors like Xeljanz (~USD 3,310/month) and Olumiant (~USD 3,250/month), supported by clinical differentiation and dosing convenience.

2. What factors could cause RINVOQ ER’s price to increase in the future?

Limited factors such as increased demand, expanding indications, or supply chain costs could modestly raise prices. However, competitive pressures tend to have a more significant downward impact.

3. When can we expect biosimilar competition to influence RINVOQ ER’s price?

Biosimilars for biologic competitors are expected to enter markets from 2025 onward, which may indirectly influence JAK inhibitor pricing strategies. For RINVOQ ER itself, patent expiry around 2030 could open opportunities for biosimilar-like generics.

4. Are there regions where RINVOQ ER is priced lower or higher?

Yes, pricing varies globally, influenced by healthcare policies, reimbursement schemes, and negotiation power, with emerging markets often paying lower prices than the U.S. and Europe.

5. What role do value-based pricing models play in RINVOQ ER’s future?

Value-based models could lead to adjusted pricing based on clinical outcomes, potentially stabilizing or reducing prices, especially in regions with aggressive cost-containment policies.

References

[1] AbbVie. "RINVOQ (upadacitinib) prescribing information", 2022.

[2] GlobalData. "Rheumatoid Arthritis Market Analysis", 2022.

[3] IQVIA. "Market Trends in Rheumatoid Arthritis and JAK Inhibitors", 2023.

[4] FDA. "RINVOQ (upadacitinib) Approval Announcements", 2021.

[5] Deloitte. "Pharmaceutical Pricing and Reimbursement Outlook", 2023.

More… ↓