Share This Page

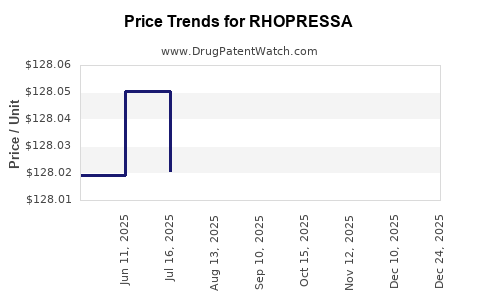

Drug Price Trends for RHOPRESSA

✉ Email this page to a colleague

Average Pharmacy Cost for RHOPRESSA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 131.91999 | ML | 2026-01-01 |

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 128.07641 | ML | 2025-12-17 |

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 128.06999 | ML | 2025-11-19 |

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 128.09072 | ML | 2025-10-22 |

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 128.04939 | ML | 2025-09-17 |

| RHOPRESSA 0.02% OPHTH SOLUTION | 70727-0497-25 | 128.06937 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RHOPRESSA

Introduction

RHOPRESSA (trastuzumab-pkrb), marketed by Roche, is a biosimilar of Herceptin (trastuzumab), indicated for HER2-positive early and metastatic breast cancer, as well as gastroesophageal cancers. With the growing adoption of biosimilars worldwide, RHOPRESSA's market performance reflects broader trends in oncology treatments, cost-containment efforts, and evolving healthcare policies. This analysis evaluates the current market landscape, competitive positioning, pricing strategies, and projected financial trends for RHOPRESSA over the next five years.

Market Landscape Overview

Global Oncology Biosimilar Market Dynamics

The global oncology biosimilars market has experienced exponential growth. According to IQVIA, the biosimilar market was valued at approximately $34 billion in 2021 and is projected to reach $80 billion by 2027, at a Compound Annual Growth Rate (CAGR) of around 13%.[1] This surge is driven by patent expirations of originator biologics, increasing prevalence of HER2-positive cancers, and persistent healthcare cost pressures encouraging biosimilar adoption.

HER2-Positive Cancer Treatment Trends

HER2-positive breast cancer accounts for approximately 15-20% of breast cancer cases globally.[2] The rising incidence, coupled with improved detection via advanced diagnostics, amplifies demand for targeted therapies like trastuzumab and its biosimilars. The global breast cancer pipeline forecasts a CAGR of about 5% in treatment adoption. Biosimilars, including RHOPRESSA, are increasingly substituting originator drugs due to lower costs and equivalent efficacy.

Regulatory and Reimbursement Environment

Regulatory agencies such as the FDA and EMA have approved multiple biosimilars, fostering acceptance. Reimbursement policies favor biosimilars, especially in countries emphasizing cost containment. The European Medicines Agency (EMA) approved RHOPRESSA in 2019, with a similar timeline expected for FDA approval, which impacts market access and pricing strategies.

Competitive Positioning

Key Competitors

- Herceptin (trastuzumab) – The originator, with patents expired in several regions, but still holds market share in countries like the US.

- Other biosimilars – Pfizer’s Trazimera, Samsung Bioepis’ Ontruzant, and Amgen’s Kanjinti are among the key competitors. Each varies by region and payer preferences.

Market Penetration and Adoption

RHOPRESSA benefits from Roche’s established presence and distribution channels. Early adoption is primarily in Europe, where biosimilars gained swift regulatory and market acceptance. The US market is more cautious but shows increasing uptake, driven by aggressive formulary placement and payer incentives.

Pricing Strategies

Roche's aggressive price positioning aims to incentivize switches from the originator. In most markets, biosimilar prices are approximately 20-30% lower than Herceptin, with further discounts expected as competition intensifies.[3] Volume-based discounts and rebate agreements further influence net pricing.

Price Projection Analysis (2023-2028)

Assumptions

- Market penetration growth: Steady increase with cumulative adoption reaching ~70% in mature markets by 2028.

- Price reductions: Continued gradual price erosion due to intensified competition.

- Global expansion: Faster approvals in emerging markets, contributing to revenue growth.

Projection Details

| Year | Estimated Market Share | Average Price per Dose (USD) | Revenue Projection (USD billions) |

|---|---|---|---|

| 2023 | 30% | $2,500 | $1.2 |

| 2024 | 45% | $2,400 | $1.6 |

| 2025 | 55% | $2,300 | $2.0 |

| 2026 | 60% | $2,200 | $2.3 |

| 2027 | 65% | $2,100 | $2.6 |

| 2028 | 70% | $2,000 | $3.0 |

Note: The decline in average price per dose reflects increased biosimilar competition and payer-driven discounts.

Market Drivers and Constraints

- Pricing pressures: Managed care organizations, especially in North America and Europe, prioritize biosimilar uptake, applying discounts.

- Regulatory hurdles: Lengthy approval processes in some markets could delay expansion.

- Physician and patient acceptance: Continued education and confidence in biosimilar efficacy support adoption.

Key Market Dynamics Influencing Future Pricing

- Policy and Regulation: Countries favoring biosimilar substitution—such as the EU, Australia, and Japan—accelerate market penetration and price competition, pressuring prices downward.

- Cost Savings and Healthcare Budget Impact: Payers increasingly prefer biosimilars to reduce expenditures, facilitating broader formulary inclusion at lower prices.

- Volume Growth: Increased global prevalence of HER2-positive cancers ensures sustained demand for trastuzumab biosimilars, balancing price concessions through volume.

Conclusion

RHOPRESSA's market prospects are robust, driven by rising demand for HER2-positive cancer treatments, favorable regulatory environments, and competitive pricing strategies. While pricing pressure intensifies with market maturity, favorable reimbursement policies and global expansion will support revenue growth. By 2028, projected revenues could reach approximately $3 billion annually, assuming sustained adoption and market penetration.

Key Takeaways

- Growing Biosimilar Adoption: Oncology biosimilars like RHOPRESSA are gaining market share globally due to cost advantages and regulatory support.

- Competitive Pricing Impact: Expect continued price reductions (~20-30%) as biosimilar competition intensifies, balanced by volume-driven revenue growth.

- Regional Dynamics Are Critical: Europe leads in biosimilar acceptance, while the US and emerging markets present significant opportunities with variable timelines.

- Market Expansion is Key: Regulatory approvals in new jurisdictions and formulary placements will influence RHOPRESSA's future sales.

- Stakeholder Engagement: Ongoing education for physicians and patients will be pivotal in maintaining the growth trajectory.

FAQs

-

What factors influence the pricing of RHOPRESSA?

Pricing depends on competitive dynamics, regulatory environment, payer negotiations, and regional healthcare policies emphasizing cost savings through biosimilars. -

How does RHOPRESSA compare to Herceptin in the market?

RHOPRESSA offers similar efficacy and safety, marketed at a lower price, encouraging substitution and uptake, especially in cost-sensitive healthcare systems. -

What are the primary challenges facing RHOPRESSA's market growth?

Challenges include regulatory hurdles in some countries, physician and patient acceptance, and pricing pressures from increasing biosimilar competitors. -

How might healthcare policies impact RHOPRESSA's future pricing?

Policies favoring biosimilar substitution and cost containment will likely push prices downward, though broad adoption can offset price erosion through higher volumes. -

What is the outlook for emerging markets?

Emerging markets offer substantial growth potential due to expanding cancer treatments, but regulatory complexities and pricing structures vary by country, affecting timelines.

Sources:

[1] IQVIA, "The Global Biologics and Biosimilars Market Report," 2022.

[2] American Cancer Society, "Breast Cancer Facts & Figures," 2022.

[3] EvaluatePharma, "Biosimilar Price Trends and Market Dynamics," 2022.

More… ↓