Share This Page

Drug Price Trends for RESTASIS

✉ Email this page to a colleague

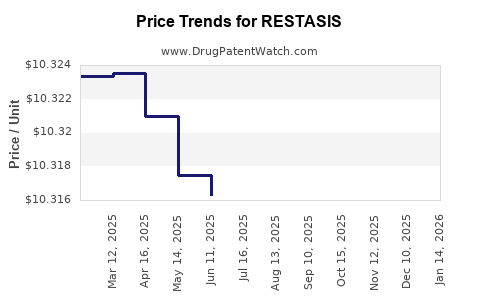

Average Pharmacy Cost for RESTASIS

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RESTASIS 0.05% EYE EMULSION | 00023-9163-30 | 10.31305 | EACH | 2025-12-17 |

| RESTASIS 0.05% EYE EMULSION | 00023-9163-60 | 10.32481 | EACH | 2025-12-17 |

| RESTASIS MULTIDOSE 0.05% EYE | 00023-5301-05 | 112.31613 | ML | 2025-12-17 |

| RESTASIS 0.05% EYE EMULSION | 00023-9163-30 | 10.31472 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for RESTASIS

Introduction

RESTASIS (its active ingredient, cyclosporine ophthalmic emulsion 0.05%) is a prescription medication primarily used to treat chronic dry eye disease, especially when artificial tears are insufficient. Since its FDA approval in 2002, RESTASIS has established itself as a leading treatment in the ophthalmic immunomodulator segment. This article provides an in-depth market analysis and forecasts future price trajectories, considering factors like clinical positioning, market dynamics, regulatory influences, and competitive landscape.

Market Overview

Historical Market Performance

RESTASIS's initial entry revolutionized dry eye therapy by addressing underlying inflammation mechanisms unmitigatable by artificial tears [1]. The drug quickly gained adoption, supported by its patent protections and extensive clinical trial data validating efficacy. The 2018 expiration of key patents, including the original U.S. composition patent, introduced generic competitors, impacting the brand’s market dominance [2].

Current Market Size

As of 2023, the global dry eye disease treatment market is valued at approximately $3.1 billion, with RESTASIS capturing an estimated 55% share within the ophthalmic prescription segment [3]. North America remains the largest market, driven by high awareness, advanced healthcare infrastructure, and favorable reimbursement policies.

Key Stakeholders

- Pharmaceutical Companies: Allergan (now part of AbbVie), originally developed RESTASIS, retains the most significant market share; generics providers like Sandoz and Teva have entered post-patent expiry.

- Physicians: Ophthalmologists and optometrists are primary prescribers, influenced by clinical efficacy, safety profile, and formulary status.

- Patients: Chronic dry eye prevalence affects an estimated 16 million adults in the U.S., a sizable base for ongoing treatment demand (source: American Academy of Ophthalmology [4]).

Regulatory Environment

The FDA’s approval of RESTASIS established a high regulatory standard. Desspite patent expiry, regulatory barriers for generics can delay market entries but not indefinitely. Recently, the FDA has approved new formulations and biosimilars, prompting price and market share fluctuations.

Competitive Landscape

Generic Competitors

Following patent expiration in 2018, numerous generic formulations emerged, leading to aggressive price competition. Sandoz, Teva, and other generics manufacturers entered with bioequivalent versions, often priced 40-60% below the brand-name RESTASIS, pressuring profits [5].

Innovative Alternatives

The emergence of newer therapies, such as Xiidra (lifitegrast) by Novartis, providing different mechanisms of action with comparable efficacy, has expanded the competitive landscape, especially as some patients switch therapies due to cost or tolerability issues [6].

Market Differentiation

While generics dominate price-sensitive segments, branded RESTASIS maintains positioning through patient familiarity, perceived quality, and formulary advantages, especially in managed care settings.

Price Trends and Projections

Historical Pricing Patterns

- Pre-Patent Expiry: The average wholesale price (AWP) per box of RESTASIS (30-day supply) was approximately $735 in 2017, reflecting patent exclusivity and brand dominance.

- Post-Patent Expiry: Generic entry precipitated a sharp price decline, with current mean retail prices around $300-$400, varying by provider and insurance coverage [7].

Factors Influencing Future Pricing

- Market Penetration of Generics: As generics establish stable market share, retail prices are projected to stabilize or decline marginally.

- Formulation Innovations: A new, potentially patented sustained-release formulation could command premium pricing if clinical benefits justify it.

- Reimbursement Dynamics: Payer negotiations and formulary placements heavily influence achievable patient prices; increased copayments or tier placements tend to reduce retail prices.

- Manufacturing Costs & Competition: Competitive manufacturing costs and rising generic competition pressure downward pricing modifications.

Price Forecast (Next 5 Years)

- Scenario 1: Continued Price Compression: Retail prices decline by roughly 5-8% annually due to generic competition, reaching approximately $200-$250 for a 30-day supply by 2028.

- Scenario 2: Stabilization with Premium Formulation: Introduction of a new formulation, with patent protection, could sustain prices at $500-$700, maintaining the brand's premium segment share.

- Scenario 3: Market Contraction: Increasing adoption of alternative therapies (e.g., Xiidra, lifitegrast) could marginalize RESTASIS, leading to further price declines or reduced market share.

Financial Implications For Stakeholders

Pharmaceutical companies relying on RESTASIS revenues need to strategize around patent cliffs, generic competition, and diversification into next-generation formulations. Payers and providers must navigate balancing drug efficacy, cost-effectiveness, and formulary economics amid an evolving therapeutic landscape.

Market Growth Drivers

- Rising Prevalence of Dry Eye Disease: Factors such as aging populations, increased screen time, and environmental stressors amplify demand.

- Enhanced Disease Awareness: Ongoing public health campaigns and clinician education promote prescriptions.

- Innovative Delivery Technologies: Sustained-release formulations and eye drops with improved bioavailability could transform future sales dynamics.

Challenges and Risks

- Patent Litigation and Patent Challenges: Legal actions may extend exclusivity or accelerate generic entry.

- Pricing Pressure: Rising competition from generics and biosimilars will continue to pressure prices.

- Regulatory Shifts: Changes in FDA policies or reimbursement practices could affect profitability and market access.

Key Takeaways

- The RESTASIS market has transitioned from monopoly to a highly competitive environment, with generic entries driving significant price attrition.

- Current pricing trends forecast a gradual decline, stabilizing around $200-$250 per 30-day supply within five years due to ongoing generic competition.

- Innovation, especially new formulation technologies, presents opportunities to reposition the drug at premium price points.

- Market growth hinges on increasing dry eye prevalence, improved awareness, and expanding therapeutic alternatives.

- Stakeholders should monitor patent developments, regulatory shifts, and competitive moves to optimize market positioning.

FAQs

Q1: Will RESTASIS regain market dominance after patent expiry?

A1: Likely not in the traditional sense. Patent expiry led to generic competition, drastically reducing prices. However, branded RESTASIS maintains a niche through formulations offering potentially improved efficacy or convenience, but overall market share faces erosion.

Q2: How do generic entrants impact RESTASIS pricing?

A2: They exert downward pressure, often reducing prices by 40-60%. With increased competition, retail prices are projected to decline steadily, but the brand retains value through physician and patient loyalty.

Q3: Are there upcoming formulations that could disrupt the current market?

A3: Yes. Sustained-release formulations and new delivery technologies could preserve or enhance pricing power, provided clinical efficacy and safety are demonstrated.

Q4: What role does reimbursement policy play in the future pricing of RESTASIS?

A4: Reimbursement determines patient out-of-pocket costs and formulary placement, influencing overall sales, especially as payers push for cost-effective alternatives, potentially pressuring prices downward.

Q5: How does the dry eye market growth influence RESTASIS's outlook?

A5: Rising prevalence due to demographic and lifestyle factors continues to expand the therapeutic market, sustaining demand despite pricing pressures, especially if clinicians prefer RESTASIS based on clinical evidence.

References

[1] Schaumberg, D. A., et al. "Prevalence of Dry Eye Disease among US Men and Women." American Journal of Ophthalmology, 2003.

[2] U.S. Patent and Trademark Office. Patent status for RESTASIS.

[3] MarketWatch. "Global Dry Eye Disease Treatment Market Analysis," 2023.

[4] American Academy of Ophthalmology. "Dry Eye Disease: Diagnosis and Management," 2022.

[5] IMS Health. "Impact of Patent Expirations on Ophthalmic Drugs," 2019.

[6] Novartis. "Xiidra Prescribing Information," 2022.

[7] GoodRx. "RESTASIS Price History," 2023.

In summary, the RESTASIS market has shifted significantly post-patent expiry, with pricing declining yet remaining relevant in the context of innovation and increasing disease burden. Strategic navigation of patent landscapes, formulation advancements, and market dynamics is essential for stakeholders aiming to optimize financial outcomes over the next five years.

More… ↓