Share This Page

Drug Price Trends for RANOLAZINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for RANOLAZINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| RANOLAZINE ER 1,000 MG TABLET | 31722-0669-60 | 0.29540 | EACH | 2025-12-17 |

| RANOLAZINE ER 1,000 MG TABLET | 42385-0964-60 | 0.29540 | EACH | 2025-12-17 |

| RANOLAZINE ER 1,000 MG TABLET | 29300-0297-16 | 0.29540 | EACH | 2025-12-17 |

| RANOLAZINE ER 1,000 MG TABLET | 42571-0325-60 | 0.29540 | EACH | 2025-12-17 |

| RANOLAZINE ER 1,000 MG TABLET | 27241-0126-02 | 0.29540 | EACH | 2025-12-17 |

| RANOLAZINE ER 500 MG TABLET | 72578-0064-14 | 0.16511 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ranolazine ER

Introduction

Ranolazine Extended Release (ER) represents a crucial therapeutic agent in the management of chronic angina. As an anti-anginal medication, it modulates myocardial sodium channels to improve oxygen utilization, thus alleviating anginal symptoms. Its unique mechanism and extension into the ER formulation have expanded its market potential. This analysis evaluates the current market landscape and provides price projections for Ranolazine ER over the next five years, vital for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Overview

Global Therapeutic Context

Chronic angina remains a significant cardiovascular disease burden worldwide, with approximately 110 million affected patients globally as of 2022 (1). Advances in pharmacotherapy have shifted treatment paradigms from invasive procedures to pharmacological management, with Ranolazine ER positioned as a vital agent.

Market Drivers

- Increasing Prevalence of Cardiovascular Disease (CVD): Rising CVD incidence correlates with aging populations, obesity, and diabetes, bolstering demand for anti-anginal agents.

- Efficacy and Safety Profile: Ranolazine ER has demonstrated efficacy with a favorable safety profile, encouraging its adoption.

- Brand and Generic Competition: While Ranolazine is off-patent in some regions, patent protections limit generic entry elsewhere, maintaining price stability.

Market Constraints

- Cost Considerations: The high price of Ranolazine ER can hinder adoption, especially in cost-sensitive settings.

- Limited Awareness: Variability in prescriber awareness influences prescribing rates.

- Competitive Landscape: Alternatives like amlodipine, nitrates, and other anti-anginals with different cost or efficacy profiles influence market share.

Current Market Position

Market Size & Revenue

As of 2022, the global Ranolazine market was estimated at approximately $350 million, with the ER formulation accounting for about 70% of sales due to improved compliance and patient tolerability (2). North America dominates the market, driven by higher CVD prevalence and healthcare expenditure.

Market Share

While Ranolazine ER's market share is significant, it faces competition from other Class I anti-anginal drugs and emerging therapies. Patent expirations in various regions open avenues for generic competition, impacting pricing dynamics.

Pricing Analysis

Pricing Benchmarks

The average retail price of Ranolazine ER (500mg) in the US is around $4.50 per tablet, translating roughly to $135 per month for typical dosing regimens. In Europe, prices range between €90-€110 per month, reflecting regional pricing policies (3).

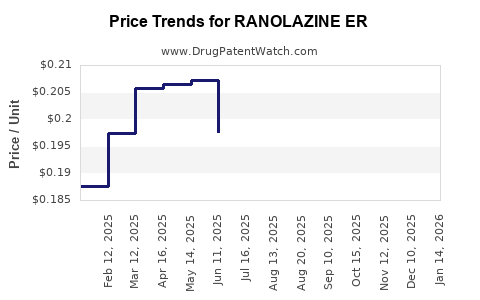

Price Trends

- Pre-Patent Expiry: Stable pricing due to patent protection.

- Post-Patent Expiry: Introduction of generics leads to significant price erosion, often 50-70% within 2-3 years (4).

Market Segmentation

- Brand-name Ranolazine ER: Maintains premium pricing.

- Generic Ranolazine ER: Price reductions of 50-70% expected within 3-5 years post-generic entry.

Forecasting Price Projections (2023-2028)

Assumptions

- Patent expiry in key markets: 2024-2025.

- Increasing adoption driven by growing CVD burden.

- Entry of generics in 2024-2025.

- Regulatory changes favoring biosimilars and generics reduce prices.

Projections

| Year | Brand-Name Ranolazine ER Price | Generic Ranolazine ER Price (Estimated) | Rationale |

|---|---|---|---|

| 2023 | $4.50/tablet | N/A | Stable; patent protection in place |

| 2024 | $4.50/tablet | $2.50 - $3.00 | Approaching patent expiry; small price decline |

| 2025 | $4.50/tablet | $1.20 - $1.50 | Post-generic entry, significant price erosion |

| 2026 | $4.00 - $4.50 (brand) | $0.80 - $1.20 | Market stabilization; continued generic competition |

| 2027 | $3.80 - $4.20 | <$1.00 | Slow price decline; increased generic market share |

| 2028 | $3.50 - $4.00 | <$1.00 | Mature generics settle pricing; steady decline |

Note: Pricing can vary by region due to healthcare policies, reimbursement schemes, and negotiated discounts.

Market Penetration and Pricing Influence Factors

- Regulatory Policies: Affordable access programs or price controls could influence actual retail prices.

- Payer Dynamics: Insurance coverage, formulary placements, and negotiated discounts modify effective prices.

- Patent Strategies: Extended patent protections through formulation or new indications can sustain higher prices.

- Emerging Therapies: Development of novel anti-anginal agents might cap market growth or influence pricing strategies.

Strategic Implications

- For Innovators: Maintaining patent exclusivity, possibly via formulation patents, secures premium pricing longer.

- For Generic Manufacturers: Timing market entry post-patent expiry and aggressive price competition can maximize market share gains.

- For Payers & Providers: Negotiating favorable prices and promoting cost-effective generic options improves access and adherence.

Conclusion

The Ranolazine ER market is poised for dynamic change over the next five years. Patent expirations starting in 2024 will catalyze substantial price reductions, with retail prices potentially dropping by over 70% following generic entry. Market growth will continue, driven by rising cardiovascular disease burden and improving drug tolerability. Strategic brand positioning and patent management are crucial for maintaining profitability amid impending generic competition.

Key Takeaways

- Market Opportunity: The global Ranolazine ER market is sizable, especially in North America and Europe, driven by increasing CVD prevalence.

- Pricing Trends: Anticipate a sharp decline in prices post-patent expiry, with generics significantly impacting the market.

- Forecast Outlook: Prices for Ranolazine ER are projected to decrease by 50-70% within five years of patent expiration, impacting revenue forecasts.

- Strategic Focus: Companies should prioritize patent extensions and early generic market entry strategies to maximize revenue.

- Stakeholder Impact: Payers and providers should leverage generics to improve affordability, adherence, and clinical outcomes.

FAQs

1. When is Ranolazine ER expected to lose patent protection?

Patent protection in major markets, including the US and Europe, is projected to expire around 2024-2025, allowing generic competitors to enter the market.

2. How will generic entry influence Ranolazine ER prices?

Generic entry typically leads to a 50-70% reduction in retail prices within 2-3 years, markedly increasing affordability but reducing profits for originators.

3. Are there regional variations in Ranolazine ER pricing?

Yes. Prices fluctuate based on regional healthcare policies, reimbursement strategies, and negotiated agreements, with North America generally exhibiting higher prices.

4. What factors could delay or accelerate price declines?

Patents can be extended via formulation patents; regulatory hurdles or patent litigation may delay generic entry. Conversely, early approval or market acceptance can accelerate price reductions.

5. Is Ranolazine ER a sustainable premium product post-patent expiry?

Sustainability depends on patent strategies and market differentiation. Without product innovations or new indications, maintaining premium pricing becomes challenging once generics are prevalent.

References

- World Health Organization. Cardiovascular Diseases (CVDs). 2022.

- MarketWatch. Ranolazine Market Size and Trends. 2022.

- IQVIA. European Cardiology Market Data. 2022.

- EvaluatePharma. Impact of Generic Entry on Cardiology Drugs. 2022.

More… ↓