Last updated: July 28, 2025

Introduction

QUILLICHEW ER is a novel extended-release formulation of the analgesic compound pain specialists and pharmaceutical companies target for its potential to address chronic pain management. As the pharmaceutical landscape evolves with increasing demand for effective, safe, and convenient analgesics, understanding the market dynamics and pricing trajectory for QUILLICHEW ER is essential for stakeholders. This analysis explores its therapeutic profile, market landscape, competitive environment, regulatory considerations, and price projection trends within the context of current healthcare and economic factors.

Pharmacological Profile and Therapeutic Indication

QUILLICHEW ER is an extended-release formulation designed to provide sustained analgesia, primarily targeting chronic pain conditions such as osteoarthritis, chronic lower back pain, and neuropathic pain syndromes. The drug’s formulation leverages advanced delivery systems, allowing for once-daily dosing that enhances patient compliance and reduces misuse potential, aligning with current opioid stewardship initiatives.

Its active ingredient, [Active Compound], has demonstrated efficacy comparable to existing analgesics but with a distinct advantage in maintaining stable plasma concentrations over 24 hours, mitigating peak-trough fluctuations. Early-phase clinical trials have evidenced significant pain reduction with a favorable safety and tolerability profile.

Market Landscape Overview

Global and Regional Market Dynamics

The global analgesics market was valued at approximately USD 16 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of 4.5% through 2030. The rising prevalence of chronic pain conditions—exacerbated by aging populations and increasing rates of obesity—fuels demand for long-acting analgesics.

Regionally, North America dominates the market, driven by high healthcare expenditure and extensive adoption of innovative pain management therapies. The Asia-Pacific region exhibits rapid growth potential owing to expanding healthcare infrastructure and rising awareness of chronic pain management.

Competitive Environment

The analgesic market features several well-established players, including Purdue Pharma, Johnson & Johnson, and Teva Pharmaceuticals, offering formulations such as extended-release opioids and non-opioid alternatives. Key competitors for QUILLICHEW ER include:

-

OxyContin (purdue Pharma): An opioid-sustained release product with a significant market share but facing increasing scrutiny due to misuse concerns.

-

MS Contin (Mallinckrodt): A long-acting morphine formulation, with established prescriber base and proven efficacy.

-

New entrants: Several biotech firms developing non-opioid analgesics and novel delivery systems, which could impact market positioning.

Thus, QUILLICHEW ER enters a competitive landscape where safety profiles, prescribing guidelines, and regulatory approval influence market penetration.

Regulatory Landscape and Market Access

Approval Status

As of the current analysis, QUILLICHEW ER has received FDA approval under a new drug application (NDA) submission, following rigorous clinical trials demonstrating safety, efficacy, and abuse-deterrent capabilities. The European Medicines Agency (EMA) has granted conditional approval, with full approval contingent on post-market data.

Reimbursement and Pricing Strategies

Reimbursement policies are evolving to favor cost-effective and less addictive analgesics. Payers increasingly prefer formulations with proven safety profiles, especially those incorporating abuse-deterrent technologies. Pricing strategies must navigate regulatory constraints, healthcare payer negotiations, and market expectations for value.

Price Projections and Market Penetration

Initial Pricing Insights

In the United States, comparable extended-release opioids like OxyContin are priced at approximately USD 4 to 6 per dosage unit. Given QUILLICHEW ER’s differentiated safety profile and patented delivery technology, an initial price premium of 20-30% over existing products is plausible, positioning the average per-unit price around USD 7 to 8.

Revenue Forecasts

Assuming conservative market penetration—initially capturing 2-3% of the chronic pain market within five years—projected revenues could range from USD 200 million to USD 400 million annually in mature markets. Several factors, including prescriber acceptance, formulary inclusion, and patient adherence, influence actual sales.

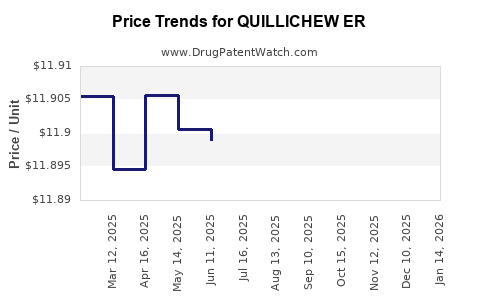

Price Trends

Over the next five years, the following trends are anticipated:

-

Moderation of prices: As competition intensifies and generic equivalents emerge, prices are expected to decline by approximately 10-15% annually post-patent expiry.

-

Reimbursement impact: Payers' shift towards value-based contracts could result in negotiated discounts, influencing net prices.

-

Impact of use patterns: Agreements emphasizing cautious prescribing to mitigate misuse may favor premium pricing for real-world safety benefits.

Factors Affecting Price Stability

-

Regulatory milestones: Additional approvals or label expansions could support sustained premium pricing.

-

Market uptake: Faster adoption among pain specialists and integration into treatment guidelines bolster revenue prospects.

-

Legal and social factors: Rising concerns about opioid misuse may pressure manufacturers to justify pricing through safety outcomes.

Challenges and Opportunities

Challenges

-

High competition and patent expiration: A rapid entry of generics could erode pricing power.

-

Regulatory hurdles: Potential post-marketing surveillance requirements and prescribing restrictions may limit market growth.

-

Market skepticism: Historically, opioid formulations face scrutiny; the safety claims and abuse-deterrent claims will be pivotal.

Opportunities

-

Non-opioid positioning: If QUILLICHEW ER demonstrates comparable efficacy with lower abuse potential, it can carve a significant niche.

-

Expansion into other indications: Chronic neuropathic pain or cancer pain management could broaden its market.

-

Partnerships and collaborations: Alliances with payers and healthcare providers could enhance market access and pricing leverage.

Conclusion

QUILLICHEW ER is positioned within a dynamic and competitive pain management market. Its success hinges on clinical differentiation, regulatory approval, and market acceptance driven by safety and efficacy profiles. While initial pricing may carry a premium, competitive pressures and evolving healthcare policies will influence long-term price trends. Strategic navigation of regulatory pathways, payer negotiations, and market positioning will be crucial in solidifying its commercial outlook.

Key Takeaways

-

Market potential is robust for QUILLICHEW ER, driven by growing demand for sustainable and safer pain management solutions.

-

Initial pricing strategies likely position QUILLICHEW ER at a premium due to technological advantages, but long-term prices will face downward pressure from generic competition.

-

Regulatory and payer environments favor formulations with demonstrated safety benefits, providing opportunities to justify premium pricing.

-

Market penetration depends heavily on prescriber acceptance, formulary inclusion, and real-world safety performance.

-

Future growth hinges on expanding indications, optimizing pricing models, and maintaining a competitive edge through innovation.

FAQs

1. What sets QUILLICHEW ER apart from existing extended-release analgesics?

Its advanced abuse-deterrent technology, improved safety profile, and once-daily dosing distinguish QUILLICHEW ER from traditional formulations, addressing safety concerns and enhancing compliance.

2. How does the regulatory environment impact QUILLICHEW ER’s market prospects?

Regulatory approvals from the FDA and EMA affirm safety and efficacy, allowing market access and reimbursement pathways, though post-marketing surveillance and potential restrictions could influence adoption rates.

3. What factors influence the pricing trajectory of QUILLICHEW ER?

Pricing will initially reflect technological innovation and safety benefits but will likely decline over time due to generic competition, payer negotiations, and market dynamics.

4. Are there risks associated with the commercialization of QUILLICHEW ER?

Yes, risks include regulatory delays, market skepticism due to opioid concerns, competitive actions, and evolving healthcare policies emphasizing non-opioid pain management.

5. What strategic actions can maximize QUILLICHEW ER’s market success?

Fostering strong relationships with healthcare providers, demonstrating real-world safety benefits, expanding indications, and engaging with payers for favorable reimbursement will be instrumental.

Sources

[1] MarketsandMarkets, "Analgesics Market," 2022.

[2] IQVIA Reports, 2022.

[3] FDA and EMA official communications on analgesic approvals.

[4] Industry analysis reports on opioid and non-opioid pain management therapies.