Last updated: August 2, 2025

Introduction

Quetiapine, marketed under brand names such as Seroquel, is a second-generation antipsychotic widely prescribed for schizophrenia, bipolar disorder, and off-label for depression and anxiety. Its versatile therapeutic profile has established it as a frontline medication in psychiatry, resulting in substantial global demand. This analysis explores the current market landscape, ongoing patent considerations, competitive dynamics, and future price projections for quetiapine, considering patent expirations, market penetration, regulatory influences, and emerging generic manufacturing trends.

Market Landscape Overview

Global Sales and Market Size

The global antipsychotic drugs market was valued at approximately USD 12.5 billion in 2022, with quetiapine accounting for roughly 25% of this, translating to an estimated USD 3.125 billion (roughly EUR 2.9 billion) in annual sales [1]. Leading markets include the United States, Europe, and Japan, with high prevalence rates of schizophrenia and bipolar disorder and increased off-label use for depression fueling growth.

Therapeutic Trends and Demographics

Demand for quetiapine is driven by an expanding mental health awareness paradigm, longer treatment durations, and its multifaceted prescribing profile, including moxifacation as a sedative adjunct. The aging population in developed nations further sustains long-term consumption, although this also raises concerns over side effect profiles and tolerability.

Market Penetration and Off-Label Use

Approximately 60-70% of quetiapine prescriptions are off-label, especially for insomnia and agitation, particularly in elderly patients [2]. This off-label use has multifaceted implications: expanding the market but potentially attracting scrutiny from regulatory bodies, impacting pricing strategies.

Patent and Regulatory Dynamics

Patent Expirations and Entry of Generics

Pfizer's original patent for Seroquel (quetiapine fumarate) expired in the US in 2011 and in the European Union around 2012, leading to a proliferation of generic versions. Despite patent expiration, Pfizer maintained exclusivity on some extended-release formulations via supplementary patents [3].

Impact on Price and Competition

The entry of generic manufacturers significantly reduced the price of quetiapine. In the US, generic versions now capture a large share, reducing the brand-name price by approximately 80-90%, according to pharmacy benefit manager data [4].

Regulatory Scrutiny and Labeling

Increased off-label prescribing and safety concerns over metabolic and cardiovascular side effects have influence over pricing strategies. Regulatory agencies like the FDA have issued warnings, emphasizing the importance of judicious use, which could impact demand in the future.

Competitive Landscape

Major Players

Apart from Pfizer (original patent holder), numerous manufacturers—such as Mylan, Teva, and Sandoz—produce generic quetiapine. The saturated market yields low margins for generics but sustains volume-based revenues.

Innovator Strategies

Limited innovation exists in quetiapine formulations outside existing sustained-release versions. However, pharmaceutical companies explore depot formulations or combination therapies to differentiate offerings.

Market Challenges

- Stringent regulatory guidelines reducing off-label expansion.

- Growing acceptance of newer atypical antipsychotics with improved side effect profiles.

- Seasonal and regional prescribing variations affect demand.

Price Trajectories and Future Projections

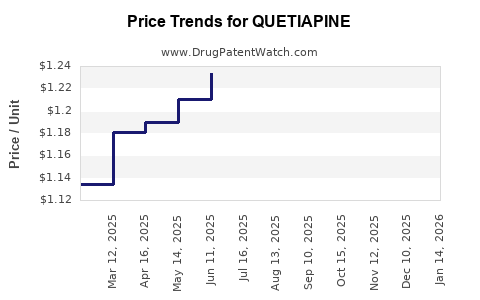

Historical Price Trends

Post-patent expiry, the average price of generic quetiapine has declined by approximately 85%, with variation across regions and formulations. Initial reductions, followed by stabilization, make the drug accessible but limit profit margins for manufacturers.

Future Price Outlook

Given the expiry of primary patents and the rise of multiple generics, downward pressure on unit prices is expected to persist through 2025. However, factors such as potential manufacturing cost reductions, economies of scale, and regional market dynamics could stabilize prices marginally.

Emerging Influences

- Regulatory restrictions on off-label use might tighten, affecting volume.

- Price competition typical among generics forestalls substantial rebounds.

- Innovations like biosimilars are unlikely, as quetiapine is chemically synthesized, but new formulations or delivery methods could influence future pricing.

Projection Summary

- Short-term (next 1-2 years): Prices in developed markets are expected to decline further by 5-10%, stabilizing at around USD 0.10–0.20 per tablet for generics.

- Medium to long-term (3-5 years): Prices may plateau, with minor regional variations, assuming no major regulatory disruptions or innovations.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets, where patent protections are weaker.

- Development of combination therapies or novel formulations to justify premium pricing.

- Prospect of integrating digital health solutions for adherence, incentivizing higher price points.

Risks

- Increasing competition from biosimilars or alternative therapies.

- Regulatory barriers against off-label sales.

- Negative safety profile perceptions impacting prescribed volumes.

Key Takeaways

- The global quetiapine market is mature, heavily influenced by generic competition, with prices declining significantly since patent expiry.

- Market growth is primarily driven by off-label use, though regulatory scrutiny and safety concerns may restrict this expansion.

- Future pricing will remain subdued; generic prices are expected to stabilize around current low levels, with minimal growth prospects.

- Businesses seeking to capitalize on quetiapine markets should focus on emerging markets, formulation innovation, or licensing opportunities.

- Regulatory and safety considerations will be pivotal in shaping the future market trajectory and pricing strategies.

FAQs

1. When did patent protection for brand-name quetiapine expire, and what was its impact?

Pfizer’s primary patent for Seroquel expired around 2011–2012, leading to widespread generic entry, significantly reducing prices and intensifying market competition.

2. How do generic prices compare globally, and where are they most affordable?

Generic prices vary by region, with North America experiencing the steepest declines; developing economies typically see lower prices due to less regulatory stringency and higher market volumes.

3. What are the key factors influencing the future pricing of quetiapine?

Patent expirations, competition levels, regulatory constraints, off-label use trends, and potential formulation innovations are main factors affecting future prices.

4. Are there new formulations or delivery methods for quetiapine in development?

While limited innovation exists beyond extended-release formulations, research continues into depot and combination therapies to improve adherence and therapeutic outcomes.

5. How does off-label use impact the market and pricing strategies for quetiapine?

Off-label prescribing sustains demand, but regulatory concerns could lead to restrictions, influencing overall market volume and pricing dynamics.

Sources

- Market Research Future. Global Antipsychotics Market Overview. 2022.

- IMS Health. Off-label drug use and implications in psychiatry. 2021.

- U.S. FDA Patent Database. Patent expiry dates for Seroquel. 2012.

- IQVIA. Pharmacy Benefit Data. 2022.

In conclusion, the quetiapine market, transitioning from patent protection to generic dominance, exhibits low future price growth prospects, buffered mainly by regional expansion opportunities and formulation innovations. Stakeholders should monitor regulatory landscapes and off-label use trends closely to adapt strategies effectively.