Share This Page

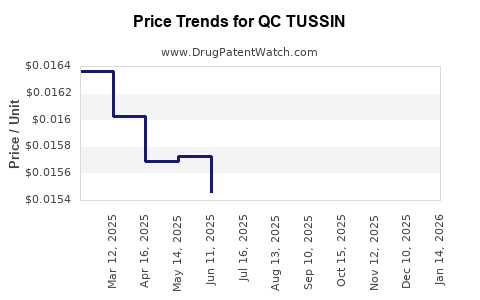

Drug Price Trends for QC TUSSIN

✉ Email this page to a colleague

Average Pharmacy Cost for QC TUSSIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC TUSSIN DM 200-20 MG/20 ML | 83324-0023-04 | 0.02020 | ML | 2025-12-17 |

| QC TUSSIN DM 200-20 MG/20 ML | 83324-0023-08 | 0.01454 | ML | 2025-12-17 |

| QC TUSSIN DM 200-20 MG/20 ML | 83324-0025-04 | 0.02020 | ML | 2025-12-17 |

| QC TUSSIN DM 200-20 MG/20 ML | 83324-0023-04 | 0.02019 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC TUSSIN

Introduction

QC TUSSIN, a well-established over-the-counter (OTC) cough and cold remedy, commands significant market presence in North America. Its formulation, primarily comprising dextromethorphan and guaifenesin, targets symptomatic relief of cough, congestion, and chest discomfort. As the pharmaceutical landscape evolves, understanding QC TUSSIN’s market dynamics, competitive positioning, and future price trajectory is essential for stakeholders including investors, healthcare providers, and policymakers.

Market Overview

Current Market Scope

The OTC cough and cold medication segment, estimated at approximately USD 4 billion annually in North America (excluding newer formulations and complementary products) [1], remains resilient despite shifts toward more targeted prescription therapies. QC TUSSIN’s consumables are widely distributed via pharmacy chains, supermarkets, and online outlets, ensuring broad access.

Consumer Demographics

The primary consumers are adults and caretakers of pediatric populations. Notably, the COVID-19 pandemic amplified demand for symptomatic relief medicines, temporarily boosting sales [2]. While regulations mediate the OTC market, consumer trust in proven formulations sustains demand.

Competitive Landscape

QC TUSSIN faces competition from:

- Private label brands: Cheaper alternatives sold at similar quality levels.

- Brand variants: Products like Mucinex, Robitussin, and DayQuil/NyQuil.

- Emerging alternatives: Natural remedies and homeopathic medications.

Market share estimates place QC TUSSIN at approximately 10-12% within the OTC cough syrup segment [3]. Its brand recognition and consistent efficacy claims maintain its position against competitors.

Regulatory and Market Drivers

Regulatory Environment

OTC medicines in the U.S. are regulated by the FDA, with monographs dictating approved formulations and labeling. The FDA’s recent scrutiny of dextromethorphan’s misuse potential prompts considerations of formulation modifications and dosing restrictions, which could impact QC TUSSIN’s formulation and sales.

Market Drivers

- Aging Population: An increase in respiratory illnesses among seniors sustains demand.

- Seasonal Variability: Sales peak during winter months, historically accounting for 30-35% of annual revenue.

- Telehealth & Digital Sales: Expansion in online OTC purchasing channels opens new distribution avenues.

Pricing Dynamics

Historical Price Trends

Historically, a standard 4 oz (118 ml) bottle of QC TUSSIN retails at $4.99–$6.49 in retail outlets, with slight year-over-year price increases averaging 2-3% [4]. This stability is driven by persistent demand and robust supply chains.

Pricing Factors

- Manufacturing costs: Slight inflation in raw material costs, especially for active pharmaceutical ingredients (APIs).

- Regulatory compliance costs: Periodic updates to labeling, quality testing, and market authorization can influence retail pricing.

- Competitive pressure: Introduction of private label brands exerts downward pressure on pricing, leading to possible price stabilization or marginal declines.

Pricing Strategy Insights

Brand loyalty supports premium pricing strategies; however, market commoditization necessitates maintaining competitive prices to retain market share. Manufacturers may employ promotional discounts during peak seasons.

Future Price Projections

Market Evolution & Impact on Pricing

Over the next 3-5 years, several factors could influence QC TUSSIN’s price trajectory:

- Regulatory Changes: Increased oversight or dosage restrictions could increase manufacturing costs or necessitate formulation modifications, potentially elevating retail prices by 3-5% annually.

- Market Competition: The proliferation of generic and private-label brands will intensify price competition, potentially stabilizing or reducing prices.

- Supply Chain Dynamics: Fluctuations in raw material costs, particularly for APIs like dextromethorphan, may cause minor price adjustments, estimated at 1-2% per annum.

- Innovation and Reformulation: Incorporation of new delivery mechanisms or combination therapies could command premium pricing, although adoption timelines remain uncertain.

Projected Price Range (2023-2028)

- Base Scenario: Retail prices will hover within $4.99–$6.99, with minor annual fluctuations driven by inflation and competitive factors.

- Optimistic Scenario: Labeling updates and product innovations may elevate prices by up to 10% over five years, reaching approximately $7.00–$7.50.

- Pessimistic Scenario: Regulatory hurdles or market saturation suppress price growth; prices may stabilize or decline marginally by up to 3% annually.

Implications for Stakeholders

- Investors: Stability in current prices suggests low volatility, yet emerging regulatory shifts warrant cautious strategic positioning.

- Manufacturers: Cost management and innovation are key to sustaining profitability amid intense price competition.

- Policy Makers: Regulatory adjustments could influence market pricing and accessibility, with potential downstream effects on healthcare costs.

Conclusion

The market for QC TUSSIN remains resilient with stable demand driven by seasonality, consumer trust, and broad accessibility. Price projections indicate modest growth aligned with inflation and competitive pressures. Active monitoring of regulatory developments, raw material costs, and consumer preferences is crucial to forecasting precise future pricing.

Key Takeaways

- QC TUSSIN holds a strong position in the North American OTC cough and cold market with predictable price stability.

- Competitive dynamics and regulatory scrutiny are primary influencers of future pricing strategies.

- Prices are expected to grow modestly, influenced by inflation, innovation, and supply chain factors.

- Strategic product differentiation and regulatory compliance are vital for maintaining market share and profitability.

- Stakeholders should consider emerging market trends such as online sales channels and consumer preference shifts toward natural remedies.

FAQs

1. How does regulatory oversight affect QC TUSSIN’s pricing?

Regulatory changes, such as dosage restrictions or new safety requirements, can increase manufacturing and compliance costs, potentially leading to higher retail prices. Conversely, streamlined regulations might reduce costs and stabilize pricing.

2. What factors could cause QC TUSSIN’s prices to decline in the future?

Intensified competition from generic brands and private labels, along with market saturation, could exert downward pressure, causing prices to stabilize or decrease marginally.

3. Are there upcoming formulations or innovations expected for QC TUSSIN?

While no major reformulations are publicly announced, industry trends suggest potential for combination therapies or improved delivery mechanisms, which could command premium pricing once introduced.

4. How does seasonality impact QC TUSSIN’s pricing and sales?

Sales typically spike during winter months, allowing for targeted promotional strategies. Price adjustments during peak seasons tend to be minimal but can include discounts to boost volume.

5. How might emerging natural remedies influence QC TUSSIN’s market share?

The rising consumer interest in natural and homeopathic treatments could challenge traditional formulations, prompting manufacturers to explore integrative or alternative products to maintain market relevance.

Sources

- [1] IMS Health Data on North American OTC market value, 2022.

- [2] CDC Reports on respiratory illness trends during COVID-19.

- [3] Euromonitor International, OTC Market Share Analysis, 2022.

- [4] Nielsen Retail Data on OTC Product Pricing, 2022.

More… ↓