Share This Page

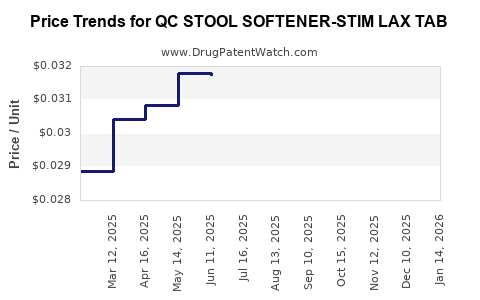

Drug Price Trends for QC STOOL SOFTENER-STIM LAX TAB

✉ Email this page to a colleague

Average Pharmacy Cost for QC STOOL SOFTENER-STIM LAX TAB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03270 | EACH | 2025-12-17 |

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03270 | EACH | 2025-11-19 |

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03217 | EACH | 2025-10-22 |

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03099 | EACH | 2025-09-17 |

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03094 | EACH | 2025-08-20 |

| QC STOOL SOFTENER-STIM LAX TAB | 83324-0136-01 | 0.03195 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC STOOL SOFTENER-STIM LAX TAB

Introduction

The pharmaceutical landscape for over-the-counter (OTC) laxatives, such as QC Stool Softener-Stim Lax Tab, reflects a mature segment with consistent demand driven by aging populations, rising prevalence of gastrointestinal conditions, and increasing consumer health awareness. This analysis synthesizes current market dynamics, competitive positioning, and future price trajectory to assist stakeholders in making informed strategic decisions.

Product Overview

QC Stool Softener-Stim Lax Tab combines stool softening agents with stimulant laxatives, providing comprehensive relief from constipation. Its formulation targets both softening stool and stimulating bowel movements, enhancing efficacy for acute and chronic use cases. As an OTC medication, it appeals broadly to consumers seeking accessible gastrointestinal remedies.

Market Dynamics

1. Market Size and Growth Drivers

The global laxatives market is projected to attain a Compound Annual Growth Rate (CAGR) of approximately 4-5% through 2028 [1]. Key drivers include:

- Demographic shifts: Aging populations in North America, Europe, and parts of Asia increase demand for constipation remedies.

- Chronic conditions: Rising prevalence of gastrointestinal disorders and lifestyle-related constipation tied to diet and sedentary behavior.

- Health consciousness: Greater consumer focus on digestive health promotes OTC product use.

- Regulatory landscapes: Favorable OTC classifications in major markets facilitate over-the-counter sales expansion.

2. Competitive Landscape

The segment features a range of brands—including Docusate sodium-based stool softeners, bisacodyl, senna, and combinations thereof. Key players include Johnson & Johnson, Bayer, and GlaxoSmithKline, often competing on product efficacy, regulatory approval, and consumer trust.

QC Stool Softener-Stim Lax Tab positions itself as a value-priced, dual-action formulation. Its differentiation hinges on its combination therapy addressing both stool consistency and motility, appealing to consumers seeking comprehensive relief.

3. Regulatory Considerations

In major markets like the U.S., the FDA categorizes OTC laxatives under monographs or NDA pathways, influencing formulation standards and marketing claims. Maintaining compliance ensures product accessibility and supports demand stability.

Pricing Landscape

1. Current Market Pricing

Retail prices for OTC stool softeners and stimulant laxatives vary:

- Stool softeners alone: US$5-10 per box (20-30 tabs).

- Combination formulations (like QC): Typically retail between US$8-15 per box, reflecting added stimulant action.

- Private labels: Price points may undercut national brands by 10-15%, intensifying price competition.

Regional variability exists, with markets like Europe and Asia exhibiting different pricing norms due to regulatory, economic, and distribution factors.

2. Price Trends and Influencing Factors

- Generic proliferation: Increased availability of generics exerts downward pressure on prices.

- Supply chain costs: Raw material pricing, manufacturing, and distribution costs influence retail pricing.

- Brand positioning: Premium brands may command higher prices based on perceived efficacy and trust.

- Regulatory changes: Demands for added safety and efficacy data can impact product pricing strategies.

Forecasted Price Trajectory (Next 3-5 Years)

Looking ahead, several factors suggest a relatively stable or modestly declining price environment for QC Stool Softener-Stim Lax Tab:

- Market Saturation: High penetration in developed markets limits significant price hikes.

- Generic Competition: The entry of similar formulations at lower prices is expected to suppress prices by 3-5% annually.

- Innovation and Differentiation: Introduction of extended-release or combination variants could sustain premium pricing temporarily.

- Consumer Price Sensitivity: Growing health-conscious consumers may prefer cost-effective brands, putting pressure on price points.

Projected retail price range (2023-2028): US$7-13 per box, with average around US$9-11, aligning with historical patterns and competitive dynamics.

Key Market Opportunities and Risks

Opportunities

- Expansion into emerging markets with growing middle classes and increasing OTC consumption.

- Product innovation, including formulations with improved safety profiles or added health benefits.

- Digital marketing and e-commerce channels, facilitating wider reach and price transparency.

Risks

- Regulatory hurdles potentially delaying new formulations or market entry.

- Generic rivalry lowering profit margins.

- Shifts in consumer preferences towards natural or alternative remedies.

Conclusion

QC Stool Softener-Stim Lax Tab operates within a stable, competitive OTC laxative market characterized by moderate growth and pricing pressures from generics. Its dual-action formulation supports sustained demand, although future pricing will hinge on innovation, market expansion, and regulatory developments. Stakeholders should leverage product differentiation and strategic pricing to maximize market share whilst navigating competitive and regulatory landscapes.

Key Takeaways

- The global OTC laxatives market is forecasted to grow steadily, driven by demographic and lifestyle factors.

- Average retail prices for combined stool softener-stimulant formulations are expected to stabilize around US$9-11, with slight downward trends due to increased generic competition.

- Market expansion into emerging economies and product innovation present significant opportunities for growth.

- Price erosion driven by generics necessitates focus on brand differentiation and consumer loyalty.

- Regulatory compliance remains pivotal in maintaining market access and safeguarding profitability.

FAQs

1. What are the main factors influencing the price of QC Stool Softener-Stim Lax Tab?

Market demand, generic competition, supply chain costs, regulatory compliance, and brand positioning primarily influence retail pricing.

2. How does the rise of generic versions impact the market for QC Stool Softener-Stim Lax Tab?

Generics exert downward pressure on prices, compelling brand manufacturers to differentiate through formulation, packaging, or branding to maintain margins.

3. Are there emerging markets likely to see higher demand for OTC laxatives?

Yes. Countries in Asia, Latin America, and parts of Africa are experiencing rising middle-class populations and increased consumer health awareness, boosting demand.

4. What innovations could influence future pricing strategies?

Extended-release formulations, natural or herbal variants, and added health benefits could command premium prices and stimulate growth.

5. How might regulatory changes affect the pricing outlook?

Stricter safety and efficacy standards may increase development costs, potentially raising prices temporarily. Conversely, regulatory approval streamlining could improve market access and competition, reducing prices.

References

[1] Statista. (2022). Global Laxatives Market Forecast.

More… ↓