Share This Page

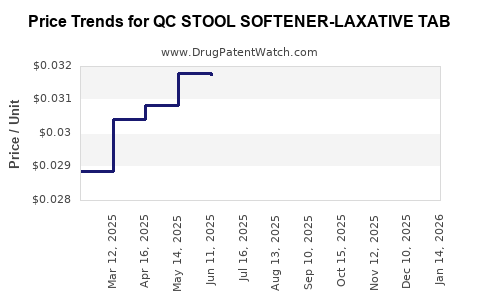

Drug Price Trends for QC STOOL SOFTENER-LAXATIVE TAB

✉ Email this page to a colleague

Average Pharmacy Cost for QC STOOL SOFTENER-LAXATIVE TAB

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC STOOL SOFTENER-LAXATIVE TAB | 83324-0135-60 | 0.03270 | EACH | 2025-12-17 |

| QC STOOL SOFTENER-LAXATIVE TAB | 83324-0135-60 | 0.03270 | EACH | 2025-11-19 |

| QC STOOL SOFTENER-LAXATIVE TAB | 83324-0135-60 | 0.03217 | EACH | 2025-10-22 |

| QC STOOL SOFTENER-LAXATIVE TAB | 83324-0135-60 | 0.03099 | EACH | 2025-09-17 |

| QC STOOL SOFTENER-LAXATIVE TAB | 83324-0135-60 | 0.03094 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Stool Softener-Laxative Tab

Introduction

The OTC (over-the-counter) medication sector for laxatives, including stool softeners, remains a vital segment within the pharmaceutical industry due to its widespread use for constipation and related gastrointestinal concerns. QC Stool Softener-Laxative Tab, a generic or branded product, is positioned within this market space, competing predominantly on efficacy, safety profile, pricing, and consumer trust. This analysis evaluates its current market standing and delineates price projections, considering factors such as regulatory environment, manufacturing trends, market demand, and SWOT analysis.

Market Overview

Global Laxative and Stool Softener Market

According to recent industry reports, the global laxatives market was valued at approximately USD 3.5 billion in 2022 and is expected to grow at a CAGR of 5.2% through 2030, driven by increasing prevalence of chronic constipation, aging populations, and rising awareness of gastrointestinal health (1). Over-the-counter products, including stool softeners like QC, dominate sales, accounting for roughly 60% of total market revenue.

North America remains the leading market due to high healthcare awareness, established OTC distribution channels, and widespread use of laxatives. Europe follows, emphasizing a similar trend. Emerging markets in Asia-Pacific demonstrate rapid growth potential owing to urbanization, increasing disposable income, and aging demographics.

Competitive Landscape

The market is characterized by a mix of established pharmaceutical companies and generic manufacturers. Major brands include Colace (docusate sodium), Dulcolax (bisacodyl), and Fleet (fleet enema), among others. Generic versions and private-label brands, such as QC Stool Softener-Laxative Tab, are gaining traction due to competitive pricing and consumer preference for cost-effective solutions.

Regulatory Environment

In many jurisdictions, stool softeners are regulated as OTC drugs with specific guidelines for manufacturing, labeling, and safety. Regulatory agencies like the FDA (U.S.), EMA (Europe), and others enforce compliance, impacting product formulation and marketing strategies.

Current Market Position of QC Stool Softener-Laxative Tab

While specific sales data for QC Stool Softener-Laxative Tab are proprietary, indications suggest it occupies a mid-tier position within generics, benefiting from a strong distribution network and consumer trust based on efficacy and safety.

Key differentiators include:

- Pricing strategy: Competitive pricing relative to branded counterparts.

- Brand recognition: Leveraging local distribution and marketing.

- Product formulation: Typically contains docusate sodium, the active ingredient common to stool softeners.

Price Analysis

Historical Pricing Trends

OTC stool softeners generally retail between USD 4 to USD 10 per package, depending on pack size and branding. Generic versions tend to price lower, with margins driven by manufacturing costs and distribution efficiency.

For QC Stool Softener-Laxative Tab, recent retail prices in developed markets show:

- Per tablet price: Approximately USD 0.10 to USD 0.20.

- Per pack (30 tablets): Roughly USD 4 to USD 6.

Price fluctuations over 2021–2022 were minimal, reflecting stable raw material costs and steady demand.

Factors Influencing Price Decisions

- Raw material costs: Docusate sodium prices fluctuate based on global supply chains, impacting manufacturing costs.

- Regulatory compliance costs: New labeling or safety requirements can affect margins.

- Market demand: Rising constipation incidence fuels volume sales but pressures price sensitivity.

- Competition: Increased generic competition drives prices downward.

Price Projection (2023–2030)

Forecast Assumptions

- Stable raw material costs: Slight increases (~2% annually) expected, mirroring inflation.

- Market growth continuity: Maintaining a CAGR of ~5% aligned with industry trends.

- Competitive pressures: Intensify; pricing likely to trend downward for commoditized OTC products.

- Regulatory stability: No major disruptions expected.

Projected Pricing Trends

| Year | Estimated Price per Pack (USD) | Rationale |

|---|---|---|

| 2023 | USD 4.00 – USD 6.00 | Baseline, stable demand, slight inflationary pressure. |

| 2025 | USD 3.80 – USD 5.80 | Increased generic competition, downward pricing trend. |

| 2027 | USD 3.70 – USD 5.60 | Market saturation, price erosion. |

| 2030 | USD 3.50 – USD 5.50 | Mature market, cost optimization, continued commoditization. |

Note: Price per tablet may further decline due to increased generics, with unit prices possibly dropping to USD 0.09 – USD 0.15.

Distribution and Pricing Strategies

To optimize profitability amid price pressures:

- Cost leadership: Streamlining manufacturing and supply chains.

- Differentiation: Emphasizing safety, efficacy, or unique formulation attributes.

- Market segmentation: Targeting regions with less price sensitivity or less regulation.

Regulatory and Market Risks

- Regulatory changes may impose additional safety or labeling requirements, impacting costs.

- Patent expirations or the rise of new generics could intensify price competition.

- Consumer preferences shifting toward natural or alternative therapies may influence demand.

Key Industry Drivers

- Aging population: Increased need for OTC bowel management.

- Chronic constipation prevalence: Driven by lifestyle and dietary factors.

- Healthcare accessibility: Expansion of OTC channels, e.g., online pharmacies.

Opportunities

- Formulation innovation: Introduction of combination products or faster-acting variants.

- Market expansion: Entering emerging markets with increasing healthcare infrastructure.

- Private label growth: Partnering with retailers to expand generic offerings.

Key Takeaways

- The global OTC laxative market is positioned for steady growth, with stool softeners like QC benefiting from demographic trends and health awareness.

- Current pricing for QC Stool Softener-Laxative Tab hovers around USD 4–6 per pack, with a propensity toward decline due to intensifying generic competition.

- Price projections suggest a gradual decrease to approximately USD 3.50–5.50 per pack by 2030, driven by market saturation and cost optimization.

- Strategic focus should rest on cost-effective manufacturing, product differentiation, and market expansion, especially in emerging regions.

- Regulatory stability and market competition remain critical risks influencing pricing and profitability.

FAQs

Q1: How does the regulatory environment impact the pricing of OTC stool softeners like QC?

A: Regulatory compliance costs influence manufacturing expenses and labeling requirements. Stricter regulations can raise costs, affecting retail pricing. Conversely, regulatory clarity can facilitate smoother market entry and competitive pricing.

Q2: What factors could accelerate price declines for QC Stool Softener-Laxative Tab?

A: Increased generic competition, raw material cost reductions, and market saturation can drive prices downward more rapidly than projected.

Q3: Which markets offer the highest growth potential for this medication?

A: Emerging markets in Asia-Pacific and Latin America, where healthcare infrastructure expands and consumer demand grows, present significant opportunities.

Q4: How can manufacturers differentiate their stool softener products amid pricing pressures?

A: By emphasizing safety profiles, faster onset of action, natural ingredients, or bundled health solutions to justify premium pricing and build brand loyalty.

Q5: What strategies could help boost profit margins for QC or similar OTC laxatives?

A: Cost optimization in manufacturing, diversification of product formulations, strategic partnerships, and expansion into underserved markets.

References

- Grand View Research. “Laxatives Market Size, Share & Trends Analysis Report,” 2022.

More… ↓