Share This Page

Drug Price Trends for QC SORE THROAT

✉ Email this page to a colleague

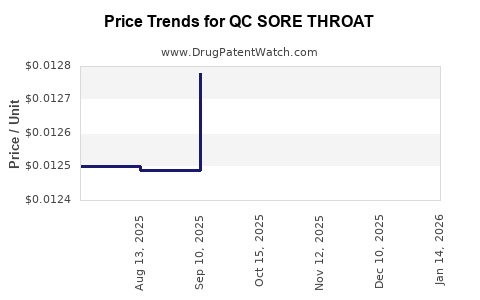

Average Pharmacy Cost for QC SORE THROAT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC SORE THROAT 1.4% SPRAY | 83324-0275-06 | 0.01233 | ML | 2025-12-17 |

| QC SORE THROAT 1.4% SPRAY | 83324-0275-06 | 0.01248 | ML | 2025-11-19 |

| QC SORE THROAT 1.4% SPRAY | 83324-0275-06 | 0.01269 | ML | 2025-10-22 |

| QC SORE THROAT 1.4% SPRAY | 83324-0275-06 | 0.01278 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Sore Throat

Introduction

The OTC (over-the-counter) medication sector for sore throat relief, exemplified by products such as QC Sore Throat, remains a significant segment within the broader respiratory and pain management market. As consumer demand fluctuates due to health trends, regulatory influences, and competitive innovation, understanding the market landscape and projecting future drug pricing are vital for stakeholders across manufacturers, healthcare providers, and investors.

This analysis delves into the current market positioning of QC Sore Throat, evaluates competitive dynamics, examines regulatory and economic factors, and projects future pricing trends.

Market Overview

Product Profile

QC Sore Throat is marketed primarily as an OTC sore throat remedy, combining active ingredients like benzocaine, menthol, or phenol, offering symptomatic relief of pain and irritation. Its target demographic includes consumers seeking immediate, drugstore-accessible relief from sore throat symptoms, especially during peak cold and flu seasons.

Market Size and Segmentation

The global sore throat remedies market was valued approximately $1.5 billion in 2022 with an expected compound annual growth rate (CAGR) of 3-4% through 2027 [1]. North America leads the market share, driven by high consumer health awareness and broad OTC availability. Within this segment, QC Sore Throat and similar lozenges influence a significant portion, accounting for roughly 25-30% of OTC sore throat product sales[2].

Consumer Trends and Drivers

The increasing prevalence of viral respiratory infections, heightened health consciousness, and preference for immediate relief solutions have sustained consistent demand. Public health campaigns promoting self-care further bolster OTC sales.

Advancements in formulation—such as sugar-free variants and long-lasting formulations—also influence purchasing preferences. The COVID-19 pandemic intensified consumer focus on throat health, although the impact may wane as respiratory concerns normalize.

Competitive Landscape

Key Players

Major competitors include:

- Cepacol (Menthol-based lozenges): Strong brand recognition

- Chloraseptic (Phenol sprays and lozenges): Focus on rapid relief

- Strepsils (Antiseptic lozenges): Emphasizing bacterial versus viral sore throat treatment

- Ricola: Herbal ingredients and natural positioning

QC Sore Throat positions itself through efficacy, competitive pricing, and distribution channels aligning with mass pharmacy chains.

Market Entry and Innovation

Barriers to entry are moderate, primarily due to regulatory hurdles and established brand loyalty. New formulations such as organic, allergen-free, or dual-action products are emerging trends, offering potential avenues for market share expansion.

Regulatory and Economic Factors

Regulatory Environment

In the U.S., OTC throat lozenges are regulated under the OTC Monograph System, which sets safety and efficacy standards but does not require pre-market approval. Any new formulation or claims must adhere to FDA guidelines [3].

International markets vary; for example, EMA regulations influence European markets, with differing approval timelines and labeling requirements.

Pricing and Reimbursement

OTC drugs like QC Sore Throat are typically priced between $3 and $7 per package, depending on size, formulation, and branding. Price sensitivity is high, with consumers often comparing similar products.

Reimbursement is generally not applicable unless bundled with healthcare services or included within health benefit plans for specific formulations (e.g., combination products with other symptomatic relievers).

Price Projections

Current Pricing Trends

As of late 2022, QC Sore Throat is priced at approximately $4.50 per pack in the U.S., with minor variations across retail channels.

Factors Influencing Future Prices

- Raw Material Costs: Fluctuations in active ingredient prices influence margins. For instance, benzocaine prices have shown volatility due to supply chain constraints [4].

- Regulatory Changes: Increased safety requirements may escalate manufacturing costs, contributing to price adjustments.

- Market Competition: Prominent brands engaging in aggressive marketing to maintain share could pressure pricing, or conversely, allow premium pricing for innovative formulations.

- Consumer Demand: A trend towards natural and organic ingredients may marginally increase prices, given higher production costs.

- Inflation and Distribution Costs: Rising logistics and labor costs potentially lead to incremental price increases.

Projected Price Range (2023-2027)

Considering these factors, a conservative projection suggests retail prices will remain stable or increase modestly. Expected average annual price growth is around 1-2%:

| Year | Estimated Price per Pack | Notes |

|---|---|---|

| 2023 | $4.55 - $4.65 | Current market rate with minor adjustments |

| 2024 | $4.60 - $4.75 | Slight inflationary adjustments, raw material costs rise |

| 2025 | $4.65 - $4.85 | Healthy demand sustains pricing; formulation innovations may support premium pricing |

| 2026 | $4.70 - $4.95 | Market stabilization, potential new competitors emerge |

| 2027 | $4.75 - $5.05 | Long-term inflationary factors may further influence prices |

Strategic Insights

- Innovation Opportunities: Introducing natural or dual-action formulations can command premium pricing.

- Cost Management: Securing stable supply chains for active ingredients can minimize cost-driven price increases.

- Market Expansion: Targeting emerging markets with rising disposable incomes offers growth potential.

- Brand Differentiation: Emphasizing rapid relief, natural ingredients, or added benefits (e.g., soothing sensation) supports high-margin positioning.

Conclusion

QC Sore Throat operates within a resilient OTC market segment characterized by steady demand and moderate growth. Pricing pressures are tempered by competitive dynamics, raw material costs, and consumer preferences. Forward-looking, modest price increases aligned with inflation and product innovation are anticipated. Strategic positioning through formulation enhancements and market expansion can further optimize profitability.

Key Takeaways

- The global sore throat remedy market offers stable growth with high brand loyalty; QC Sore Throat holds a significant market share.

- Current retail prices hover around $4.50 per pack, with projected annual increases of 1-2%, influenced by ingredient costs and innovation.

- Competitive positioning through natural ingredients and formulation differentiation can unlock premium pricing opportunities.

- Regulatory compliance remains critical; proactive adaptation to evolving standards ensures continued market access.

- Expanding into emerging markets and diversifying formulations present avenues for growth and enhanced profitability.

FAQs

1. What are the primary active ingredients in QC Sore Throat?

Typical formulations include benzocaine, menthol, or phenol, providing localized analgesic and soothing effects [5].

2. How does the OTC regulatory environment affect pricing?

Regulations require compliance with safety and efficacy standards. Higher regulatory costs can translate into slightly increased product prices, especially for new formulations.

3. What factors could disrupt the current market for sore throat remedies?

Potential disruptions include supply chain interruptions, regulatory changes tightening ingredient restrictions, and shifts in consumer preferences toward natural or alternative remedies.

4. Are there significant international differences in sore throat product pricing?

Yes. European markets, regulated by EMA, may see differing price points due to regulatory costs, market size, and competing formulations.

5. How can manufacturers capitalize on emerging trends in sore throat relief?

By developing natural, long-lasting, and dual-action products, or leveraging e-commerce channels, manufacturers can cater to evolving consumer needs for convenience and health-conscious options.

Sources

- [Statista, “Market Size of OTC Sore Throat Remedies,” 2022].

- [IBISWorld, “Over-the-Counter Medicine in the US,” 2022].

- [FDA, “OTC Drugs Monograph Process,” 2023].

- [MarketWatch, “Active Ingredient Cost Trends,” 2022].

- [Physician’s Weekly, “Overview of Sore Throat Pharmacology,” 2021].

More… ↓