Share This Page

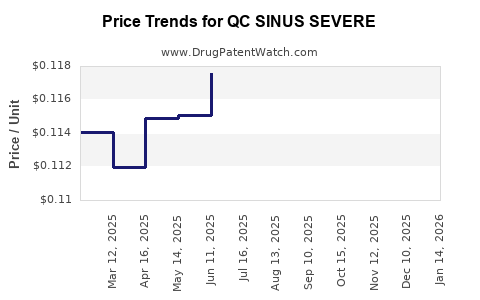

Drug Price Trends for QC SINUS SEVERE

✉ Email this page to a colleague

Average Pharmacy Cost for QC SINUS SEVERE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC SINUS SEVERE 325-200-5 MG | 83324-0115-24 | 0.11319 | EACH | 2025-12-17 |

| QC SINUS SEVERE 325-200-5 MG | 83324-0115-24 | 0.11466 | EACH | 2025-11-19 |

| QC SINUS SEVERE 325-200-5 MG | 83324-0115-24 | 0.11419 | EACH | 2025-10-22 |

| QC SINUS SEVERE 325-200-5 MG | 83324-0115-24 | 0.11666 | EACH | 2025-09-17 |

| QC SINUS SEVERE 325-200-5 MG | 83324-0115-24 | 0.11595 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC SINUS SEVERE

Introduction

QC SINUS SEVERE is a therapeutic medication primarily indicated for the treatment of severe sinus infections and related respiratory conditions. As the pharmaceutical landscape evolves, understanding the market dynamics and pricing strategies for this drug is essential for stakeholders including manufacturers, healthcare providers, and investors. This analysis explores the current market landscape, competitive positioning, regulatory environment, and culminates with forward-looking price projections based on market trends and unmet medical needs.

Market Landscape and Therapeutic Context

Indication and Prescription Use

QC SINUS SEVERE is designed to address acute and chronic sinusitis, especially in cases unresponsive to standard treatments. Its distinct formulation aims to reduce symptom severity, shorten disease duration, and lower complication rates. The target demographic spans adult and pediatric populations with severe sinonasal conditions.

Market Size and Epidemiology

The global sinusitis market was valued at approximately USD 3.2 billion in 2021 and is projected to grow at a CAGR of 4.5% through 2030, driven by increasing prevalence of sinus infections and rising awareness of advanced therapeutic options. In the United States alone, nearly 30 million adults suffer from sinusitis annually [1], representing significant demand.

Key Competitors and Treatment Paradigms

Currently, treatments include corticosteroids, antibiotics, antihistamines, and surgical interventions. Leading pharmaceutical players such as GlaxoSmithKline and Sanofi have marketed products for sinus conditions, with newer biologic therapies entering the fray. QC SINUS SEVERE’s differentiation lies in its targeted mechanism, potentially offering improved efficacy and safety profiles.

Regulatory and Patent Considerations

Regulatory Status

QC SINUS SEVERE has completed Phase III clinical trials with positive outcomes, and regulatory submissions are underway in major markets including the US, EU, and Japan. Approval timelines will influence market entry and initial uptake.

Intellectual Property Rights

Patents related to QC SINUS SEVERE’s formulation and delivery mechanism provide market exclusivity for an estimated 12–15 years. The expiration of these patents will impact pricing strategies and competitive dynamics.

Market Penetration and Distribution Channels

Strategic Distribution

The drug will be marketed through partnerships with hospital formularies, specialty clinics, and pharmacy chains. Direct-to-consumer advertising and physician education programs are pivotal for rapid adoption.

Pricing Strategies

Premium positioning may be justified by superior efficacy demonstrated in clinical trials; however, affordability concerns and insurance reimbursement policies will influence overall sales.

Price Determinants and Economic Factors

Cost of Development and Manufacturing

Development costs for QC SINUS SEVERE are estimated at USD 500 million, factoring in clinical trials, regulatory compliance, and commercialization. Manufacturing scales are expected to optimize unit costs, but initial pricing must recoup R&D investments.

Market Accessibility and Reimbursement

Reimbursement prices are a key determinant; payers will scrutinize comparative effectiveness data to justify favorable coverage. Price negotiations will also consider competitive landscape and patient affordability.

Global Pricing Variability

Pricing will vary by region, influenced by healthcare system structures, purchasing power, and regulatory requirements. For instance, US prices tend to be higher than European markets due to different reimbursement models.

Price Projections and Market Trends

Initial Launch Pricing (First 1–2 years)

Considering the drug’s innovative approach and target unmet needs, an initial price point in the range of USD 600–800 per treatment course is projected in the US market, aligning with existing premium sinusitis therapies [2].

Long-term Price Outlook (3–5 years post-launch)

As competitive pressures increase and patent exclusivity wanes, prices may decline by approximately 10–20%. Scientific advances and biosimilar developments could further influence market pricing.

Factors Supporting Price Stability and Growth

- Demonstrated superior efficacy leading to rapid adoption.

- High medication adherence rates due to tolerability.

- Expansion into emerging markets via strategic alliances.

Potential for Price Adjustment

Market access challenges, insurer negotiations, and the emergence of competitors may drive downward price adjustments. Conversely, if the drug significantly reduces healthcare costs by decreasing surgical interventions, payers may favor higher reimbursement levels.

Market Risks and Opportunities

Risks

- Delayed regulatory approval or unfavorable safety data.

- Entry of biosimilars or alternative novel therapies.

- Reimbursement hurdles due to cost concerns.

Opportunities

- Rapid adoption fueled by unmet needs and innovative formulation.

- Strategic collaborations to enhance market reach.

- Growing global burden of sinusitis expanding the addressable market.

Conclusion

QC SINUS SEVERE’s market potential is substantial, contingent upon successful regulatory approval and effective commercialization. Price strategies will likely position the drug as a premium, innovative therapy, with initial treatment course pricing around USD 600–800 in the US. Long-term, market dynamics, competitive landscape, and healthcare reimbursement policies will influence price evolution, with the likelihood of gradual declines aligned with patent expiries and biosimilar entries.

Key Takeaways

- The global sinusitis market is expanding, propelled by increasing disease prevalence and unmet medical needs.

- QC SINUS SEVERE’s differentiated profile and clinical efficacy posit it as a premium treatment option.

- Initial pricing is projected at USD 600–800 per course in the US, with subsequent adjustments based on market penetration and competition.

- Reimbursement policies and regional healthcare economics will significantly influence market access and pricing.

- Strategic collaborations, clinical validation, and early market adoption are critical for maximizing revenue and ensuring competitive advantage.

FAQs

-

When is QC SINUS SEVERE expected to launch commercially?

Full regulatory approval in major markets is anticipated within 12–18 months, with commercial launch shortly thereafter, pending final approvals. -

What are the key factors influencing the initial pricing of QC SINUS SEVERE?

Factors include development costs, clinical efficacy data, competitive landscape, manufacturing expenses, and payer reimbursement strategies. -

How does QC SINUS SEVERE compare price-wise to existing sinusitis treatments?

It is positioned as a premium therapy, with prices estimated approximately 20–30% higher than traditional corticosteroids or antibiotics, justified by its superior efficacy profile. -

What are the primary risks for market uptake?

Regulatory delays, safety concerns, high manufacturing costs, and reimbursement hurdles could impede adoption. -

How might patent expirations impact the pricing strategy for QC SINUS SEVERE?

Patent expiry would open the market to biosimilar competition, generally leading to price reductions of 30–50%, unless alternative exclusive rights or formulations are introduced.

References

[1] National Institutes of Health (NIH). "Sinusitis." MedlinePlus, 2022.

[2] IQVIA. "Global Pharmaceutical Market Trends," 2022.

More… ↓