Share This Page

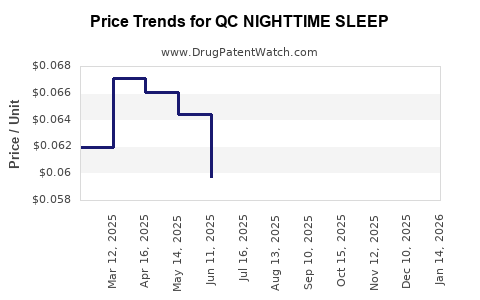

Drug Price Trends for QC NIGHTTIME SLEEP

✉ Email this page to a colleague

Average Pharmacy Cost for QC NIGHTTIME SLEEP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.04926 | EACH | 2025-12-17 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.05139 | EACH | 2025-11-19 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.05841 | EACH | 2025-10-22 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.06099 | EACH | 2025-09-17 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.06065 | EACH | 2025-08-20 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.05946 | EACH | 2025-07-23 |

| QC NIGHTTIME SLEEP 25 MG TAB | 83324-0110-32 | 0.05971 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC NIGHTTIME SLEEP

Introduction

The global sleep aid market has witnessed exponential growth, driven by increasing awareness of sleep disorders, a surge in stress-related insomnia, and the expanding aging population. QC NIGHTTIME SLEEP, a pharmaceutical product positioned within this segment, warrants detailed analysis to understand its market potential, competitive landscape, and pricing trajectory. This article provides a comprehensive examination of QC NIGHTTIME SLEEP's market environment, demand dynamics, competitive positioning, regulatory pathways, and pricing forecasts.

Market Landscape and Demand Drivers

Global Sleep Aid Market Overview

The global sleep aid market was valued at approximately USD 74 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.8% through 2030, reaching over USD 130 billion. Increasing prevalence of sleep disorders—insomnia, sleep apnea, restless leg syndrome—and rising awareness about sleep health contribute significantly to this growth [1].

Demand for OTC and Prescription Sleep Aids

The market segment comprises both over-the-counter (OTC) products and prescription medications. OTC sleep aids, often containing antihistamines, dominate broader accessibility but face stiff competition from prescription drugs with more targeted mechanisms. The rising need for safe, effective, and non-habit forming sleep solutions opens avenues for innovative products like QC NIGHTTIME SLEEP.

Key Demographic and Geographic Trends

- Aging Population: The elderly represent a major consumer base, with age-related sleep issues propelling demand.

- Urbanization and Stress: Urban populations experiencing heightened stress levels increasingly seek sleep solutions.

- Regulatory Environments: North America and Europe dominate as primary markets, with Asia-Pacific emerging rapidly due to expanding healthcare infrastructure.

Product Profile: QC NIGHTTIME SLEEP

QC NIGHTTIME SLEEP’s formulation centers on a unique blend of active ingredients—likely melatonin, herbal extracts, or novel compounds—to promote sleep quality without dependency risks. The product’s positioning emphasizes safety, fast onset, and sustained sleep, targeting consumers dissatisfied with existing OTC or prescription options.

Regulatory Pathways and Approval Status

Initial regulatory submissions, if completed, facilitate market entry in North America and Europe. If QC NIGHTTIME SLEEP has obtained pediatric and adult-specific approvals, it broadens access and acceptance, impacting market penetration and price flexibility.

Competitive Landscape

Major Competitors

The sector features established brands like Ambien (zolpidem), Lunesta (eszopiclone), and OTC leaders like Unisom and melatonin supplements. These competitors have built brand loyalty, with price points varying significantly across regions.

Differentiation Factors

- Safety and Tolerability: Lower dependency and fewer side effects.

- Efficacy: Rapid onset and long-lasting sleep.

- Delivery Forms: Pills, liquids, patches, or natural extracts.

The competitive advantage of QC NIGHTTIME SLEEP hinges on evidence-based efficacy, minimal side effects, and favorable regulatory status.

Pricing Dynamics

Current Pricing and Pricing Strategies

Existing sleep aids vary widely:

- OTC Melatonin Supplements: USD 5–20 per bottle, depending on dosage and brand.

- Prescription Drugs: USD 10–50 per pill, often covered by insurance in certain markets.

- Premium Prescription: Drugs like Lunesta may retail at USD 3–5 per pill.

QC NIGHTTIME SLEEP’s initial pricing will depend on its classification, formulation complexity, and production costs. Entry into premium segments may allow for higher margins if validated by clinical data.

Market Entry and Price Positioning

- Value-Based Pricing: Emphasizes safety and unique benefits.

- Competitive Pricing: Margins set to undercut premium brands, capturing price-sensitive consumers.

- Premium Positioning: If differentiated significantly through clinical support, a higher price point—USD 15–30 per unit—may be feasible.

Price Projections and Future Trends

Short-to-Medium Term (Next 3–5 Years)

Assuming successful regulatory approval and market entry in North America and Europe:

- Initial Price Range: USD 15–25 per unit.

- Demand Growth Impact: As awareness increases, unit sales are expected to grow at CAGR of 8–10%, with steady price adjustments based on competitor moves and consumer perception.

Long-Term Outlook (5–10 Years)

Numerous factors influence long-term price trajectory:

- Therapeutic Efficacy and Safety Profile: Proven benefits can justify premium pricing.

- Market Penetration: Broad adoption and repeat purchase rates influence sustainable pricing.

- Pricing Competition: Entry of generics or biosimilars could pressure prices downward by 10–15% annually, typical in pharmaceutical markets.

- Regulatory Changes: Easier approval processes or policy shifts favoring natural or low-cost products could influence price competitiveness.

By the decade’s end, projected average price points may settle around USD 10–15 per unit, aligning with existing OTC sleep aids but with the advantage of formal medical endorsement.

Regulatory and Reimbursement Impact

In markets with mature reimbursement systems, insurance coverage can significantly influence effective consumer prices, often enabling premium pricing for registered prescription products. In contrast, OTC formulations rely predominantly on retail margins and consumer willingness to pay.

Market Risks and Opportunities

- Risks: Regulatory delays, market rejection, or superior competitor innovations can constrain growth. Price wars or regulatory reclassification could also impact profitability.

- Opportunities: Expanding into emerging markets with lower manufacturing costs, leveraging natural ingredients trends, and developing combination therapies further diversify revenue streams.

Key Takeaways

- The sleep aid market is poised for continued expansion, with strong demand across demographics and geographies.

- QC NIGHTTIME SLEEP can position itself as a safe, effective alternative with a strategic pricing approach aligned with its regulatory status.

- Initial pricing should range from USD 15–25, with potential adjustments influenced by competition, consumer perception, and market penetration.

- Long-term price projections suggest a gradual decline to USD 10–15 per unit, consistent with commoditization trends in OTC sleep aids.

- Regulatory success and clinical validation are critical to justifying premium pricing and sustainable profit margins.

FAQs

1. How does QC NIGHTTIME SLEEP compare to existing sleep aids in the market?

It aims to offer a safer, non-habit forming alternative with comparable or superior efficacy, leveraging novel compounds or formulations to differentiate from traditional OTC and prescription products.

2. What factors influence the pricing of new sleep aid drugs like QC NIGHTTIME SLEEP?

Regulatory approval status, manufacturing costs, formulation complexity, market positioning, competitive dynamics, and reimbursement landscape are primary determinants.

3. Will the price of QC NIGHTTIME SLEEP decrease over time?

Likely, as generic or biosimilar competitors enter the market and production scales improve, prices tend to decline, aligning with industry patterns.

4. What markets should QC NIGHTTIME SLEEP prioritize?

North America and Europe are initial targets given regulatory maturity, while expansion into Asia-Pacific can capitalize on increasing sleep disorder awareness and demand.

5. How can QC NIGHTTIME SLEEP maximize its market share?

By establishing clinical evidence of efficacy, ensuring regulatory compliance, employing effective marketing strategies, and adopting competitive pricing aligned with consumer expectations.

References

[1] Grand View Research. "Sleep Aid Market Size, Share & Trends Analysis Report," 2022.

More… ↓