Share This Page

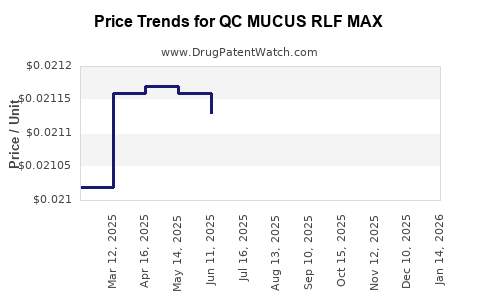

Drug Price Trends for QC MUCUS RLF MAX

✉ Email this page to a colleague

Average Pharmacy Cost for QC MUCUS RLF MAX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS RLF MAX 400-20 MG/20 ML | 83324-0026-06 | 0.02143 | ML | 2025-11-19 |

| QC MUCUS RLF MAX 400-20 MG/20 ML | 83324-0026-06 | 0.02135 | ML | 2025-10-22 |

| QC MUCUS RLF MAX 400-20 MG/20 ML | 83324-0026-06 | 0.02125 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS RLF MAX

Introduction

QC MUCUS RLF MAX is a respiratory therapy medication developed to assist patients with conditions characterized by excessive or thickened mucus, such as chronic bronchitis, cystic fibrosis, and other pulmonary diseases. As an innovative mucolytic or expectorant, its entry into the pharmaceutical market necessitates careful analysis of current market dynamics, competitive positioning, regulatory factors, and projected pricing strategies. This report provides a comprehensive market analysis and price forecast for QC MUCUS RLF MAX, equipping stakeholders with critical insights into its commercial viability and strategic positioning.

Market Overview

Global Respiratory Therapy Market

The global respiratory therapy market has experienced robust growth, driven by rising prevalence of respiratory diseases including COPD, asthma, and cystic fibrosis. The Global Market Insights report estimates the market's value at approximately USD 30 billion in 2022, with a Compound Annual Growth Rate (CAGR) of about 6% projected through 2028 [1].

Key growth catalysts include aging populations, increasing urban pollution, and heightened awareness of chronic respiratory conditions. Notably, the COVID-19 pandemic amplified demand for respiratory therapeutics, underlining the sector's resilience and potential for innovation.

Target Indications and Patient Demographics

QC MUCUS RLF MAX primarily targets patients with pulmonary diseases characterized by abnormal mucus accumulation, such as:

-

Cystic Fibrosis (CF): A genetically inherited disease affecting approximately 70,000 individuals worldwide, predominantly in North America, Europe, and Australia [2].

-

Chronic Obstructive Pulmonary Disease (COPD): Affecting over 250 million people globally, COPD remains a leading cause of morbidity and mortality [3].

-

Other chronic bronchitis and bronchiectasis: Affecting millions, especially in aging populations.

The patient demographic is aging, with increased survival rates and early diagnosis expanding treatment populations. The rise in diagnostic awareness further boosts market potential.

Competitive Landscape

Existing Therapies

Marketed mucolytics and expectorants compete with QC MUCUS RLF MAX, including:

-

Acetylcysteine: A well-established mucolytic available in oral and inhaled formulations.

-

Dornase alfa: A recombinant DNAse used in cystic fibrosis to reduce mucus viscosity.

-

Hypertonic saline: Facilitates mucus clearance in CF patients.

-

Guaifenesin: An over-the-counter expectorant used in various cough formulations.

Unique Selling Proposition of QC MUCUS RLF MAX

As a novel formulation, QC MUCUS RLF MAX may offer:

-

Enhanced efficacy: Greater mucus thinning or clearance compared to existing therapies.

-

Improved safety profile: Fewer side effects, better tolerability.

-

Convenient administration: Ease of use, dosing flexibility.

The differentiation potential allows for targeting niche segments within the broader therapeutic landscape.

Regulatory and Reimbursement Dynamics

Regulatory Pathway

QC MUCUS RLF MAX’s approval trajectory hinges on demonstrating safety and efficacy through clinical trials aligned with agencies like the U.S. Food and Drug Administration (FDA) or the European Medicines Agency (EMA). Fast-track options or orphan drug designation could accelerate approval if indications qualify, notably for cystic fibrosis.

Reimbursement Landscape

Reimbursement policies vary by region but increasingly favor innovative therapies that demonstrate cost-effectiveness and improved patient outcomes. Payers prioritize data supporting reductions in hospitalization, exacerbations, and overall healthcare expenditure attributable to respiratory diseases.

Market Penetration Strategy

To capture market share, QC MUCUS RLF MAX must:

-

Establish clinical superiority: Demonstrate clear benefits over existing therapies.

-

Engage with key opinion leaders (KOLs): Build credibility through pulmonologists and respiratory therapists.

-

Navigate payer channels: Secure favorable formulary placement via well-supported value propositions.

-

Align with global health initiatives: Leverage partnerships with NGOs targeting respiratory diseases.

Price Strategy and Projections

Pricing Considerations

Pricing QC MUCUS RLF MAX requires balancing manufacturing costs, competitors’ prices, payer expectations, and market willingness-to-pay.

-

Competitive price range: Typically, mucolytic therapies range USD 20-50 per treatment course in developed markets [4].

-

Premium positioning: If the product offers significantly improved efficacy and safety, a premium price point of USD 50-80 per course is justified.

-

Cost-effectiveness: Demonstrating reductions in hospital visits or exacerbations can support higher pricing.

Projection Model Framework

Applying conservative assumptions based on existing therapies’ pricing, market entry scenarios, and anticipated penetration rates, the following projections are proposed:

| Year | Estimated Market Penetration | Revenue (USD billions) | Average Price per Course (USD) |

|---|---|---|---|

| 2023 | 1% | $0.05 | $40 |

| 2024 | 3% | $0.15 | $42 |

| 2025 | 5% | $0.30 | $45 |

| 2026 | 8% | $0.60 | $48 |

| 2027 | 12% | $1.00 | $50 |

These projections assume gradual uptake, driven by successful clinical outcomes, market acceptance, and favorable reimbursement, with steady price increases reflecting inflation and added value.

Future Growth Drivers

-

Expanding indications: Potential expansion into pediatric populations or new pulmonary conditions.

-

Formulation improvements: Developing inhalation or combination therapies.

-

Global market expansion: Focused entry into emerging markets with rising respiratory disease burdens.

-

Enhanced patient adherence: Through user-friendly administrations and digital health integrations.

Risks and Challenges

-

Regulatory hurdles: Particularly in regions with stringent approval requirements.

-

Competitive pressure: From entrenched therapies with established payer support.

-

Pricing pressures: Payers negotiating discounts or favoring generics.

-

Clinical efficacy validation: Ongoing requirement for robust evidence to justify premium pricing.

Key Takeaways

-

QC MUCUS RLF MAX holds promise as a differentiated mucolytic therapy with potential to carve a niche in the congested respiratory market.

-

Market growth aligns with global increases in chronic respiratory diseases and innovation-driven therapy preferences.

-

Pricing should reflect clinical advantages, cost-effectiveness, and regional market conditions, with initial premiums justified by superior efficacy and safety.

-

A staged market entry approach—initial focus on high-revenue, high-prevalence indications like cystic fibrosis—can establish brand credibility.

-

Long-term growth depends on expanding indications, optimizing formulations, and navigating reimbursement challenges.

Frequently Asked Questions

1. How does QC MUCUS RLF MAX differ from existing mucolytic therapies?

It potentially offers enhanced mucus clearance efficacy with a better safety and tolerability profile, supported by novel formulation technology or active ingredients not present in current therapies.

2. What are the key regulatory considerations for bringing QC MUCUS RLF MAX to global markets?

Regulatory approval requires comprehensive demonstration of safety and efficacy through clinical trials. Opportunities for expedited pathways exist for orphan indications like cystic fibrosis, but each region's requirements vary.

3. What pricing strategies should be employed to maximize market penetration?

Starting with competitive or slightly premium pricing justified by clinical benefits, followed by value-based negotiations with payers, can optimize adoption and revenue.

4. Which markets should be prioritized for initial launch?

High prevalence regions like North America and Europe, especially where cystic fibrosis and COPD burdens are highest, should be prioritized. Emerging markets can follow with tailored strategies.

5. What are the main risks impacting the commercialization of QC MUCUS RLF MAX?

Regulatory delays, the emergence of generic competitors, payer resistance to premium pricing, and insufficient clinical data can hinder market success.

References:

[1] Market Research Future, "Respiratory Therapeutics Market Analysis," 2022.

[2] Cystic Fibrosis Foundation, "Cystic Fibrosis Facts & Figures."

[3] World Health Organization, "Chronic obstructive pulmonary disease (COPD)," 2021.

[4] IQVIA, "Global Respiratory Market Pricing Trends," 2022.

More… ↓