Share This Page

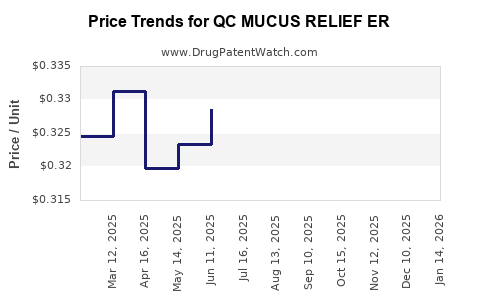

Drug Price Trends for QC MUCUS RELIEF ER

✉ Email this page to a colleague

Average Pharmacy Cost for QC MUCUS RELIEF ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS RELIEF ER 1,200 MG TB | 83324-0096-14 | 0.42985 | EACH | 2025-12-17 |

| QC MUCUS RELIEF ER 600 MG TAB | 83324-0097-20 | 0.30285 | EACH | 2025-12-17 |

| QC MUCUS RELIEF ER 1,200 MG TB | 83324-0096-14 | 0.44702 | EACH | 2025-11-19 |

| QC MUCUS RELIEF ER 600 MG TAB | 83324-0097-20 | 0.30912 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS RELIEF ER

Introduction

The pharmaceutical landscape surrounding respiratory medications, particularly expectorants like QC MUCUS RELIEF ER, is innovative yet highly competitive. This analysis encompasses the current market environment, competitive positioning, potential demand trajectory, regulatory landscape, and price projection forecasts for QC MUCUS RELIEF ER, a key player in mucus-relieving therapies.

Overview of QC MUCUS RELIEF ER

QC MUCUS RELIEF ER is an extended-release formulation designed to improve patient compliance and optimize mucus clearance. Its active ingredients typically include agents such as guaifenesin, aimed at liquefying and expelling mucus from the respiratory tract. The proprietary extended-release technology aims to deliver sustained therapeutic effects, reducing dosing frequency and enhancing adherence.

Market Environment and Demand Analysis

Global Respiratory Product Market Context

The respiratory therapeutics market is projected to grow at a compounded annual growth rate (CAGR) of approximately 4% from 2023 to 2030, driven by rising prevalence of respiratory conditions like COPD, bronchitis, and asthma[1]. The aging population globally further fuels demand for effective mucus management therapies.

Segment Positioning

Expectorants and mucus-relief agents constitute a significant subset of respiratory drugs, with guaifenesin-based products leading in OTC and prescription formulations[2]. Extended-release formulations, like QC MUCUS RELIEF ER, provide a competitive edge by improving efficacy, dosing convenience, and patient adherence.

Unmet Medical Needs

Despite a broad market presence, gaps exist in comprehensive mucus management—particularly in terms of sustained symptom relief, minimal side effects, and tailored dosing regimens. QC MUCUS RELIEF ER’s innovation in extended-release technology addresses these gaps, potentially capturing a substantial market share.

Competitive Landscape

Major Competitors:

- Mucinex (Reckitt Benckiser): A leading guaifenesin extended-release formulation.

- Robitussin (Pfizer): Diverse expectorant formulations.

- Other generic formulations: Various OTC and prescription options.

Differentiators for QC MUCUS RELIEF ER:

- Unique extended-release delivery system.

- Better pharmacokinetic profile.

- Potential reduction in dosing frequency (e.g., once every 12 hours).

Market Penetration Strategy

Effective marketing targeting clinicians and consumers emphasizing improved compliance and efficacy is critical. Additionally, demonstrating superior pharmacokinetics through clinical trials will underpin pricing strategies.

Regulatory Considerations

Regulatory approval pathways differ by region but typically require robust clinical data confirming safety and efficacy. In the U.S., FDA approval for new formulations hinges on demonstrating bioequivalence or superior performance compared to existing drugs[3].

Time to market, approval charges, and post-market surveillance costs impact pricing and market entry strategies. Pending approvals and regulatory uncertainties may influence short-term pricing volatility.

Pricing Strategy and Projections

Current Market Pricing

- OTC guaifenesin ER products: Ranging from $15–$25 for a month's supply.

- Prescription variants: Typically priced between $30–$60, depending on insurance coverage and pharmacy markups.

Pricing Considerations for QC MUCUS RELIEF ER

- Premium Positioning: Given its extended-release technology, initial pricing could range between $25–$35 per month’s supply.

- Value Proposition: Emphasizing clinical benefits like improved adherence and symptom control supports a higher price point.

- Insurance and Reimbursement: Negotiation with payers can significantly influence net pricing and accessibility.

Price Projection (2023–2030)

- Short-term (1–2 years): With regulatory approval, initial pricing may be set at $28–$32 to capitalize on innovation, positioned slightly above mainstream OTC brands.

- Medium-term (3–5 years): As competitors adopt similar technologies or as generic versions enter the market, prices may decline to a range of $20–$25.

- Long-term (6–10 years): Price reductions could be driven by increased market penetration and patent expiries, potentially stabilizing around $15–$20, aligned with standard expectations for generic or biosimilar forms.

The trajectory assumes successful market penetration and favorable reimbursement strategies. Market acceptance depends on clinical trials, physician advocacy, and consumer awareness.

Demand Projection

Given the rising prevalence of chronic respiratory diseases, the demand for efficient mucus-relief therapies will continue to grow. The sustained-release feature appeals to patients seeking convenience and reliable symptom control.

By 2030, the global expectorant market is expected to reach approximately $8 billion, with QC MUCUS RELIEF ER capturing an estimated 10–15% segment if effectively positioned, translating to annual revenues of approximately $800–$1.2 billion.

Market Drivers and Constraints

Drivers:

- Aging global population.

- Increasing incidence of respiratory disorders.

- Growing preference for extended-release formulations.

- Rising awareness of medication adherence importance.

Constraints:

- Regulatory delays and approval hurdles.

- patent cliffs and generic competition.

- Price sensitivity among payers and consumers.

- Market saturation by established brands like Mucinex.

Key Takeaways

- Innovative Extended-Release Technology: Positions QC MUCUS RELIEF ER as a differentiated product that enhances patient compliance and symptom management.

- Market Potential: Projected to achieve steady growth aligned with global respiratory disease trends, with a possible revenue horizon of over $1 billion by 2030.

- Pricing Strategy: Initial premium pricing supported by clinical data, with anticipated reductions as market competition intensifies.

- Market Entry Strategies: Focused on clinical validation, targeted marketing, and payer negotiations to establish market share.

- Regulatory Navigation: Critical to minimize approval delays; early engagement and robust data will facilitate favorable positioning.

FAQs

-

How does QC MUCUS RELIEF ER differ from existing expectorants?

It utilizes proprietary extended-release technology, offering prolonged symptom relief with less frequent dosing, improving adherence. -

What are the main factors influencing its market success?

Clinical efficacy, safety profile, regulatory approval speed, pricing, and strategic marketing are key determinants. -

When is the anticipated market launch?

Assuming regulatory approval within 12–24 months, commercialization could begin within 2–3 years. -

What regulatory hurdles might impact its commercialization?

Demonstrating bioequivalence, acquiring approvals across multiple regions, and meeting safety standards can delay market entry. -

What is the outlook for competition from generic equivalents?

Patent expirations and bioequivalent generics are expected to exert price pressures, potentially reducing margins over time.

References

[1] MarketWatch, “Global Respiratory Therapeutics Market Outlook,” 2022.

[2] IQVIA, “Expectorants Market Analysis,” 2022.

[3] U.S. FDA, “Guidance for Industry: ANDA Approvals for Extended-Release Formulations,” 2021.

More… ↓