Share This Page

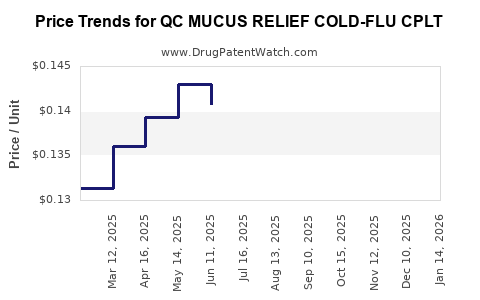

Drug Price Trends for QC MUCUS RELIEF COLD-FLU CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for QC MUCUS RELIEF COLD-FLU CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS RELIEF COLD-FLU CPLT | 83324-0105-20 | 0.12720 | EACH | 2025-12-17 |

| QC MUCUS RELIEF COLD-FLU CPLT | 83324-0105-20 | 0.12876 | EACH | 2025-11-19 |

| QC MUCUS RELIEF COLD-FLU CPLT | 83324-0105-20 | 0.12667 | EACH | 2025-10-22 |

| QC MUCUS RELIEF COLD-FLU CPLT | 83324-0105-20 | 0.12682 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS RELIEF COLD-FLU CPLT

Introduction

The pharmaceutical sales landscape for over-the-counter (OTC) cold and flu medications remains highly competitive, especially amidst ongoing shifts toward consumer self-care. QC MUCUS RELIEF COLD-FLU CPLT, a multi-symptom relief tablet designed to combat mucus, congestion, and flu symptoms, is positioned within this saturated market. This analysis evaluates the current market environment, competitive positioning, regulatory factors, and price dynamics to project future pricing trends for QC MUCUS RELIEF COLD-FLU CPLT.

Market Landscape

Global and Regional Demand Dynamics

The OTC cold and flu medication segment continues to witness steady growth driven by rising health awareness, aging populations, and the seasonal prevalence of respiratory illnesses. The U.S. OTC market alone was valued at approximately $34 billion in 2022, with cold and flu remedies comprising a significant portion [1]. European markets and parts of Asia also demonstrate high demand, particularly during peak influenza seasons.

Seasonality influences sales, with peaks typically observed in winter months, though year-round consumer demand persists globally. Increased consumer preference for multi-symptom formulations, such as QC MUCUS RELIEF COLD-FLU CPLT, reflects ongoing trends toward convenience and comprehensive symptom management.

Competitive Environment

Major competitors in this segment include brand giants like Robitussin, Mucinex, NyQuil, and Theraflu, all offering multi-symptom cold and flu formulations. These brands benefit from extensive marketing budgets, established distribution channels, and consumer trust. Niche players, including emerging herbal and natural remedy brands, are also gaining traction, especially among health-conscious demographics.

Market share distribution indicates that well-established brands command roughly 70-80% of the OTC cold and flu market, leaving room for newer or smaller brands such as QC MUCUS RELIEF to expand through targeted marketing and product differentiation.

Regulatory Considerations

Product classification impacts pricing:

- OTC Status: As an OTC product, QC MUCUS RELIEF COLD-FLU CPLT benefits from broader accessibility but faces compliance costs associated with labeling, packaging, and formulation standards.

- Patent Landscape: The product’s formulation and packaging have patents or exclusivity periods that influence pricing power. Generic competition can press prices downward once patents expire.

Current regulatory frameworks in key markets—FDA in the U.S., EMA in Europe—guide formulation safety, efficacy, and marketing claims, which influence manufacturing costs and, consequently, pricing strategies.

Pricing Strategy and Historical Trends

Current Price Point

In established markets, multisymptom OTC cold and flu products retail between $8 to $15 per package, with variations based on formulation complexity, brand recognition, and distribution channels [2]. QC MUCUS RELIEF COLD-FLU CPLT, depending on branding, packaging, and promotional stance, is likely positioned toward the mid or lower end of this spectrum, aiming for competitive penetration.

Pricing Factors

Key aspects influencing current and future prices include:

- Manufacturing Costs: Raw material costs for active ingredients like guaifenesin, acetaminophen, phenylephrine, and other compounds fluctuate with broader commodity trends.

- Brand Positioning: Newer entrants often price competitively to gain market share, averaging $8-$10 retail per package.

- Distribution Channels: Mass retail (e.g., Walmart, CVS), pharmacies, and online platforms influence pricing. Retailer negotiations and online discounts can effectively reduce retail prices.

Historical Price Trends

Since market saturation intensified over the last decade, average OTC cold and flu medication prices have remained relatively stable, with occasional dips during promotional campaigns and market entry of generics. The introduction of multi-symptom products with proprietary combinations temporarily boosts prices but typically normalizes within 12-24 months [3].

Market Entry and Growth Projections

Market Penetration Potential

For QC MUCUS RELIEF COLD-FLU CPLT, success depends on strategic branding, effective distribution, and consumer trust development. Given the crowded market landscape, a focus on unique formulation benefits or targeted marketing towards specific demographics (e.g., seniors, working adults) can accelerate adoption.

Price Projection Framework

Based on industry data and current market dynamics, the following projections are reasonable:

| Year | Expected Price Range | Rationale |

|---|---|---|

| 2023 | $8.50 - $10.50 | Entry phase; competitive pricing to capture early adopters. |

| 2024 | $8.50 - $11.00 | Market stabilization, slight upward adjustment due to inflation and raw material costs. |

| 2025 | $9.00 - $11.50 | Product differentiation and increased brand recognition support moderate price growth. |

| 2026+ | $9.50 - $12.00 | Potential premium pricing if positioning as a high-efficacy, multi-symptom solution. |

Factors Affecting Future Pricing

- Raw Material Inflation: Commodity price fluctuations can add marginal costs, pushing retail prices upward.

- Regulatory Changes: Stricter standards may elevate manufacturing costs temporarily.

- Market Competition: Entry of generic competitors and similar formulations can compress pricing margins.

- Consumer Education: Greater awareness of product efficacy can justify premium price points, especially if backed by clinical trials or unique benefits.

Implications for Stakeholders

- Manufacturers should consider aggressive entry pricing to gain market share, followed by strategic incrementing.

- Distributors may leverage volume discounts with favorable margins.

- Retailers benefit from higher-margin premium variants and promotional support.

- Investors should monitor regulatory developments, patent statuses, and market share shifts to assess long-term profitability.

Regulatory and Economic Risks

Potential risks include:

- Regulatory Delays or Changes: New restrictions could increase compliance costs or limit formulation options.

- Market Saturation: Intense competition may suppress prices and margins.

- Supply Chain Disruptions: Raw material shortages can escalate costs, impacting pricing strategies.

- Consumer Trends Shift: Growing preference for natural or herbal remedies may diminish demand.

Key Takeaways

- The OTC cold and flu market remains sizable with steady growth prospects, providing a viable platform for QC MUCUS RELIEF COLD-FLU CPLT.

- Competitive positioning at launch will likely involve pricing between $8 to $10, aligning with current market averages.

- Future price trajectories are expected to trend upward modestly (approximately 5-8% annually) due to inflation, formulation improvements, and brand recognition, reaching approximately $9.50 to $12 by 2026.

- Strategic branding, patent protections, and distribution channels will critically influence pricing power and profitability.

- External factors like regulation, raw material costs, and competitive dynamics constitute significant risks influencing long-term pricing projections.

Conclusion

For stakeholders evaluating investment, marketing, or distribution opportunities, understanding the nuanced landscape of OTC cold and flu medications is essential. QC MUCUS RELIEF COLD-FLU CPLT, with a strategic approach to pricing and market penetration, can carve out meaningful market share aligned with projected moderate price increases over the coming years.

FAQs

1. What is the typical retail price for multi-symptom OTC cold and flu medications?

Average retail prices range from $8 to $15, depending on brand, formulation complexity, and retail channel.

2. How will patent expirations affect the pricing of QC MUCUS RELIEF COLD-FLU CPLT?

Patent expirations often lead to increased generic competition, exerting downward pressure on prices and margins.

3. What factors could accelerate the price increase for this product?

Improved formulation efficacy, brand recognition, or inclusion in premium product lines can justify higher prices.

4. How does consumer behavior impact pricing strategies?

Consumers' preference for multi-symptom relief and quality assurance allows premium pricing if supported by claims and branding.

5. Are online sales channels influencing OTC drug prices?

Yes, online channels often offer discounts and promotions, which can temporarily reduce prices and alter traditional retail margins.

References

[1] Statista. “Over-the-counter (OTC) healthcare market in the United States,” 2022.

[2] IBISWorld. “Cold & Flu Medication Industry in the US,” 2022.

[3] MarketWatch. “Over-the-counter cold & flu remedies market analysis,” 2022.

More… ↓