Share This Page

Drug Price Trends for QC MUCUS DM MAX ER

✉ Email this page to a colleague

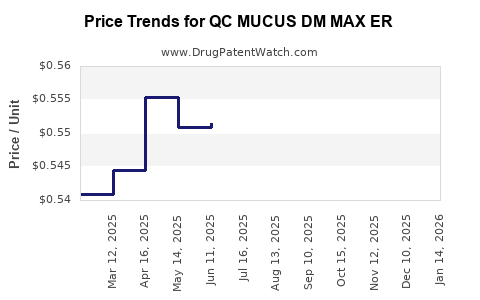

Average Pharmacy Cost for QC MUCUS DM MAX ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MUCUS DM MAX ER 1200-60 MG | 83324-0137-14 | 0.53895 | EACH | 2025-12-17 |

| QC MUCUS DM MAX ER 1200-60 MG | 83324-0137-14 | 0.54629 | EACH | 2025-11-19 |

| QC MUCUS DM MAX ER 1200-60 MG | 83324-0137-14 | 0.54136 | EACH | 2025-10-22 |

| QC MUCUS DM MAX ER 1200-60 MG | 83324-0137-14 | 0.54933 | EACH | 2025-09-17 |

| QC MUCUS DM MAX ER 1200-60 MG | 83324-0137-14 | 0.55146 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC MUCUS DM MAX ER

Introduction

QC MUCUS DM MAX ER is a prescription medication combining an expectorant, a cough suppressant, and a decongestant, designed primarily for symptomatic relief of respiratory conditions such as coughs, mucus congestion, and cold symptoms. As with any pharmaceutical product, understanding its market landscape and potential pricing trajectory is essential for stakeholders, including pharmaceutical companies, investors, healthcare providers, and policy makers. This analysis explores the current demand, competitive landscape, regulatory environment, manufacturing considerations, and pricing trends critical to forecasting the future of QC MUCUS DM MAX ER.

Market Overview

Therapeutic Area and Disease Incidence

Respiratory illnesses, including upper respiratory tract infections, bronchitis, and cold-associated coughs, represent a significant share of outpatient visits globally. The global cold and cough remedy market was valued at approximately USD 6.4 billion in 2021 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.6% through 2028 [1].

Patient Demographics and Demand Factors

The primary consumer base for QC MUCUS DM MAX ER includes adults and pediatric populations seeking over-the-counter (OTC) and prescription relief for acute symptoms. Factors impacting demand include:

- Rising awareness of respiratory illnesses.

- Increasing prevalence of chronic respiratory conditions.

- Aging populations, particularly in developed countries.

- Seasonal variations, with peaks during winter months.

Market Segments and Distribution Channels

The product’s distribution spans pharmacies, hospitals, and drugstores, with a growing trend toward online pharmaceutical sales. Prescriptions drive higher-margin sales, especially in regions with strict prescription requirements or where physicians prefer prescribing combination therapies for immediate symptom relief.

Competitive Landscape

Key Players and Market Share

While specific data on QC MUCUS DM MAX ER is limited due to proprietary product status, it competes in a crowded market dominated by established OTC brands and prescription medications. Notable competitors include:

- Mucinex DM (Reckitt Benckiser)

- Robitussin DM (Johnson & Johnson)

- Delsym Cough Suppressant (Insight Pharmaceuticals)

These brands offer similar combination formulations, primarily expectorants with cough suppressants.

Product Differentiation

QC MUCUS DM MAX ER’s unique value proposition hinges on its extended-release formulation, providing longer symptom control. Its active ingredients likely include dextromethorphan (cough suppressant), guaifenesin (expectorant), and pseudoephedrine (decongestant). Extended-release formulations can command premium pricing due to convenience and improved adherence.

Market Entry Barriers

Barriers include regulatory approval processes, manufacturing complexities, patent protection, and consumer brand loyalty. Patent exclusivity, if maintained, provides pricing leverage and market differentiation.

Regulatory Environment

FDA and International Regulatory Considerations

In the United States, the Food and Drug Administration (FDA) oversees combination OTC medications, requiring rigorous safety, efficacy, and manufacturing standards. The FDA’s rulemaking, including the OTC monograph process, influences product classification and permissible manufacturing claims.

Internationally, regulatory agencies like EMA (European Medicines Agency) and PMDA (Japan Pharmaceuticals and Medical Devices Agency) set similar standards. Market expansion depends on navigating these diverse approval pathways.

Patent and Exclusivity Status

The patent life for formulations like QC MUCUS DM MAX ER can impact competitive pricing. Patent expiration typically triggers increased competition and price reductions unless secured by supplementary data or regulatory barriers.

Manufacturing and Supply Chain Factors

Production Costs

Key cost drivers include active pharmaceutical ingredient (API) procurement, formulation technology (extended-release mechanisms), packaging, quality assurance, and regulatory compliance. Manufacturing complexity influences pricing strategies and profit margins.

Supply Chain Dynamics

Global disruptions, such as those induced by pandemics or geopolitical tensions, can affect raw material availability and distribution channels, potentially impacting product pricing and availability.

Pricing Trends and Projections

Current Pricing Landscape

As an ER combination formulation, QC MUCUS DM MAX ER’s average retail price in the US ranges between USD 25–35 for a 20-30 count pack, depending on pharmacy markups, insurance, and discount programs [2]. These prices are higher compared to immediate-release formulations due to extended-duration benefits.

Factors Affecting Future Prices

- Patent and Exclusivity: As patents expire, generic competitors will emerge, driving prices down.

- Market Penetration: Broader adoption, especially for OTC use, could lead to volume-based pricing models.

- Regulatory Changes: Stringent regulatory modifications could increase compliance costs.

- Economic Conditions: Inflation and pharmacy reimbursement trends influence consumer prices.

Price Projection Outlook (Next 3–5 Years)

Based on historical trends, extending patent protection, and market growth, the following projections are reasonable:

- Short-term (1–2 years): Stabilization of current prices with minimal fluctuation due to patent protections or limited generic competition.

- Medium-term (3–5 years): Potential price erosion of 15–25% upon patent expiry, with generic versions capturing substantial market share.

- Long-term (beyond 5 years): Generic competition dominates, with prices declining to USD 10–15 per pack, paralleling established OTC formulations.

Market Drivers and Challenges

Drivers

- Increasing prevalence of respiratory illnesses.

- Rising geriatric population requiring longer-term symptom management.

- Preference for combination, extended-release formulations for convenience.

- Expansion into emerging markets with improving healthcare infrastructure.

Challenges

- Regulatory hurdles and delays in approval.

- Intense competition and rapid generic entry.

- Consumer preference shifting towards natural or herbal remedies.

- Price sensitivity in certain markets and insurance coverage limitations.

Opportunities for Stakeholders

- Pharmaceutical companies can optimize formulations or improve delivery mechanisms to extend patent life.

- Investors should monitor patent statuses and regulatory approvals to time market entry or divestments.

- Healthcare providers can evaluate the cost-benefit profile of prescribing QC MUCUS DM MAX ER versus alternatives.

- Policymakers may consider the role of pricing transparency and affordability in public health strategies.

Key Takeaways

- QC MUCUS DM MAX ER operates within a dynamic market driven by respiratory disease prevalence, technological innovation, and regulatory factors.

- The product's extended-release formulation offers a competitive advantage, enabling premium pricing potential in the short term.

- Patent expiration and increasing generic competition are expected to drive prices downward over the next 3–5 years.

- Cost structures are influenced by manufacturing complexity and supply chain stability, which can impact pricing strategies.

- Market success depends on differentiation, regulatory navigation, and effective distribution channels amid fierce competition.

FAQs

Q1: How does patent expiration influence the pricing of QC MUCUS DM MAX ER?

Patent expiration typically leads to generic competitors entering the market, significantly reducing prices and eroding profit margins for the original branded product.

Q2: What is the primary driver for demand growth in respiratory symptomatic medications?

Rising global incidence of respiratory illnesses and an aging population seeking symptom relief are key drivers.

Q3: Can the extended-release formulation command higher prices than immediate-release versions?

Yes, due to the convenience, improved adherence, and longer duration of action offered by extended-release formulations, they generally attract higher prices.

Q4: What are the major regulatory hurdles for QC MUCUS DM MAX ER in international markets?

Regulatory approval depends on compliance with local standards, validation of safety and efficacy data, and navigating diverse licensing requirements, which can delay market entry and impact pricing.

Q5: How might emerging telemedicine trends impact the market for QC MUCUS DM MAX ER?

Telemedicine can facilitate easier access to prescriptions, potentially increasing demand, but also intensify price competition through online pharmacies and discount channels.

References

[1] Grand View Research. Cold and Cough Remedy Market Size & Trends Analysis, 2021–2028.

[2] GoodRx. Cost comparison for Mucinex DM and alternatives, 2022.

More… ↓