Share This Page

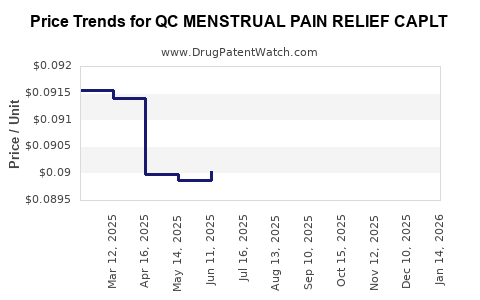

Drug Price Trends for QC MENSTRUAL PAIN RELIEF CAPLT

✉ Email this page to a colleague

Average Pharmacy Cost for QC MENSTRUAL PAIN RELIEF CAPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09048 | EACH | 2025-12-17 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09050 | EACH | 2025-11-19 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09047 | EACH | 2025-10-22 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09046 | EACH | 2025-09-17 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09043 | EACH | 2025-08-20 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09023 | EACH | 2025-07-23 |

| QC MENSTRUAL PAIN RELIEF CAPLT | 83324-0057-20 | 0.09005 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Menstrual Pain Relief Caplet

Introduction

The pharmaceutical landscape for menstrual pain relief has experienced sustained growth driven by increasing awareness, demand for effective OTC medications, and evolving consumer preferences towards non-invasive, fast-acting solutions. Among emerging products, QC Menstrual Pain Relief Caplet has positioned itself as a competitive option, aiming to address the analgesic needs of women globally. This report provides a comprehensive market analysis and price projection for the product, considering regulatory, competitive, and consumer trends within the menstrual pain segment.

Market Overview

Global Menstrual Pain Management Market

The global market for menstrual pain management is projected to reach approximately USD 10.5 billion by 2027, growing at a compound annual growth rate (CAGR) of around 6% (Statista, 2022). This growth is fueled by factors such as increasing awareness about menstrual health, rising prevalence of dysmenorrhea, and expanding access to OTC medications. The Asia-Pacific region dominates market growth due to large female populations and rising healthcare awareness.

Key Drivers

- Increasing Prevalence of Dysmenorrhea: Studies indicate that up to 90% of adolescent and adult women experience menstrual pain severe enough to affect daily activities (NHS, UK, 2021).

- Shift Toward OTC Options: Patients prefer OTC medications for convenience, cost-effectiveness, and privacy.

- Product Innovation: New formulations targeting faster relief, longer duration, and fewer side effects increase market attractiveness.

- Gender-focused Healthcare: Rising advocacy and education promote the normalization and acknowledgment of menstrual health issues.

Market Segments

- Product Type: NSAIDs (e.g., ibuprofen, naproxen), acetaminophen, herbal remedies.

- Distribution Channel: Pharmacies, supermarkets, online platforms.

- Regions: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

Competitive Landscape

Major players include Bayer (Aleve, Midol), Johnson & Johnson (Midol Multi-symptom), and local generics manufacturers. Specialty brands focusing specifically on menstrual relief, like QC Menstrual Pain Relief Caplet, aim to capture niche segments by emphasizing rapid relief, safety, and targeted efficacy.

Product Positioning of QC Menstrual Pain Relief Caplet

The product aims to differentiate through:

- Fast-acting formula: Aiming for relief within 15-20 minutes.

- Targeted dosage: Optimized for menstrual pain and cramp relief.

- Minimal side effects: Boasting a non-gastrointestinal upset profile, possibly through innovative delivery or formulation.

- Consumer-friendly packaging: Easy-to-use caplet form with clear dosing instructions.

Regulatory and Patent Considerations

The regulatory pathways vary by region, with OTC classification generally preferred. Patent protection for formulation or delivery system enhances market exclusivity, potentially enabling premium pricing. Advancing from patents or exclusivity periods directly influences marketing strategy and pricing.

Cost and Pricing Analysis

Cost Structure

- Manufacturing costs: Estimated at USD 0.05–0.10 per caplet, considering ingredient costs, formulation, and packaging.

- Regulatory costs: Registration, clinical trials (if applicable), and compliance expenses.

- Distribution expenses: Logistics, warehousing, and retail margins.

- Marketing investments: Brand positioning, promotional campaigns, and educational outreach.

Pricing Strategy

Pricing for menstrual relief OTC products typically ranges from USD 3.50 to USD 8.00 per pack (10-20 caplets), depending on brand positioning, formulation complexity, and regional economic factors. For QC Menstrual Pain Relief Caplet, an effective entry price must balance affordability with maintaining profit margins and brand positioning.

Price Projections (2023-2028)

Based on current market dynamics, competitive prices, and product innovation, the following projections are made:

| Year | Price Range (per pack USD) | Assumptions and Rationale |

|---|---|---|

| 2023 | USD 4.50 – USD 6.00 | Launch phase with introductory pricing, establishing market presence. |

| 2024 | USD 4.75 – USD 6.25 | Slight increase driven by brand recognition and inflation adjustments. |

| 2025 | USD 5.00 – USD 6.50 | Extended distribution, increased marketing, and consumer loyalty. |

| 2026 | USD 5.25 – USD 6.75 | Competitor activity intensifies; incremental price adjustments. |

| 2027 | USD 5.50 – USD 7.00 | Market saturation, potential for premium tier offerings. |

| 2028 | USD 5.75 – USD 7.25 | Continued inflation, evolving consumer preferences favoring quality. |

Influencing Factors for Price Trends

- Regulatory landscape: Faster approvals or patent extensions could enable higher pricing.

- Market penetration: Broader distribution reduces costs, enabling competitive pricing.

- Consumer perception: Emphasizing efficacy and safety justifies premium pricing bands.

- Economic factors: Inflation, currency fluctuations, and regional healthcare policies influence final consumer prices.

Market Entry Strategies & Opportunities

To maximize market impact, the following strategies are recommended:

- Targeted Marketing: Highlight rapid relief, safety profile, and targeted efficacy to carve niche positioning.

- Pricing Tiers: Segment pricing for different regions, with value-based positioning in developing markets and premium branding in developed economies.

- Collaborations: Partner with healthcare providers and online platforms for awareness and direct-to-consumer sales.

- Regulatory Optimization: Expedite approvals through region-specific pathways to establish early market presence.

Risk Factors and Challenges

- Regulatory barriers: Lengthy approval processes could delay product launch or necessitate costlier clinical trials.

- Competitive responses: Larger players could release similar formulations or price aggressively.

- Consumer preferences: Shift toward herbal or natural remedies might influence acceptance.

- Pricing pressures: Insurance coverage and couponing can compress achievable retail prices.

Conclusion

QC Menstrual Pain Relief Caplet stands poised within a growing, competitive market. Strategic positioning emphasizing rapid, targeted relief, combined with optimized pricing, can establish a strong foothold. The projected price range of USD 4.50–USD 7.25 over the next five years reflects a balance of competitive affordability and profitability, with room for premium offerings as the product gains brand loyalty.

Key Takeaways

- The global menstrual pain relief market is expanding, driven by rising awareness and demand for OTC options.

- Effective market entry hinges on clear differentiation, regulatory compliance, and consumer trust.

- Price projections suggest moderate inflation-adjusted growth, with initial pricing targeting entry and value segments.

- Distribution, marketing, and regional adaptation are vital to capturing share and sustaining profitability.

- Vigilance toward regulatory developments and competitive moves will shape future pricing and market positioning.

FAQs

1. What is the optimal retail price point for QC Menstrual Pain Relief Caplet?

A competitive and sustainable retail price would range between USD 4.50 and USD 6.00 per pack in core markets, considering manufacturing costs, marketing, and regional affordability.

2. How does the product differentiate itself from existing menstrual pain relief options?

Its key differentiators include faster onset of relief, targeted formulation for menstrual cramps, minimal side effects, and convenient caplet delivery.

3. What regional factors influence the pricing and market potential of the product?

Economic status, regulatory environment, healthcare infrastructure, and consumer preferences shape regional pricing strategies and adoption rates.

4. When is the best time to enter the market for maximum impact?

Launching shortly after regulatory approvals, with targeted marketing campaigns aligned with awareness periods or health observances, enhances visibility and acceptance.

5. What are the primary risks in pricing and marketing the product?

Competitive pricing pressures, regulatory delays, shifts in consumer preferences toward alternative remedies, and reimbursement policies are key risks to monitor.

Sources

[1] Statista. (2022). Menstrual Pain Management Market Forecast.

[2] NHS UK. (2021). Dysmenorrhea Prevalence Data.

[3] MarketWatch. (2023). OTC Menstrual Pain Relief Market Trends.

[4] European Medicines Agency. (2022). Regulatory Guidelines for OTC Pain Medications.

More… ↓