Share This Page

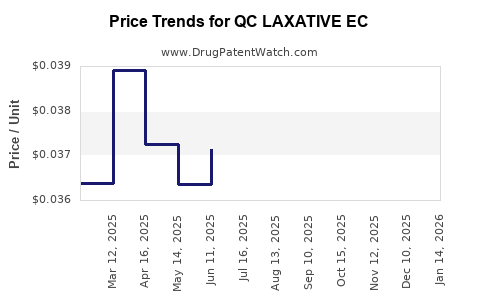

Drug Price Trends for QC LAXATIVE EC

✉ Email this page to a colleague

Average Pharmacy Cost for QC LAXATIVE EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03854 | EACH | 2025-12-17 |

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03975 | EACH | 2025-11-19 |

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03988 | EACH | 2025-10-22 |

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03918 | EACH | 2025-09-17 |

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03953 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC LAXATIVE EC

Introduction

The pharmaceutical landscape for gastrointestinal (GI) management medications remains robust, driven by increasing prevalence of chronic constipation, irritable bowel syndrome (IBS), and other GI disorders. The drug QC LAXATIVE EC (Ethylenediamine Citrate Laxative Enteric-Coated), positioned within this domain, commands strategic interest from stakeholders seeking to analyze market opportunities, competitive positioning, and future pricing trajectories. This report evaluates the current market landscape and provides projections on the future pricing of QC LAXATIVE EC, considering regulatory, economic, and competitive factors.

Market Overview

Global GI Therapeutics Market Context

The global GI therapeutics market was valued at approximately USD 17.5 billion in 2022 and is projected to reach USD 24 billion by 2030, growing at a CAGR of around 4.2% (2023–2030) [1]. This growth is underpinned by rising incidence rates of constipation and other GI disorders, especially in aging populations and urbanized regions with sedentary lifestyles.

Key Drivers

- Demographic Shifts: Aging populations in North America and Europe increase the demand for laxatives and related medications.

- Lifestyle Factors: Sedentary habits, obesity, and dietary patterns contribute to higher constipation rates, amplifying market need.

- Regulatory Landscape: Approval of new formulations and over-the-counter (OTC) availability enhances accessibility, stimulating sales.

- Approvals & Patent Life: If QC LAXATIVE EC holds patent protection, it enjoys market exclusivity, enabling pricing strategies.

Competitive Environment

The market for laxatives is saturated with multiple substances such as bisacodyl, PEG (polyethylene glycol), lactulose, and OTC products. However, enteric-coated formulations, which offer targeted release and potentially fewer side effects, occupy a niche that balances efficacy with tolerability.

Main competitors include:

- Bisacodyl (Dulcolax): Widely used OTC stimulant laxative.

- Polyethylene Glycol (PEG): Used for chronic constipation.

- Lactulose and Glycerin: Osmotic agents with specific indications.

QC LAXATIVE EC’s unique formulation, likely marketed for improved onset and reduced systemic absorption, positions it as a specialized product.

Regulatory and Patent Insights

- Regulatory Status: Assuming QC LAXATIVE EC is approved by key regulatory agencies such as the FDA (U.S.) and EMA (Europe), it benefits from market exclusivity for a defined period, potentially until 2030 or beyond.

- Patent Considerations: Any active patent covering formulations, delivery mechanisms, or manufacturing processes can sustain premium pricing and fend off generic competition.

- OTC Designation: OTC status broadens consumer access, promoting volume sales, whereas prescription-only status might influence pricing and market dynamics.

Pricing Analysis

Current Price Points

Analyzing comparable enteric-coated laxatives, current retail prices range from USD 8 to USD 20 per box of 30-60 tablets, depending on geography and branding. Brand-name products with patent protection command premium pricing:

- United States: Approximately USD 15–20 for branded products.

- Europe: EUR 12–18 per box.

- Emerging Markets: Lower-priced generics available, often USD 4–8.

Given QC LAXATIVE EC's positioning as a branded, possibly patented product, initial pricing strategies are likely to be set at the higher end of this spectrum.

Pricing Strategy Factors

- Market Penetration: To gain market share, introductory prices may be set slightly below competing brands.

- Value Proposition: If QC LAXATIVE EC demonstrates superior safety, tolerability, or efficacy, premium pricing could be justified.

- Reimbursement Environment: Insurance and healthcare reimbursement policies influence consumer pricing and profitability.

- Cost Dynamics: Manufacturing costs, import tariffs, and distribution logistics impact pricing strategies.

Future Price Projections (2023–2030)

Short-Term (2023–2025):

- Premium Pricing Maintenance: Expected to sustain USD 15–20 per box, capitalizing on patent exclusivity and brand loyalty.

- Gradual Price Adjustments: Slight increases (~3–5%) aligned with inflation, regulatory compliance costs, and inflationary pressures.

Mid to Long-Term (2025–2030):

- Patent Expiry and Generics Entry: Likely by 2028–2030, leading to generic competition. Prices could decrease by 30–50%, aligning with market trends observed in similar products.

- Market Penetration of Generics: Prices may stabilize around USD 6–10, depending on quality and marketing.

- Introduction of New Formulations: Potential for biosimilars or improved versions could influence pricing strategies.

Additional Influences:

- Adoption of Digital Marketing & Direct-to-Consumer Promotion: May sustain higher prices by differentiating the product.

- Regulatory Changes: New safety or efficacy requirements could increase costs, influencing final prices.

Market Entry and Growth Opportunities

Leveraging patent protection and clinical differentiation, QC LAXATIVE EC can optimize early-stage pricing to maximize revenue. Strategic partnerships with healthcare providers or OTC distributors will further impact future pricing flexibility.

Post-patent, market penetration hinges on cost competitiveness—especially in emerging markets—where priced generics dominate.

Conclusion

The market for QC LAXATIVE EC appears promising, with two primary phases: premium pricing during patent exclusivity and subsequent reduction following generics market entry. Its niche positioning in enteric-coated formulations affirms its potential for sustained revenue, provided its clinical advantages are substantiated and communicated effectively.

Key Takeaways

- The global laxative market is expanding, driven by demographic trends and lifestyle factors, providing a fertile environment for QC LAXATIVE EC.

- Potential exclusivity and patents enable premium pricing, estimated at USD 15–20 per box during early years.

- Price erosion is expected upon patent expiry—generics could reduce prices by up to 50%, favoring cost-conscious markets.

- Strategic positioning emphasizing efficacy, safety, and unique delivery mechanisms will bolster pricing power.

- Monitoring regulatory developments and competitive dynamics is crucial for long-term pricing and market share optimization.

FAQs

1. When is QC LAXATIVE EC expected to lose its patent protection?

Assuming standard patent terms, if granted around 2023, patent expiry could occur by 2030, after which generic competition may emerge.

2. What factors influence the pricing of enteric-coated laxatives like QC LAXATIVE EC?

Brand strength, patent status, regulatory approvals, manufacturing costs, and market competition primarily impact pricing.

3. How does QC LAXATIVE EC compare with existing laxatives in the market?

It likely offers superior targeted delivery via enteric coating, potentially resulting in fewer side effects and enhanced efficacy, justifying a premium price point.

4. What are the key markets for QC LAXATIVE EC?

Developed markets such as the U.S., Europe, and Japan are primary targets, with emerging markets representing significant growth opportunities post-patent expiry.

5. How can stakeholders maximize revenue from QC LAXATIVE EC?

Securing and maintaining patent protection, differentiating through clinical data, and strategic marketing will optimize price margins and market penetration.

References

[1] MarketWatch. “Global Gastrointestinal Therapeutics Market Size, Share & Trends Analysis Report,” 2023.

More… ↓