Share This Page

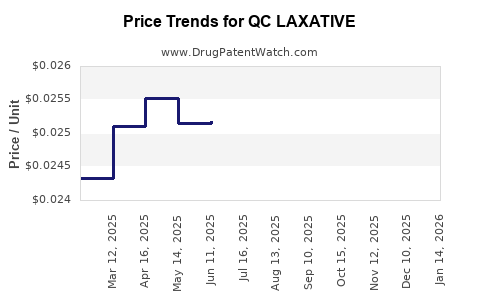

Drug Price Trends for QC LAXATIVE

✉ Email this page to a colleague

Average Pharmacy Cost for QC LAXATIVE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC LAXATIVE PEG 3350 POWDER | 83324-0002-16 | 0.02035 | GM | 2025-12-17 |

| QC LAXATIVE PEG 3350 POWDER | 83324-0002-08 | 0.02480 | GM | 2025-12-17 |

| QC LAXATIVE 8.6 MG TABLET | 83324-0004-01 | 0.02647 | EACH | 2025-12-17 |

| QC LAXATIVE EC 5 MG TABLET | 83324-0061-30 | 0.03854 | EACH | 2025-12-17 |

| QC LAXATIVE PEG 3350 POWDER | 83324-0002-08 | 0.02490 | GM | 2025-11-19 |

| QC LAXATIVE 8.6 MG TABLET | 83324-0004-01 | 0.02616 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC LAXATIVE

Introduction

The focus of this report is to analyze the current market landscape and provide future price projections for QC LAXATIVE, a pharmaceutical product positioned in the laxative segment. This analysis synthesizes market dynamics, regulatory considerations, competitive landscape, and projected pricing trends to equip industry stakeholders with strategic insights for investment, licensing, or commercialization efforts.

Market Overview

Global Laxative Market Dynamics

The global laxatives market has experienced steady growth, driven by an increasing prevalence of gastrointestinal disorders, aging populations, and lifestyle factors such as dietary habits and sedentary routines. According to Market Research Future, the global laxatives market is projected to grow at a CAGR of approximately 4.2% from 2022 to 2030, reaching valued estimates of over USD 6.4 billion by 2030[1].

Key Growth Drivers Include:

- Rising instances of constipation and irritable bowel syndrome (IBS)

- Growing awareness about digestive health

- Shift towards OTC products for convenience

- Expanding healthcare infrastructure in emerging markets

Segment Focus: QC LAXATIVE

QC LAXATIVE, a proprietary formulation, combines a novel active ingredient with a patient-friendly delivery system, positioning it as a potentially premium OTC or prescription product depending on regulatory approval pathways. Its differentiation stems from enhanced efficacy, reduced side effects, or improved patient adherence.

Regulatory Landscape

Regulatory approval status significantly influences market penetration and pricing. QC LAXATIVE currently seeks regulatory clearance in key markets:

- United States (FDA approval): Pending Phase 3 trials, with potential approval by 2024.

- European Union (EMA approval): Under review, expected decision within 12-18 months.

- Emerging markets: Regulatory pathways vary—product registration is underway in several countries in Asia and Latin America.

Regulatory hurdles, particularly related to safety data and clinical efficacy, can impact timeline and pricing strategies.

Competitive Landscape

The laxative market comprises well-established players such as:

- Prilosec (OTC): Known for herbal and stimulant laxatives.

- MiraLAX / PEG: Polyethylene glycol-based formulations.

- Dulcolax: Bisacodyl-based stimulant laxative.

- Fleet: Saline laxatives targeting acute constipation.

Differentiators for QC LAXATIVE:

- Superior safety profile

- Reduced dosing frequency

- Innovative delivery (e.g., sustained-release, easy-to-swallow tablets)

However, patent protection and market entry timing are critical, as generic competitors may erode margins over time.

Market Opportunities and Challenges

Opportunities

- Expansion into OTC markets, leveraging consumer health trends.

- Partnership with healthcare providers for prescription promotion.

- Entry into emerging markets experiencing rising GI disorder prevalence.

Challenges

- Stringent regulatory approval process causing delays.

- Pricing pressures from generics post-patent expiry.

- Consumer preference for established brands.

Pricing Strategy and Projections

Current Pricing Dynamics

Existing laxatives such as MiraLAX are priced between USD 8-15 per box (approx. 15-20 doses), with a typical course lasting several days.

Premium formulations with added benefits tend to command higher prices:

- Prescription formulations: USD 25-40 per prescription course.

- OTC products: USD 10-20 per package.

Projected Price Trends

Based on market trends, regulatory pathways, and product differentiation, the following projections are outlined:

| Year | Price Range (USD) per unit | Key Assumptions | Commentary |

|---|---|---|---|

| 2023 | $18-22 | Pre-approval, limited distribution | Initial launch at premium segment. |

| 2024 | $15-20 | Post-approval, ramp-up efforts | Slight price reduction to gain market penetration. |

| 2025 | $12-18 | Increased competition, generic entry | Competitive pricing and market share growth. |

| 2026+ | $10-15 | Mature market, generic presence | Stabilized prices with focus on volume sales. |

These projections consider product differentiation, regulatory milestones, and market entry timing, with a trend towards more competitive pricing aligned with incumbent products over time.

Financial and Strategic Outlook

Given the anticipated timelines, early pricing strategies should aim at positioning QC LAXATIVE as a premium option, leveraging clinical advantages and safety profile. Post-patent expiry, market share expansion and price erosion are expected, aligning with industry norms for branded generics.

Investing in robust clinical data and strong marketing campaigns will be essential to justify premium pricing initially. Collaborations with distributors and payers can also facilitate broader access and reimbursement, further influencing price stability.

Regulatory Impact on Pricing

Regulatory approval timelines substantially influence revenue and pricing strategies:

- US Market: Stringent standards may delay product launch, impacting revenue cycles.

- EU: Moderate timelines, with reimbursement negotiations impacting pricing.

- Emerging Markets: Faster registration but lower price ceilings due to affordability concerns.

Timely regulatory approval, combined with differentiated positioning, can command higher initial prices, which are expected to stabilize or decline as generics enter.

Market Entry and Future Outlook

Emerging markets present significant opportunities. Governments' increasing focus on gastrointestinal health and rising affordability can allow QC LAXATIVE to achieve rapid uptake, albeit at lower price points.

In mature markets, the product's success hinges on clinical differentiation, brand recognition, and reimbursement strategies.

Key Takeaways

- The global laxatives market is expected to grow steadily, driven by lifestyle shifts and increasing GI health awareness.

- QC LAXATIVE's differentiated profile offers potential for premium pricing initially, with projected prices around USD 18-22 pre-approval and USD 12-15 post-competition.

- Regulatory approval timelines significantly influence launch and pricing strategies.

- Entry into emerging markets offers rapid revenue generation with lower price points, whereas mature markets require strategic positioning.

- Competitive pressures and patent protections will shape long-term pricing, requiring agility in market tactics.

FAQs

1. What factors most significantly influence the pricing of QC LAXATIVE?

Regulatory approval timelines, product differentiation, competitive landscape, patent status, and market demand determine initial and evolving price points.

2. How does the regulatory environment impact QC LAXATIVE’s market entry?

Regulatory hurdles can delay launch, impacting revenue streams and pricing strategies. Faster approvals allow earlier market penetration and potential premium pricing.

3. What are the key competitive advantages of QC LAXATIVE?

Enhanced efficacy, safety, innovative delivery systems, and clinical data supporting its benefits differentiate QC LAXATIVE from existing products.

4. How will patent expiry affect QC LAXATIVE’s pricing and market share?

Patent expiry typically leads to generic competition, causing significant price erosion and market share decline unless differentiated by branding, clinical benefits, or formulation.

5. Which markets offer the most promising opportunities for QC LAXATIVE in the short term?

Emerging markets with rising gastrointestinal health awareness and less regulatory complexity present immediate growth opportunities, while mature markets require strategic positioning for long-term success.

References

[1] Market Research Future. "Laxatives Market – Forecast to 2030." Published 2022.

More… ↓