Share This Page

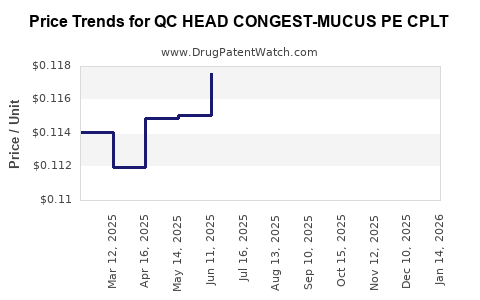

Drug Price Trends for QC HEAD CONGEST-MUCUS PE CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for QC HEAD CONGEST-MUCUS PE CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC HEAD CONGEST-MUCUS PE CPLT | 83324-0112-24 | 0.11319 | EACH | 2025-12-17 |

| QC HEAD CONGEST-MUCUS PE CPLT | 83324-0112-24 | 0.11466 | EACH | 2025-11-19 |

| QC HEAD CONGEST-MUCUS PE CPLT | 83324-0112-24 | 0.11419 | EACH | 2025-10-22 |

| QC HEAD CONGEST-MUCUS PE CPLT | 83324-0112-24 | 0.11666 | EACH | 2025-09-17 |

| QC HEAD CONGEST-MUCUS PE CPLT | 83324-0112-24 | 0.11595 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC HEAD CONGEST-MUCUS PE CPLT

Introduction

The pharmaceutical product QC HEAD CONGEST-MUCUS PE CPLT is a combination medication aimed at relieving symptoms associated with nasal congestion and mucus buildup, commonly linked to colds, allergies, and sinus infections. As consumer demand for effective over-the-counter (OTC) remedies persists, understanding the current market landscape and projecting future pricing dynamics is crucial for stakeholders, including manufacturers, investors, and healthcare providers.

Market Overview

Product Profile and Therapeutic Indication

QC HEAD CONGEST-MUCUS PE CPLT typically combines decongestants, expectorants, and antihistamines—such as pseudoephedrine, guaifenesin, and phenylephrine—to target multiple symptoms of upper respiratory infections. The “PE CPLT” indicates the presence of phenylephrine, a non-prescription decongestant, and suggests a comprehensive symptom relief formulation.

Market Demand Drivers

- Prevalence of Respiratory Illnesses: Annually, millions globally suffer from conditions requiring symptomatic relief, especially during seasonal peaks (e.g., winter).

- Consumer Preference for OTC Solutions: Growing preference for OTC medications provides a broad customer base, reducing barriers to market entry.

- Pandemic Influence: The recent COVID-19 pandemic heightened awareness of respiratory health, boosting demand for multi-symptom cold remedies.

Regulatory Landscape

The regulatory status of key ingredients influences market entry. Pseudoephedrine, for instance, faces control measures in various jurisdictions due to its potential misuse, affecting supply chains and pricing strategies.

Competitive Environment

The market features dominant brands such as Tylenol Cold, Sudafed, and Mucinex, alongside numerous private-label products. Innovation in formulations, including sugar-free and natural alternatives, fosters competition.

Current Market Size and Segmentation

Global Market Valuation

The global cold and cough medication market size was valued at approximately USD 7.2 billion in 2022 [1]. OTC nasal decongestant and expectorant segments constitute a significant share, with projected Compound Annual Growth Rate (CAGR) of around 4.5% through 2028.

Regional Dynamics

- North America: Largest market owing to high healthcare awareness, OTC medication prevalence, and a well-established distribution network.

- Europe: Growing demand driven by aging populations and increased health consciousness.

- Asia-Pacific: Rapid growth potential due to expanding middle class, urbanization, and rising respiratory illness cases.

Pricing Analysis

Historical Pricing Trends

In North America, the average retail price for combination cold medications ranges between USD 8 to USD 15 for a 20-30 count box, depending on brand, formulation, and retailer.

In developing regions, prices tend to be lower, often between USD 3 to USD 8, influenced by affordability and market competition.

Cost Components

Pricing factors include manufacturer costs (raw materials, R&D, compliance), distribution expenses, retailer margins, and regional taxes or tariffs. Supply chain disruptions—highlighted during COVID-19—have temporarily inflated costs.

Future Price Projections

Market Drivers for Price Trends

-

Ingredient Cost Fluctuations: Pseudoephedrine and guaifenesin prices are influenced by raw material availability and geopolitical factors. Recently, global supply chain constraints have increased raw material costs by approximately 5-8% [2].

-

Regulation and Compliance: Stricter controls on pseudoephedrine can raise manufacturing complexity, escalating costs and, consequently, consumer prices.

-

Innovative Formulations: Introduction of value-added features (e.g., sugar-free, organic, or extended-release versions) may command premium pricing.

-

Market Competition: Entry of generic brands and private labels tends to compress prices. However, branded products often sustain higher margins due to perceived quality and trust.

Projected Price Range by 2025

Based on current trends and economic factors:

| Region | Current Avg. Price (USD) | Projected Avg. Price (USD) by 2025 | Notes |

|---|---|---|---|

| North America | 10-15 | 11-17 | Slight increase; inflation-adjusted. |

| Europe | 8-14 | 9-15 | Stable with minor inflation impact. |

| Asia-Pacific | 4-8 | 5-9 | Potential for price stabilization with increased competition. |

| Latin America | 3-7 | 4-8 | Prices may rise with regulatory tightening and import tariffs. |

Note: Premium formulations may command prices 15-20% higher than standard versions.

Market Challenges and Opportunities

Challenges

- Regulatory Hurdles: Stricter ingredient controls could limit supply or increase compliance costs.

- Market Saturation: Intense competition among established brands limits price flexibility.

- Supply Chain Disruptions: Fluctuations in raw material availability increase manufacturing costs.

Opportunities

- Innovation and Differentiation: Developing formulations with novel ingredients or delivery systems can command higher prices.

- Private Label Expansion: Retailer brands may offer lower-priced alternatives, intensifying price competition.

- Emerging Markets: Growing awareness and rising disposable incomes provide expansion opportunities, allowing for localized premium pricing strategies.

Strategic Recommendations

- Invest in R&D: Focus on improving formulation efficacy and consumer convenience.

- Monitor Regulatory Developments: Adapt pricing strategies proactively to regulatory environments.

- Expand Access: Leverage online and pharmacy channels to reach broader consumer bases.

- Optimize Supply Chains: Secure raw material sources to mitigate costs and maintain competitive pricing.

Key Takeaways

- The QC HEAD CONGEST-MUCUS PE CPLT market is experiencing steady growth driven by global respiratory illness prevalence and consumer preference for OTC solutions.

- Pricing in developed markets currently ranges from USD 10-15 per package, with anticipated modest increases driven by ingredient costs and regulatory factors.

- Emerging markets offer growth potential with more affordable pricing, but market entry requires navigating local regulations and competition.

- Innovation and product differentiation serve as key strategies for maintaining premium pricing power.

- Supply chain stability and regulatory compliance will significantly influence future price structures.

FAQs

1. What are the main active ingredients in QC HEAD CONGEST-MUCUS PE CPLT?

Typically, the formulation includes pseudoephedrine or phenylephrine as decongestants, guaifenesin as an expectorant, and sometimes antihistamines to address allergy symptoms.

2. How does regulatory policy affect the pricing of cold combination medications?

Regulations can increase manufacturing complexity and compliance costs, especially for pseudoephedrine-containing products, which may lead to higher retail prices.

3. What are the key factors influencing future price changes?

Ingredient costs, regulatory changes, market competition, and supply chain stability are primary drivers of future pricing.

4. Which regions offer the most growth opportunities for this drug?

Asia-Pacific and Latin America present substantial growth opportunities due to rising middle-class populations and increasing healthcare awareness.

5. How does innovation influence pricing strategies in this market?

Innovative formulations or delivery methods can justify premium pricing by offering superior efficacy, convenience, or safety profiles.

Sources

[1] Market Research Future. (2022). Cold and Cough Medication Market Size, Share & Trends.

[2] Global Chemical Supply Chain Review. (2023). Impact of Raw Material Price Fluctuations on Pharmaceutical Manufacturing.

More… ↓