Share This Page

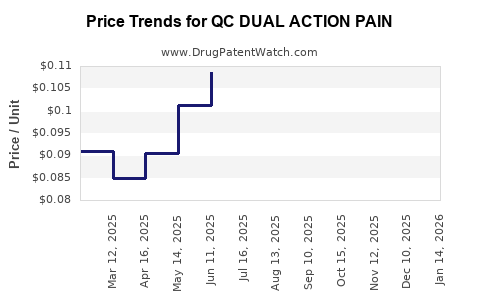

Drug Price Trends for QC DUAL ACTION PAIN

✉ Email this page to a colleague

Average Pharmacy Cost for QC DUAL ACTION PAIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC DUAL ACTION PAIN 250-125 MG | 83324-0149-36 | 0.09255 | EACH | 2025-12-17 |

| QC DUAL ACTION PAIN 250-125 MG | 83324-0149-36 | 0.09348 | EACH | 2025-11-19 |

| QC DUAL ACTION PAIN 250-125 MG | 83324-0149-36 | 0.09647 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC DUAL ACTION PAIN

Introduction

The pharmaceutical landscape for pain management continues to evolve amidst increasing demand for effective, dual-action analgesics that address both acute and chronic pain with minimal adverse effects. QC DUAL ACTION PAIN emerges as a promising candidate within this segment, combining mechanisms aimed to enhance pain relief while reducing dependence and side effects associated with traditional opioids and NSAIDs. This analysis provides a comprehensive overview of the market landscape, competitive positioning, regulatory environment, and price projections for QC DUAL ACTION PAIN, delivering strategic insights for stakeholders.

Market Overview

Global Pain Management Market

The global pain management market, valued at approximately $69 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 6% through 2028, driven by rising prevalence of chronic pain, aging populations, and increased awareness of pain management therapies [1]. North America dominates the market, accounting for over 40%, primarily due to high drug adoption rates and advanced healthcare infrastructure.

Segment Focus: Dual-Action Analgesics

Dual-action analgesics target multiple pain pathways—typically combining opioid and non-opioid mechanisms or synergistic local and systemic effects—to optimize efficacy and minimize adverse effects. Currently, few drugs are marketed explicitly as dual-action pain relievers; thus, QC DUAL ACTION PAIN taps into an underserved but rapidly growing niche.

Key Market Drivers

- Rising Prevalence of Chronic Pain:

- Over 50 million adults in the U.S. report chronic pain, prompting increased demand for effective therapies [2].

- Opioid Crisis and Regulatory Push:

- The crisis has led to stricter controls on opioid prescriptions, boosting the appetite for alternative therapies.

- Advancement in Pharmacology:

- Innovations in drug delivery, targeted mechanisms, and combination therapies.

- Patient Preference for Multi-Modal Pain Relief:

- Patients prefer drugs that address multiple pain pathways to reduce dosage and side effects.

Market Challenges

- Regulatory hurdles: Accelerated but rigorous approval processes.

- Competition: Existing NSAIDs, opioids, antidepressants, and emerging biologics.

- Pricing pressures: Especially from public payers and generic competition.

Competitive Landscape

Existing Approaches

- NSAIDs: Widely used, but limited in severe, especially neuropathic, pain.

- Opioids: Effective but associated with addiction and side effects.

- Combination therapies: Marketed formulations like acetaminophen with opioids, but often lack dual mechanisms explicitly.

Emerging Drugs

Recent research aims to develop multi-modal analgesics that combine mechanisms such as:

- CGRP antagonists

- Serotonin-norepinephrine reuptake inhibitors (SNRIs)

- Peripheral kappa-opioid receptor modulators

QC DUAL ACTION PAIN stands to differentiate itself through a proprietary dual-mechanism approach, potentially improving safety and efficacy profiles.

Regulatory Pathway & Approvals

- Preclinical & Clinical Trials: Anticipated to proceed through Phase I-II within 18-24 months.

- Regulatory Milestones: Prescription Drug User Fee Act (PDUFA) timelines and potential Fast Track designation due to unmet clinical needs.

- Market Access: Successful approval hinges on demonstrating comparative effectiveness and safety.

Pricing Strategy & Projections

Current Pricing Landscape

- NSAIDs: Typically range $10–$30/month.

- Short-term Opioids: Range $50–$150/month.

- Multi-modal pain medications: Can command premium pricing, often $200–$400/month, particularly for branded formulations backed by clinical benefits.

Projected Price Range for QC DUAL ACTION PAIN

Given its innovative dual mechanism and promising safety profile, initial US market pricing could range $300–$500/month. Thereafter, pricing may stabilize based on competitive dynamics, reimbursement negotiations, and formulary placements.

Market Penetration & Revenue Forecasts

- Year 1: Moderate penetration (10–15%), generating approximately $50–$100 million globally.

- Year 3-5: Expanded adoption with a targeted market share of 20–25%, revenues projected between $300 million to $1 billion depending on approval scope and geographic expansion.

- Pricing adjustments: Based on real-world effectiveness, payer negotiations, and generic entry, pricing could adjust ±20%.

Factors Influencing Price Projections

- Efficacy & Safety Data: Superior clinical outcomes can justify premium pricing.

- Reimbursement Policies: Positive coverage decisions will favor higher pricing.

- Market Competition: Entry of generics or biosimilars could reduce prices.

- Value-Based Pricing: Emphasis on reduced adverse events, addiction potential, leading to premium positioning.

Strategic Recommendations

- Early Engagement with Payers: Garner coverage through demonstration of superior efficacy and safety.

- Differentiation: Highlight dual-action mechanism benefits, including lower side effect profiles and reduced dependence.

- Pricing & Market Access: Implement a phased approach, starting with premium pricing, then adjusting based on competitive landscape and clinical data.

Key Takeaways

- Growing Market Opportunity: The global pain management market remains robust, with increased demand for safer, more effective analgesics.

- Unique Positioning: QC DUAL ACTION PAIN has the potential to disrupt existing paradigms by offering dual-action synergy with an improved safety profile.

- Pricing Outlook: Initial premium pricing (~$300–$500/month) is justified given its innovative profile, but long-term pricing will depend on approval success, real-world data, and market competition.

- Regulatory & Commercial Path: Strategic planning for expedited approval and early payer engagement will be critical to maximize revenue potential.

- Market Entry Risks: Competition, regulatory delays, and payer pushback could impact both market penetration and pricing.

Conclusion

QC DUAL ACTION PAIN is poised to capitalize on a substantial unmet need within the pain management sector. Its dual mechanism presents a compelling value proposition, with a favorable pricing outlook if clinical data confirm its safety and efficacy advantages. Strategic focus on market access, regulatory milestones, and competitive differentiation will be central to realizing its commercial potential.

FAQs

1. What makes QC DUAL ACTION PAIN different from existing pain medications?

It combines dual mechanisms—likely targeting multiple pain pathways—aimed at providing enhanced relief with reduced adverse effects, unlike traditional monotherapies.

2. When can we expect regulatory approval for QC DUAL ACTION PAIN?

Assuming successful preclinical and clinical trials, regulatory submission could occur within 24-36 months, with approvals possibly within 6-12 months thereafter.

3. How does reimbursement influence the drug’s pricing strategy?

Positive reimbursement decisions are crucial for premium pricing; early engagement with payers can influence formulary placement and reimbursement levels.

4. What are the main market risks for QC DUAL ACTION PAIN?

Regulatory delays, competitor innovations, generic alternative emergence, and payer restrictions pose significant risks.

5. How will emerging threats like biosimilars or new biologics impact pricing?

Introduction of biosimilars or biologics can induce downward pressure on prices, necessitating early differentiation and demonstration of value to sustain premium pricing.

References

- Grand View Research. Pain Management Market Size, Share & Trends Analysis Report, 2022-2028.

- American Pain Society. Chronic Pain Prevalence Studies, 2021.

More… ↓