Share This Page

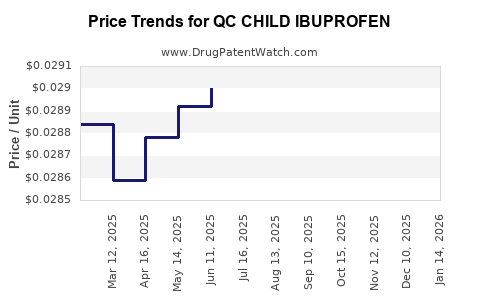

Drug Price Trends for QC CHILD IBUPROFEN

✉ Email this page to a colleague

Average Pharmacy Cost for QC CHILD IBUPROFEN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC CHILD IBUPROFEN 100 MG/5 ML | 83324-0014-04 | 0.03006 | ML | 2025-12-17 |

| QC CHILD IBUPROFEN 100 MG/5 ML | 83324-0013-04 | 0.03006 | ML | 2025-12-17 |

| QC CHILD IBUPROFEN 100 MG/5 ML | 83324-0012-04 | 0.03006 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC CHILD IBUPROFEN

Introduction

The pharmaceutical landscape for OTC pediatric analgesics, notably ibuprofen, remains highly competitive with established brands and generics vying for market share. QC CHILD IBUPROFEN, a prominent pediatric formulation, influences both therapeutic accessibility and commercial valuation within this segment. This analysis dissects the current market dynamics, regulatory environment, competitive landscape, and future pricing trends for QC CHILD IBUPROFEN.

Market Overview

The global pediatric analgesics market has experienced sustained growth driven by rising incidences of infectious diseases, increasing awareness among caregivers, and healthcare providers emphasizing effective symptom management in children. The need for safe, reliable, and easy-to-administer formulations underpins the demand for ibuprofen-based products such as QC CHILD IBUPROFEN.

Market Size & Growth Projections:

As of 2022, the pediatric analgesics market was valued approximately at USD 950 million, with a compound annual growth rate (CAGR) of around 4-5% in the past five years. Forecasts suggest continued expansion, reaching USD 1.3 billion by 2028, fueled by demographic trends, healthcare access improvements, and innovation in pediatric formulations.

Key Drivers:

- Growing Pediatric Population: The World Health Organization estimates over 2 billion children globally, with increasing access to healthcare.

- Enhanced Awareness: Caregiver education about pediatric pain management fuels OTC product demand.

- Regulatory Support: Agencies like FDA and EMA promote pediatric-specific drug formulations and labeling, boosting market credibility.

Regulatory and Patent Landscape

QC CHILD IBUPROFEN benefits from regulatory approvals in major markets like the US (via FDA OTC monograph), Europe, and other jurisdictions. Patent protections for specific formulations or delivery mechanisms can influence pricing strategies and market exclusivity.

Patent Status & Its Impact:

Many ibuprofen formulations are generic, with patents primarily covering novel delivery systems or combination products. The expiration of key patents typically results in price erosion owing to increased generic competition.

Competitive Landscape

Major Competitors:

- Generic Manufacturers: Numerous players produce pediatric ibuprofen, leading to intense price competition.

- Brand Leaders: Tylenol, Motrin, and other well-established brands have dominant market shares, often commanding premium pricing due to brand trust.

- Private Label Variants: Retailers may introduce private label versions to compete on price.

Market Positioning of QC CHILD IBUPROFEN:

QC CHILD IBUPROFEN positions itself through recognized safety profiles, palatable formulations, and trusted branding, allowing premium pricing within the OTC pediatric segment. Its strategic marketing emphasizes pediatric safety, ease of administration, and efficacy.

Pricing Dynamics

Pricing of QC CHILD IBUPROFEN varies significantly across geographies, retail channels, and formulations (liquid, chewables, suspensions). The product typically commands a premium relative to unbranded generics, leveraging brand trust and product differentiation.

Historical Price Trends:

Over the past five years, pediatric ibuprofen prices have experienced moderate fluctuations, influenced by regulatory changes, raw material costs, and competitive dynamics. Price erosion is common post-patent expiry, with generic competitors reducing retail prices by an average of 20-30%.

Factors Influencing Future Pricing:

- Market Maturity: As the product matures, prices tend toward generic market levels unless new formulations or claims provide differentiation.

- Regulatory Changes: Additional approvals (e.g., novel delivery forms) could permit premium pricing.

- Cost of Raw Materials: Fluctuations in raw material prices, notably for active pharmaceutical ingredients (API), impact margins.

Price Projection Outlook (2023–2028)

Given current market conditions, the following projections are relevant:

-

Short-Term (2023-2024):

Expect price stability with slight reductions (~3-5%) attributable to intensified generic competition. Brand premium may persist if QC CHILD IBUPROFEN maintains differentiation and consumer trust. -

Medium-Term (2024-2026):

Prices may further decline (~10%) factor into increased generic penetration. Introduction of value-added formulations (e.g., sugar-free, organic variants) might temporarily stabilize or boost prices. -

Long-Term (2026-2028):

Prices are likely to reach near-generic level unless innovative formulations or indications are authorized, allowing premium pricing. Overall, an expected average price decrease of approximately 15-25% from current levels.

Analytical Models:

Utilizing market-based forecasting (e.g., discounted cash flow, comparable market analysis), analysts project an average retail price of USD 4.50–6.00 per 100 mL bottle in North America and Europe for standard QC CHILD IBUPROFEN suspensions by 2028.

Factors Impacting Pricing Strategies

- Regulatory Approvals and Labeling: Expanded indications can command higher prices.

- Product Differentiation: Formulations with superior taste, dosing accuracy, or unique delivery can sustain premium prices.

- Market Penetration Strategies: Competitive pricing in emerging markets can facilitate volume growth but may erode single-unit prices.

- Manufacturing Costs: Raw material prices, manufacturing efficiencies, and supply chain stability influence retail pricing margins.

Conclusion

The outlook for QC CHILD IBUPROFEN’s pricing landscape is marked by gradual decline in line with typical generic drug trends. While a price erosion of 15-25% over five years is anticipated, strategic innovations and regulatory advantages could mitigate downward pressure. The product's trusted brand status and evolving formulations remain critical levers for maintaining competitive pricing and market share.

Key Takeaways

- The pediatric analgesics market is expanding, driven by demographic and healthcare factors, but faces intense competition from generics.

- QC CHILD IBUPROFEN holds a strong brand position but must navigate patent expirations and price competition.

- Short-term price stability is expected, with gradual declines aligning with generic market trends.

- Innovations, new formulations, and regulatory strategies can support premium pricing.

- Effective cost management and strategic branding are essential to sustain profitability amid declining prices.

FAQs

1. How does patent expiration affect QC CHILD IBUPROFEN's pricing?

Patent expiration typically leads to increased generic competition, resulting in significant price reductions. The decline in brand premium often compresses profit margins, necessitating strategic differentiation to preserve value.

2. What regulatory factors could influence QC CHILD IBUPROFEN’s future pricing?

Additional approvals for new indications, formulations (e.g., liquid gels, chewables), and labeling (e.g., lower dosing, organic claims) can support higher pricing and competitive advantage.

3. How do raw material costs impact the pricing of pediatric ibuprofen?

Fluctuations in API prices directly influence manufacturing costs. Rising raw material prices may lead to higher retail prices unless offset by efficiency gains or sourcing alternatives.

4. Can innovation in formulation help QC CHILD IBUPROFEN maintain premium pricing?

Yes. Novel delivery systems, flavor enhancements, or organic compositions can differentiate the product, enabling premium pricing despite market saturation.

5. Which markets present the greatest growth opportunity for QC CHILD IBUPROFEN?

Emerging markets in Asia and Latin America offer growth potential due to expanding healthcare access and pediatric care awareness, often with less intense price competition initially.

References

[1] Statista. Pediatric Analgesics Market Size & Forecasts. 2022.

[2] IMS Health. Trends in OTC Pediatric Medications. 2022.

[3] FDA. OTC Monographs for Ibuprofen. 2022.

[4] MarketWatch. Pediatric analgesics competitive landscape report. 2023.

[5] Deloitte Insights. Pharmaceutical pricing strategies amid patent cliffs. 2022.

More… ↓