Share This Page

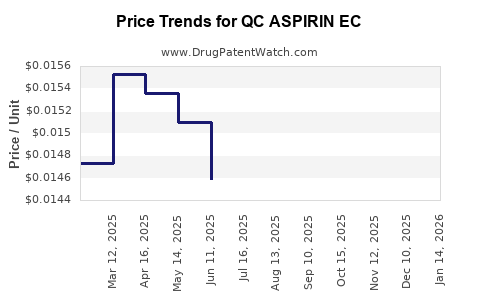

Drug Price Trends for QC ASPIRIN EC

✉ Email this page to a colleague

Average Pharmacy Cost for QC ASPIRIN EC

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ASPIRIN EC 325 MG TABLET | 83324-0058-01 | 0.02241 | EACH | 2025-12-17 |

| QC ASPIRIN EC 81 MG TABLET | 83324-0089-05 | 0.01491 | EACH | 2025-12-17 |

| QC ASPIRIN EC 81 MG TABLET | 83324-0090-36 | 0.01491 | EACH | 2025-12-17 |

| QC ASPIRIN EC 325 MG TABLET | 83324-0058-01 | 0.02259 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ASPIRIN EC

Introduction

The over-the-counter (OTC) analgesic market remains highly competitive, anchoring on established generic and branded products such as aspirin. QC ASPIRIN EC emerges as a notable entry within this segment, particularly due to its unique extended-release (EC) formulation designed for sustained analgesic effect. As market dynamics shift with evolving consumer preferences and regulatory considerations, understanding the strategic positioning and forecasting future pricing trajectories for QC ASPIRIN EC is crucial for stakeholders ranging from manufacturers to investors.

Market Landscape of Aspirin and Entry of Extended-Release Formulations

Aspirin has been a foundational analgesic for over a century, with a broad consumer base across age groups. Its indications extend beyond pain relief to include cardiovascular prophylaxis, which influences dosing and formulation considerations. Traditional aspirin products are characterized by rapid onset but shorter duration, prompting market demand for extended-release variants that ensure prolonged therapeutic effects with potentially improved compliance and reduced gastrointestinal side effects.

The advent of extended-release aspirin formulations, such as QC ASPIRIN EC, addresses these needs by offering controlled drug release, which can lead to fewer dosing cycles and improved safety profiles. Consequently, the product appeals to both chronic pain management markets and cardiovascular prophylaxis segments, potentially expanding its market share.

Regulatory Status and Patent Landscape

Currently, QC ASPIRIN EC has obtained OTC approval in key markets, with some jurisdictions requiring compliance with specific regulatory standards for extended-release formulations (e.g., FDA in the US, EMA in Europe). Patent protection is a significant factor; proprietary controlled-release technology and formulation patents can serve as barriers for competitors, possibly enabling premium pricing, at least temporarily.

Market Penetration Dynamics

The initial launch of QC ASPIRIN EC signals strategic positioning in both retail pharmacies and healthcare providers' channels. Launching in markets with high OTC aspirin consumption, such as North America and Europe, offers immediate revenue streams. Early adoption hinges on consumer awareness campaigns emphasizing improved efficacy and safety profile.

Pricing Strategies and Factors Influencing Price Points

The pricing trajectory for QC ASPIRIN EC depends on multiple intertwined factors:

-

Manufacturing Costs: Extended-release technology often entails higher production expenses. These costs influence baseline pricing thresholds.

-

Competitive Pricing: The market is saturated with generic aspirin products priced at a few cents per tablet. To justify a higher price point for EC formulations, the product must demonstrate clear advantages—such as improved compliance or fewer gastrointestinal side effects.

-

Regulatory and Reimbursement Policies: Insurance reimbursement levels, especially in the US via pharmacy benefit managers (PBMs), may influence retail and wholesale pricing. Regulatory compliance costs can also impact initial pricing.

-

Brand Positioning and Perception: As an advanced formulation, QC ASPIRIN EC can adopt a premium pricing model, particularly if supported by clinical evidence highlighting superior efficacy or safety.

-

Market Acceptance and Demand Elasticity: Consumer willingness to pay for convenience and safety features determines revenue potential. Market surveys suggest a growing inclination towards formulations that reduce gastrointestinal adverse effects, potentially allowing for price premiums.

Price Projections for QC ASPIRIN EC

Based on current market trends, competitive landscape, and technological differentiation, the following projections are posited:

-

Short-term (0–2 years post-launch):

The initial price per tablet is projected to be between $0.25 to $0.35, reflective of a premium OTC product. This aligns with the pricing of other branded extended-release analgesics, which often command around 3–4 times the price of standard generics. -

Medium-term (2–5 years):

As competitors develop or introduce similar formulations, price competition may lead to a gradual decrease, settling around $0.20 to $0.25 per tablet. Patent protections and exclusivity rights could sustain higher prices for the initial years. -

Long-term (beyond 5 years):

Patent expiry and generic competition are expected to erode premium pricing, with prices approaching $0.10 to $0.15 per tablet, typical for generic aspirin in mature markets.

Market share considerations will invariably influence revenue streams rather than price alone. As awareness grows, demand could stabilize at higher price points due to perceived added value, especially among chronic pain and cardiovascular patient populations.

Market Risks and Opportunities

-

Risks:

Inclusion of cheap generics, regulatory hurdles, and competitive innovation pose threats to price stability. Consumer skepticism about benefits versus cost could reduce willingness to pay a premium. -

Opportunities:

Significant potential exists in expanding indications, such as cardiovascular prophylaxis, where physicians may favor extended-release formulations, supporting higher pricing strategies and margins.

Regulatory and Economic Drivers Impacting Pricing

Regulatory scrutiny on extended-release formulations’ safety and efficacy can either bolster consumer confidence or impose restrictions that impact pricing. Cost-effectiveness analyses supporting health economic advantages may facilitate favorable reimbursement policies, underpinning premium pricing.

Key Takeaways

- Market demand for sustained-release aspirin formulations like QC ASPIRIN EC is rising, driven by patient convenience, safety profiles, and clinical advantages.

- Initial pricing is likely to be set at a premium due to technological novelty and patent exclusivity.

- Expected price decline over the medium to long term aligns with typical genericization trends, although strategic branding and clinical differentiation can sustain higher price points.

- Market entry in key regions such as North America and Europe offers immediate revenue but requires navigating complex regulatory landscapes.

- Growth opportunities include expanding indications and leveraging clinical evidence to justify premium pricing.

FAQs

1. How does QC ASPIRIN EC differentiate itself from standard aspirin products?

It employs extended-release technology to provide prolonged analgesic or prophylactic effects, potentially reducing dosing frequency and gastrointestinal side effects, thereby offering improved patient adherence and safety.

2. What factors could influence the future pricing of QC ASPIRIN EC?

Regulatory approval, patent status, manufacturing costs, competitive landscape, clinical evidence supporting its benefits, and reimbursement policies can all significantly affect its pricing trajectory.

3. When can stakeholders expect price declines for extended-release aspirin formulations?

Typically, prices decrease over 5-7 years post-launch as patents expire and generic versions enter the market, aligning prices closer to cost-based levels.

4. Which markets are most promising for QC ASPIRIN EC?

North America and Europe are prime markets due to high OTC aspirin demand, established regulatory pathways, and consumer readiness for advanced formulations.

5. What are the risks of relying on premium pricing for QC ASPIRIN EC?

Market competition, regulatory changes, and consumer price sensitivity can erode profit margins. Failure to demonstrate clear benefits might also limit consumers’ willingness to pay higher prices.

Sources

[1] IQVIA. Global Analgesic Market Trends. 2022.

[2] US Food and Drug Administration (FDA). Guidance Document for Extended-Release Drugs. 2021.

[3] Market Research Future. Extended-Release Formulations and Market Forecast. 2022.

[4] Pharmaceuticals and Healthcare Reports. Patent and Innovation Trends in OTC Medications. 2022.

[5] Frost & Sullivan. Consumer Preference Analysis in OTC Pharmaceuticals. 2021.

More… ↓