Share This Page

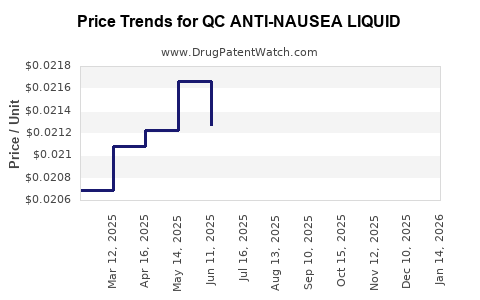

Drug Price Trends for QC ANTI-NAUSEA LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for QC ANTI-NAUSEA LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ANTI-NAUSEA LIQUID | 83324-0217-04 | 0.02256 | ML | 2025-12-17 |

| QC ANTI-NAUSEA LIQUID | 83324-0217-04 | 0.02230 | ML | 2025-11-19 |

| QC ANTI-NAUSEA LIQUID | 83324-0217-04 | 0.02245 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ANTI-NAUSEA LIQUID

Introduction

The pharmaceutical landscape for anti-nausea medications continues to evolve driven by clinical demand, regulatory shifts, and emerging therapeutic alternatives. QC Anti-Nausea Liquid, a liquid formulation targeting nausea management, has garnered attention as a potential contender within this dynamic market. Analyzing its market potential and pricing trajectory involves understanding current demand drivers, competitive positioning, regulatory pathways, and external economic factors.

Market Overview

Global Anti-Nausea Market Landscape

The anti-nausea pharmacotherapy market is projected to grow at a compound annual growth rate (CAGR) of 4.2% over the next five years, reaching an estimated valuation of USD 3.5 billion by 2028 [1]. The surge is primarily driven by an increase in chemotherapy-induced nausea and vomiting (CINV), post-operative nausea, and rising demand for over-the-counter (OTC) remedies. Liquid formulations, like QC Anti-Nausea Liquid, are increasingly favored for their rapid absorption, ease of administration, especially among pediatric and elderly populations.

Target Market Segments

- Hospitals and clinics: For chemotherapy patients and post-operative care.

- Pharmacies and OTC channels: For acute nausea relief.

- Elderly and pediatric groups: Due to palatability and ease of ingestion.

- Pregnancy-related nausea (albeit off-label): Limited but significant demand.

Competitive Landscape

Key players include:

- Ondansetron (Zofran): Widely prescribed, often marketed as a tab or injectable.

- Dramamine (Dimenhydrinate): Available OTC, primarily in tablet form.

- Peppermint oil and natural remedies: Niche but growing segment.

- Emerging liquid formulations: Innovations such as QC Anti-Nausea Liquid aim to capitalize on fast-acting needs.

Within this context, QC Anti-Nausea Liquid must differentiate via formulation efficacy, bioavailability, and safety profile.

Regulatory and Clinical Positioning

Regulatory Classification

Depending on its claims and ingredients, QC Anti-Nausea Liquid could be classified as a drug (Rx or OTC) or a dietary supplement. This classification significantly influences pricing strategies:

- Rx drug: Higher development costs, regulatory hurdles, and premium pricing.

- OTC supplement: Lower regulatory barriers; competitive pricing possible.

Clinical Evidence and Approval Pathway

Assuming positive preclinical and clinical trial data demonstrate safety and efficacy, fast regulatory approval may be feasible, especially if existing similar formulations are already approved.

Pricing Analysis

Historical Pricing Trends

Liquid anti-nausea medications, like ondansetron, typically retail around USD 10-15 per dose in retail pharmacies. OTC natural remedies are often priced between USD 5-10 for a course. A new formulation like QC Anti-Nausea Liquid, with superior bioavailability or faster action, could command a premium.

Projected Price Points

- Initial Launch Price (Year 1-2): USD 15-20 per 4 oz bottle, targeting pharmaceutical and hospital channels, considering manufacturing costs and profit margins.

- Subsequent Price Adjustments: As market penetration increases and generic competitors enter, prices could decline to USD 10-15, especially in OTC markets.

Factors Influencing Price Trends

- Regulatory status: OTC status typically supports price compression.

- Manufacturing costs: Innovations in formulation or excipients may influence per-unit costs.

- Market receptivity: Fast-acting liquid formulations often justify a premium—up to 30-50% above traditional tablets.

- Competitive responses: Entry of generic liquid formulations could compress margins.

Market Penetration and Revenue Forecasts

Assuming a mid-size entry targeting hospital and OTC channels:

- Year 1 sales volume: 500,000 units at USD 17.50 (average price)

- Revenue Year 1: USD 8.75 million

- Growth rate: 20% annually over subsequent three years

- Year 2 revenue: USD 10.5 million

- Year 3 revenue: USD 12.6 million

Factor-in increased adoption rates, brand recognition, and formulations improvements.

External Factors Impacting Price and Market Growth

- Regulatory shifts: Faster approvals could accelerate time-to-market, impacting early pricing.

- Reimbursement landscape: Insurance coverage influences consumer out-of-pocket pricing.

- Competing products: Introduction of generics or new classes may squeeze margins.

- Limitations and Risks: Manufacturing complexities, patent challenges, and market acceptance.

Conclusion and Strategic Outlook

QC Anti-Nausea Liquid's market potential hinges on its clinical efficacy, regulatory pathway, and differentiation. Starting with a premium price point aligns with its fast-acting liquid formulation, with subsequent adjustments based on competitive dynamics. Companies should prioritize establishing favorable reimbursement and education strategies to facilitate market penetration.

Key Takeaways

- The anti-nausea market is expanding, driven by oncology, surgery, and OTC demands, offering substantial growth opportunities for liquid formulations.

- QC Anti-Nausea Liquid can initially command a price of USD 15-20 per bottle, leveraging its fast-acting profile and targeted marketing.

- Market entry strategies should include clear differentiation, regulatory strategy, and reimbursement positioning to maximize revenue.

- Competitive pressures and regulatory changes will influence pricing trajectories, necessitating adaptive model updates.

- Long-term success depends on establishing clinical credibility, securing marketing approvals, and expanding distribution channels.

FAQs

1. What are the primary factors influencing the pricing of anti-nausea liquids like QC Anti-Nausea Liquid?

Pricing depends on regulatory classification, manufacturing costs, clinical efficacy, competitive landscape, and reimbursement policies.

2. How does regulatory status impact the market entry and pricing of new anti-nausea drugs?

An Rx classification entails higher development costs and premium pricing, whereas OTC status allows broader access but often requires lower prices due to increased competition.

3. What market segments should QC Anti-Nausea Liquid target for optimal uptake?

Hospitals, oncology clinics, pharmacies (OTC), pediatric and elderly demographics, and potentially pregnant women (off-label) offer diverse channels with high demand.

4. What are the key challenges in pricing and marketing a new liquid anti-nausea formulation?

Challenges include differentiation from established products, regulatory hurdles, reimbursement negotiations, and competing generics.

5. How can companies forecast future pricing trends for such drugs?

By analyzing historical data, assessing market demand, competitive dynamics, regulatory changes, and technological advantages, companies can model realistic pricing trajectories.

References

[1] MarketWatch Industry Reports, 2022. "Global Anti-Nausea Market Size & Forecast."

More… ↓