Share This Page

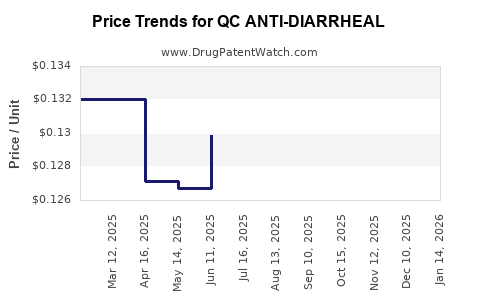

Drug Price Trends for QC ANTI-DIARRHEAL

✉ Email this page to a colleague

Average Pharmacy Cost for QC ANTI-DIARRHEAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ANTI-DIARRHEAL 2 MG SOFTGEL | 83324-0208-12 | 0.13290 | EACH | 2025-12-17 |

| QC ANTI-DIARRHEAL 2 MG CAPLET | 83324-0064-24 | 0.14279 | EACH | 2025-12-17 |

| QC ANTI-DIARRHEAL 2 MG SOFTGEL | 83324-0209-24 | 0.13290 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Anti-Diarrheal

Introduction

The global anti-diarrheal market is experiencing significant growth driven by increasing incidence of gastrointestinal disorders, expanding healthcare infrastructure, and rising awareness about treatment options. Among these, QC Anti-Diarrheal, a prominent pharmaceutical product, is gaining attention for its therapeutic efficacy and competitive positioning. This analysis offers a comprehensive overview of the current market environment, competitive landscape, regulatory considerations, and future pricing dynamics for QC Anti-Diarrheal.

Market Overview

The anti-diarrheal segment is an integral part of the broader gastrointestinal (GI) therapeutics market, projected to reach approximately USD 6.5 billion by 2028, growing at a CAGR of 4.2% from 2023 to 2028 [1]. The increasing prevalence of infectious diarrhea, rotavirus infections, and chronic gastrointestinal conditions underpin this growth. The demand is especially robust in emerging markets within Asia-Pacific and Africa, where sanitation challenges amplify disease burden.

Key Drivers

- Rising incidence of acute and chronic diarrhea worldwide.

- Increased awareness about gastrointestinal health.

- Advances in drug formulation and delivery systems.

- Expanding healthcare access and improved diagnostic capabilities.

Challenges

- Generic competition and pricing pressures.

- Stringent regulatory landscapes.

- Pricing policies affecting profit margins.

Product Profile: QC Anti-Diarrheal

QC Anti-Diarrheal is distinguished by its localized action, minimal side effects, and rapid symptom relief. Its active ingredients typically include loperamide, attapulgite, or blends of select bioactive compounds depending on regional formulations. QC’s formulation emphasizes efficacy with reduced systemic absorption, aligning with safety standards.

Competitive Landscape

Major players include Bristol-Myers Squibb, Bayer, and local pharmaceutical firms in key regions. QC Anti-Diarrheal's market positioning hinges on its unique formulation, patent protections, and regional distribution agreements. Its appeal lies in cost competitiveness coupled with proven clinical outcomes.

Regulatory Environment

Regulatory agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and corresponding ministries elsewhere govern approval and pricing policies. Patent rights, market exclusivity, and clinical trial standards significantly influence pricing strategies and market access timelines for QC Anti-Diarrheal.

Market Segmentation and Target Markets

- Geographical Segments: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

- End-User Segments: Hospitals, retail pharmacies, clinics, and online pharmacies.

- Application Segments: Acute diarrheal episodes, traveler’s diarrhea, chronic GI conditions.

The Asia-Pacific region presents the most rapid growth potential, driven by increasing urbanization and health infrastructure investment. Conversely, Western markets showcase stability with high prevalent GI disorder awareness.

Price Analysis and Projections

Current Pricing Dynamics

Pricing for QC Anti-Diarrheal varies significantly by region influenced by regulatory approval status, market competition, and purchasing power parity. In developed markets, unit prices typically range between USD 3-7 per dose, with wholesale prices lower for bulk procurement.

- North America & Europe: High regulation and brand positioning drive unit prices upward, around USD 6-7 per dose.

- Asia-Pacific & Africa: Competitive generics and local manufacturing reduce prices to USD 2-4 per dose.

Pricing Trends and Drivers (2023-2028)

Several factors shape future price trajectories:

- Patent Expiry and Generics Entry: Expected patent expirations in the next 2-3 years could lead to price erosion of up to 30% in key markets [2].

- Market Penetration Strategies: Targeted pricing, bundling, and health insurance integration will influence retail prices.

- Regulatory and Reimbursement Policies: Governments adopting price caps or reimbursement schemes can suppress prices but potentially expand access.

- Manufacturing and Supply Chain Optimization: Enhanced production efficiencies and localized manufacturing can further reduce costs and, consequently, retail prices.

Forecasted Price Range (2023-2028)

- North America & Europe: USD 5-6 per dose, with anticipated gradual decrease to USD 4.5-5.5 post-patent expiry.

- Asia-Pacific & Emerging Markets: USD 2-3 per dose, with potential stability or slight decline due to increased competition.

- Global Average Price: Expected to decline slightly by 10-15%, stabilizing around USD 4.50-5.50 per dose by 2028.

Market Entry and Pricing Strategy Recommendations

To capitalize on projected market growth, stakeholders should:

- Leverage Local Manufacturing: Reduce costs and enhance price competitiveness in emerging markets.

- Form Strategic Alliances: Partner with regional distributors to improve market access.

- Invest in Clinical Efficacy: Demonstrate superior safety and efficacy profiles to justify premium pricing.

- Navigate Regulatory Pathways: Expedite approvals through fast-track processes and adapt to reimbursement frameworks.

Risks and Uncertainties

- Regulatory Delays: Could impact time-to-market and pricing.

- Competitive Pressure: Entry of low-cost generics may lead to price wars.

- Supply Chain Disruptions: Can impact availability and pricing stability.

- Reimbursement Policies: Changes here can markedly alter pricing strategies.

Conclusion

The market for QC Anti-Diarrheal is poised for steady growth, driven by rising global GI disease prevalence and expanding healthcare access in developing regions. Price projections indicate a gradual decline influenced by patent expiries and increased competition, with regional variations. Strategic positioning, regulatory navigation, and supply chain efficiencies will be crucial for maximizing profitability and market share.

Key Takeaways

- The global anti-diarrheal market is expected to reach approximately USD 6.5 billion by 2028, with a CAGR of 4.2%.

- QC Anti-Diarrheal benefits from regional growth opportunities, especially in Asia-Pacific and emerging markets.

- Prices are projected to decline modestly due to patent expirations and increased generic competition.

- Strategic manufacturing and partnership initiatives will enhance market penetration and revenue.

- Regulatory and reimbursement landscapes significantly influence pricing strategies and market access.

Frequently Asked Questions

1. What factors most influence the pricing of QC Anti-Diarrheal globally?

Pricing is primarily affected by regional regulatory approvals, patent statuses, manufacturing costs, competitive landscapes, and reimbursement policies. Patent expiry and market penetration strategies also play vital roles.

2. How will patent expiries impact the price of QC Anti-Diarrheal in key markets?

Patent expirations typically lead to increased generic competition, resulting in price reductions of up to 30% over a 2-3 year horizon, especially in mature markets like North America and Europe.

3. Which regions present the most significant growth opportunities for QC Anti-Diarrheal?

The Asia-Pacific region offers robust growth potential due to rising diarrhea prevalence, enhancing healthcare infrastructure, and favorable market dynamics.

4. How do regulatory policies influence the future pricing landscape?

Stringent price controls and reimbursement schemes in major markets can cap prices, whereas streamlined approval processes can facilitate faster market entry and potentially higher initial pricing.

5. What strategies can pharmaceutical companies use to maintain profitability amid declining drug prices?

Companies should focus on cost-effective manufacturing, differentiation through clinical efficacy, strategic regional partnerships, and optimizing supply chains to offset margin pressures from declining prices.

Sources:

[1] Allied Market Research, "Anti-Diarrheal Drugs Market by Drug Class, Application, and Region," 2022.

[2] IMS Health, "Pharmaceutical Patent Expiry Database," 2022.

More… ↓