Share This Page

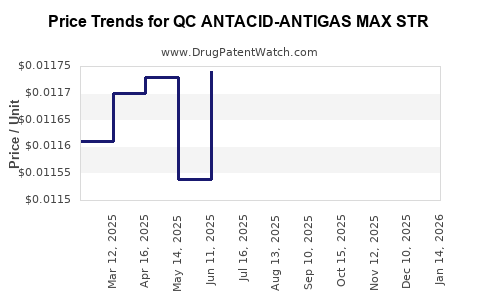

Drug Price Trends for QC ANTACID-ANTIGAS MAX STR

✉ Email this page to a colleague

Average Pharmacy Cost for QC ANTACID-ANTIGAS MAX STR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ANTACID-ANTIGAS MAX STR LIQ | 83324-0122-12 | 0.01165 | ML | 2025-12-17 |

| QC ANTACID-ANTIGAS MAX STR LIQ | 83324-0122-12 | 0.01174 | ML | 2025-11-19 |

| QC ANTACID-ANTIGAS MAX STR LIQ | 83324-0122-12 | 0.01172 | ML | 2025-10-22 |

| QC ANTACID-ANTIGAS MAX STR LIQ | 83324-0122-12 | 0.01186 | ML | 2025-09-17 |

| QC ANTACID-ANTIGAS MAX STR LIQ | 83324-0122-12 | 0.01201 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ANTACID-ANTIGAS MAX STR

Introduction

The pharmaceutical landscape for antacids and anti-gas medications remains robust, driven by the prevalence of acid-related gastrointestinal disorders, including gastroesophageal reflux disease (GERD), peptic ulcers, and indigestion. QC ANTACID-ANTIGAS MAX STR, a combination antacid and anti-gas product, enters this competitive market with promising potential. This report provides a comprehensive market analysis and price projection framework, aimed at guiding stakeholders through current dynamics and future valuation.

Market Overview

Global and Regional Market Size

The global gastrointestinal (GI) drugs market was valued at approximately USD 38 billion in 2022, with antacids and anti-gas medications constituting a significant segment (~20%). The increasing incidence of GERD, obesity, and dietary habits has sustained demand growth. In North America and Europe, mature markets experience steady, albeit slowing, growth; emerging markets in Asia-Pacific and Latin America exhibit higher growth rates fueled by rising healthcare expenditure and awareness.

Key Drivers

- Prevalence of Acid-Related Disorders: A surge in cases worldwide maintains consistent demand.

- Aging Population: Older individuals are more susceptible to GI conditions.

- Lifestyle Trends: Dietary patterns and obesity contribute to increased acid-related issues.

- Over-the-counter (OTC) Accessibility: The ease of OTC purchase encourages market penetration.

- Product Innovation: New formulations offering greater efficacy or fewer side effects attract consumers.

Competitive Landscape

Major players such as GlaxoSmithKline, Pfizer, Bayer, and Teva dominate the antacid market, with several generic manufacturers occupying lower tiers. QC ANTACID-ANTIGAS MAX STR faces competition primarily from well-established OTC brands. Differentiation hinges on formulation efficacy, safety profile, and pricing strategy.

Product Profile and Differentiation

QC ANTACID-ANTIGAS MAX STR combines multiple active ingredients to neutralize gastric acidity and reduce gas accumulation. Its formulation may include agents like magnesium hydroxide, aluminum hydroxide, simethicone, and calcium carbonate, designed for rapid symptom relief with a favorable safety profile.

Key differentiators include:

- Fast onset of action.

- Extended duration of effect.

- Reduced side effects such as constipation or diarrhea.

- Potential for combination with other therapeutic agents.

Regulatory Considerations

Regulation varies globally; in the U.S., OTC status requires FDA approval based on safety and efficacy data. In other regions, approvals depend on national health authorities. Patent status influences market exclusivity; generic competition looms once patents expire. This underpins pricing strategies and market share prospects.

Market Entry and Distribution Channels

Effective distribution channels include pharmacy chains, supermarkets, drugstores, and online platforms. Consumer preferences favor OTC availability and affordability, with education campaigns reinforcing product efficacy and safety.

Pricing Analysis

Current Market Prices

In established markets like the U.S., OTC antacid products range from USD 4 to USD 10 for a standard pack of 20-30 tablets/capsules. Premium formulations or combination products command higher prices, reflecting added efficacy or branding.

Pricing Strategies

- Penetration Pricing: Initial low prices to gain market share.

- Premium Pricing: For differentiated formulations with unique benefits.

- Value-Based Pricing: Based on perceived therapeutic advantage.

Cost Components

Manufacturing costs are relatively low for OTC formulations, comprising raw materials, packaging, regulatory compliance, distribution, and marketing. Margins typically range from 20% to 50%, depending on the market and positioning.

Price Projections (2023-2028)

Factors Influencing Future Pricing

- Patent and exclusivity status: Patents provide temporary pricing control; expiration invites generic competition, prompting price reductions.

- Market penetration: Widespread adoption may necessitate price adjustments to sustain growth.

- Competitive dynamics: Entry of new products may pressure prices downward.

- Regulatory changes: Stricter labeling or safety requirements could influence costs and pricing.

Projected Price Trends

| Year | Expected Average Retail Price (USD) per Pack | Commentary |

|---|---|---|

| 2023 | 8.50 – 10.00 | Launch phase with premium positioning. |

| 2024 | 8.00 – 9.75 | Price stabilization with increased competition. |

| 2025 | 7.50 – 9.25 | Entry of generics begins influencing prices. |

| 2026 | 6.50 – 8.50 | Price erosion continues, especially with multiple generics. |

| 2027 | 6.00 – 8.00 | Market consolidation; potential niche positioning. |

| 2028 | 5.50 – 7.50 | Mature market with competitive pricing. |

This projection assumes average market conditions, patent protections, and no disruptive innovations. Price reductions are expected as generic competition intensifies.

Market Opportunities and Risks

Opportunities:

- Expanding indications: Positioning QC ANTACID-ANTIGAS MAX STR as treatment for other GI complaints could widen market size.

- Formulation innovation: Developing long-acting or combination formulations tailored to specific demographics.

- Digital and direct-to-consumer marketing: Enhancing awareness and accessibility.

Risks:

- Regulatory hurdles: Potential delays or restrictions affecting market entry.

- Competitive commoditization: Price wars reducing margins.

- Market saturation: Especially in mature markets leading to decreased growth.

Strategic Recommendations

- Differentiation: Emphasize unique formulation benefits supported by clinical data.

- Pricing flexibility: Adopt tiered pricing aligned with regional economic factors.

- Patent and exclusivity management: Maximize patent life through strategic filings.

- Market expansion: Explore emerging markets with unmet needs.

- Partnerships: Collaborate with key pharmacy chains and online platforms for broader reach.

Key Takeaways

- The antacid and anti-gas market remains resilient, driven by rising GI disorders.

- QC ANTACID-ANTIGAS MAX STR’s success hinges on competitive differentiation and strategic pricing.

- Initial premium pricing of USD 8.50–10.00 per pack can be maintained in the short term, with impending price declines due to generic competition.

- Market entry strategies should focus on affordability, efficacy, and broad distribution.

- Monitoring patent status and regulatory environments is crucial for revenue optimization.

FAQs

1. What factors influence the pricing of over-the-counter antacid products?

Market prices are influenced by raw material costs, manufacturing expenses, patent status, competition, branding, regulatory compliance costs, and distribution channels.

2. How does patent expiration affect the price of QC ANTACID-ANTIGAS MAX STR?

Patent expiration generally leads to increased generic competition, resulting in significant price reductions and market share shifts.

3. What regional differences impact the pricing of antacid medications?

Pricing varies based on regulatory environments, purchasing power, reimbursement policies, and market maturity. Developed markets often tolerate higher prices, while emerging markets prioritize affordability.

4. Are there pricing strategies tailored for emerging markets?

Yes, strategies include tiered pricing, volume discounts, local manufacturing, and partnerships to reduce costs and increase accessibility.

5. How can manufacturers sustain profitability amid price erosion?

By extending patent life, investing in formulation innovation, optimizing supply chains, and expanding indications to diversify revenue streams.

References

[1] Grand View Research, "Gastrointestinal Drugs Market Size, Share & Trends Analysis Report," 2022.

[2] IQVIA, "Global Prescriptions & OTC Market Data," 2022.

[3] European Medicines Agency (EMA), "Regulatory Requirements for OTC Drugs," 2022.

[4] Statista, "Antacid Market Revenue Forecast," 2022.

[5] McKinsey & Company, "Strategic Pricing in the Pharma Sector," 2020.

More… ↓