Share This Page

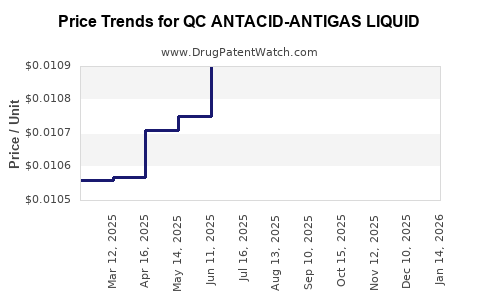

Drug Price Trends for QC ANTACID-ANTIGAS LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for QC ANTACID-ANTIGAS LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01031 | ML | 2025-12-17 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01059 | ML | 2025-11-19 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01054 | ML | 2025-10-22 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01057 | ML | 2025-09-17 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01062 | ML | 2025-08-20 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01074 | ML | 2025-07-23 |

| QC ANTACID-ANTIGAS LIQUID | 83324-0121-12 | 0.01090 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ANTACID-ANTIGAS LIQUID

Overview of QC ANTACID-ANTIGAS LIQUID

QC ANTACID-ANTIGAS LIQUID is a non-prescription pharmaceutical product formulated to neutralize stomach acid and provide relief from indigestion, heartburn, and acid reflux. It primarily targets consumers seeking quick, effective relief from gastrointestinal discomfort. The formulation typically combines active ingredients such as aluminum hydroxide, magnesium hydroxide, or calcium carbonate, known for their antacid properties.

The drug operates within a competitive over-the-counter (OTC) segment, widely accessible via pharmacies, supermarkets, and online channels. Its market positioning hinges on efficacy, safety profile, cost, and brand recognition.

Market Dynamics & Growth Drivers

1. Increasing Prevalence of Acid-Related Disorders:

The global incidence of acid reflux, GERD (Gastroesophageal Reflux Disease), and indigestion is rising, driven by dietary, lifestyle factors, and increased obesity rates. According to the Global Burden of Disease Study, gastrointestinal conditions constitute a significant portion of non-communicable diseases, augmenting demand for OTC antacid solutions like QC ANTACID-ANTIGAS LIQUID.

2. Self-Medication Trends & Consumer Preference:

Patients increasingly prefer self-treatment for minor gastrointestinal issues, reducing the burden on healthcare infrastructure. OTC availability, combined with consumer confidence in liquid formulations that offer rapid relief, stabilizes market demand.

3. Competitive Landscape:

Major global players include GlaxoSmithKline (TUMS), Bayer ( APIs like Rolaids), and local/regional brands. QC's differentiators, such as formulation additives, flavoring, or price points, influence specific market segments.

4. Regulatory Environment & Market Access:

Stringent regulatory requirements govern OTC drugs. Clear labeling, safety data, and efficacy confirmation facilitate market entry. Countries with supportive regulatory climates enhance product accessibility, supporting sales growth.

Regional Market Outlook

North America:

The US OTC antacid market is mature, with steady growth driven by consumer awareness and chronic acid-related ailments. Price sensitivity is moderate, with consumers willing to pay a premium for quick relief formulas. The presence of numerous competitors pressures pricing strategies.

Europe:

European markets exhibit stable demand, with increasing interest in natural and combination formulations. Regulatory standards are strict; compliance influences marketability and pricing.

Asia-Pacific:

This region shows the fastest growth, fueled by rising urbanization, dietary changes, and increasing healthcare awareness. Countries like India and China report expanding OTC drug markets, with consumer preference shifting towards affordable, effective remedies.

Latin America & MEA:

Emerging markets with expanding pharmaceutical infrastructure, rising middle-class populations, and increasing OTC drug penetration. Price sensitivity is high, favoring competitive pricing.

Competitive and Pricing Analysis

Pricing Strategies:

- Premium Pricing: For formulations with added ingredients, unique flavors, or innovative delivery mechanisms.

- Penetration Pricing: To establish market share among dominant brands.

- Economical Pricing: Targeting price-sensitive consumers in emerging markets.

Market Positioning:

QC ANTACID-ANTIGAS LIQUID's pricing must balance competitiveness with profit margins. Positioned as an effective, affordable OTC remedy, the product’s price point typically aligns with similar liquid antacid products, ranging from $3 to $8 per 100 mL bottle in the US and Europe.

Distribution Channels:

Online platforms and pharmacy chains facilitate broader reach, impacting pricing strategies due to differing logistic costs and promotional activities.

Price Projection Outlook (2023-2028)

Based on current market trends, inflationary pressures, and competitive dynamics:

-

Short-Term (2023-2024):

Price stability is anticipated, with minor fluctuations reflecting inflation, currency variations, and promotional discounts. The average price per 100 mL bottle likely remains within $3.50 to $7.50 globally. -

Medium Term (2024-2026):

Emerging markets may see modest price reductions to penetrate lower-income segments, while developed markets could witness slight increases driven by formulation innovations and regulatory compliance costs. Overall, prices could increase by 2-4% annually. -

Long Term (2026-2028):

Introduction of new formulations or demand shifts towards natural therapies may influence pricing. If new features justify premium pricing, the product could command $1-$2 higher per unit, contingent on consumer acceptance.

Key factors influencing projections include:

- Regulatory changes affecting OTC classifications

- Raw material cost fluctuations (e.g., active ingredient prices)

- Competitive innovations or market entries

- Consumer preferences for natural or combination products

Potential Market Opportunities and Challenges

Opportunities:

- Launching natural or organic variants at premium prices

- Expanding into emerging markets with targeted, affordable pricing

- Digital marketing and online sales channels to boost visibility and affordability

Challenges:

- Intense competition from established brands

- Regulatory restrictions on formulation claims and labeling

- Price wars driven by local competitors in emerging markets

- Consumer shift towards holistic or dietary remedies instead of pharmaceuticals

Key Takeaways

- The global OTC antacid market remains resilient, driven by rising prevalence of acid-related gastrointestinal disorders.

- QC ANTACID-ANTIGAS LIQUID holds competitive potential through strategic pricing, emphasizing affordability and efficacy.

- Pricing in developed markets stabilizes around $3.50-$7.50 per 100 mL, with gradual increases aligned with inflation and innovation.

- Emerging markets present substantial growth prospects via competitively priced formulations tailored to local affordability.

- Strategic innovation, regulatory compliance, and omnichannel distribution are critical to sustaining growth and competitive advantage.

Frequently Asked Questions (FAQs)

1. How does the pricing of QC ANTACID-ANTIGAS LIQUID compare with similar OTC antacids?

It typically aligns with market averages, priced between $3.50 and $7.50 per 100 mL, positioned competitively to balance affordability and perceived efficacy.

2. What factors could influence fluctuations in the drug’s future pricing?

Raw material costs, regulatory changes, competitive innovations, and shifts in consumer preferences toward natural remedies.

3. Which markets offer the best opportunities for growth?

Emerging markets in Asia-Pacific and Latin America offer high-growth potential due to increasing urbanization, healthcare awareness, and price sensitivity.

4. Can new formulations or natural variants command premium pricing?

Yes. Differentiation through natural ingredients, improved formulation, or added health benefits can justify higher price points.

5. How important are online sales channels for the future of this drug?

Very; online platforms provide wider access, help reduce distribution costs, and can support targeted pricing strategies, especially in regions with high digital adoption.

References

[1] Global Burden of Disease Study, 2021.

[2] MarketResearch.com, OTC Gastrointestinal Drugs Market Report, 2022.

[3] IBISWorld, Antacid and Heartburn Products Industry Overview, 2022.

[4] USA Food and Drug Administration (FDA), OTC Drug Regulations.

[5] European Medicines Agency (EMA), Guidelines on Over-the-Counter Drug Approval.

More… ↓