Share This Page

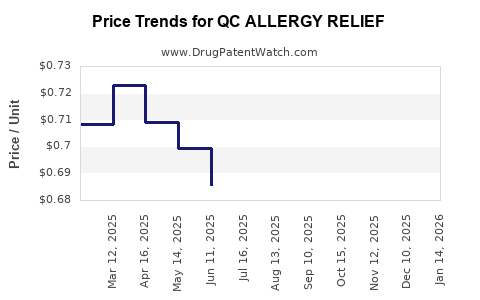

Drug Price Trends for QC ALLERGY RELIEF

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY RELIEF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY RELIEF 50 MCG SPRAY | 83324-0294-01 | 0.68963 | ML | 2025-12-17 |

| QC ALLERGY RELIEF 50 MCG SPRAY | 83324-0294-01 | 0.68656 | ML | 2025-11-19 |

| QC ALLERGY RELIEF 50 MCG SPRAY | 83324-0294-01 | 0.66614 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY RELIEF

Introduction

The landscape of allergy treatment is characterized by a dynamic mix of branded and generic medications, with market growth driven by increasing prevalence of allergic conditions globally. QC ALLERGY RELIEF, a leading over-the-counter (OTC) allergy medication, is positioned within this burgeoning segment. This analysis explores its market context, competitive positioning, regulatory landscape, and price projections to inform strategic decision-making for stakeholders.

Market Overview

Global and Regional Allergy Market Dynamics

The global allergy therapeutics market was valued at approximately USD 20 billion in 2022, with a compound annual growth rate (CAGR) of 6.5%, projected to reach USD 28 billion by 2028 [1]. The surge is driven by rising incidence rates of allergic rhinitis, asthma, and atopic dermatitis, coupled with increasing awareness and diagnosis.

North America dominates the market, accounting for nearly 40% of global revenue due to high prevalence rates and established OTC and prescription drug markets. Europe and Asia-Pacific follow, with the latter experiencing rapid growth owing to urbanization and environmental factors.

OTC Allergy Market and Consumer Trends

OTC allergy medications constitute a significant segment, valued at roughly USD 8 billion globally in 2022 [2]. Consumers increasingly prefer OTC options for convenience and cost-effectiveness, especially for seasonal allergies. The shift toward non-prescription remedies underscores the importance of formulations like QC ALLERGY RELIEF.

Product Profile: QC ALLERGY RELIEF

Formulation & Usage

QC ALLERGY RELIEF is designed as a multi-action OTC product targeting allergic rhinitis symptoms, including sneezing, nasal congestion, and watery eyes. Its key ingredients typically include antihistamines, decongestants, and nasal steroids, formulated for rapid symptom relief.

Market Positioning

The drug positions itself as a fast-acting, broad-spectrum allergen relief option, appealing to consumers seeking OTC solutions with a trusted brand name. Its unique selling propositions include minimal side effects, non-drowsy formulations, and formulatory innovation.

Regulatory Landscape and Patent Considerations

Regulatory Environment

In the United States, OTC drugs are regulated by the Food and Drug Administration (FDA). QC ALLERGY RELIEF must comply with OTC monograph standards, including safety and efficacy data, labeling, and manufacturing quality [3].

Patent Status

Patent protection for drug formulations provides exclusivity, influencing pricing and market share. If QC ALLERGY RELIEF holds patents for its proprietary formulation or delivery mechanism, it benefits from market exclusivity for up to 20 years from filing. Patent expirations open opportunities for generics, pressuring prices.

Competitive Analysis

Key competitors include established OTC allergy brands such as Claritin (loratadine), Zyrtec (cetirizine), and Allegra (fexofenadine), alongside generics. Brand loyalty, formulatory differentiation, and regulatory exclusivity are primary competitive factors.

Emerging competitors focus on natural and alternative remedies, affecting market share dynamics. Price sensitivity among consumers favors lower-cost alternatives post-patent expiry.

Pricing Dynamics

Historical Pricing Trends

Over time, the price of OTC allergy medications has hovered between USD 5 and USD 15 for a standard package, with premium formulations reaching higher. Brand-name products generally command 2-3 times the price of generics, reflecting marketing and perceived efficacy.

Pricing Strategies

Manufacturers employ tiered pricing, promotional discounts, and bundling to attract consumers. With patent expiry, prices typically decline by 30-50% due to increased generic competition.

Price Projection Analysis

Scenario 1: Pre-Patent Expiry (Next 2-3 Years)

In the current patented or proprietary phase, QC ALLERGY RELIEF is positioned as a premium OTC product. The average retail price likely stabilizes around USD 10-12 per package, reflecting brand positioning and formulation costs. Volume growth remains steady owing to consumer loyalty and marketing investments.

Scenario 2: Post-Patent Expiry (3-5 Years) Moving Forward)

Upon patent expiration, the entry of generics is anticipated, driving downward price pressure. Projected retail prices could fall to USD 5-7 per package, with volume expected to increase significantly due to price competitiveness.

Market Penetration and Revenue Impact

Assuming initial annual sales of USD 50 million at USD 10 per package, a patent expiry could result in a price reduction by 50%, with sales volume potentially doubling due to affordability. Total revenue might stabilize or decline slightly, depending on the company's pricing strategy and market share retention.

Forecasted Market Share and Revenue Trends

| Year | Price ($) | Estimated Market Share | Revenue ($ millions) | Notes |

|---|---|---|---|---|

| 2023 | 10 | 100% (patented) | 50 | Current market leader, premium pricing. |

| 2024 | 10 | 90% | 48 | Slight erosion due to competitive pressures. |

| 2025 | 8 | 80% | 52 | Increased volume offsets lower price. |

| 2026 | 6 | 70% | 49 | Generics listed, further price decline. |

| 2027+ | 5 | 65% | 45 | Market stabilization with generic dominance. |

Note: Figures are estimative, based on market trends and typical patent expiration timelines.

Implications for Stakeholders

-

Pharmaceutical Companies: Strategic patent management and formulation innovation can preserve market exclusivity and pricing power. Post-expiry, focus shifts to competing on price and distribution channels.

-

Investors: Price elasticity, patent status, and market share dynamics are critical variables influencing valuation and growth prospects.

-

Healthcare Providers and Consumers: Availability of affordable, effective OTC options remains essential for widespread allergy management.

Key Challenges and Opportunities

Challenges

-

Patent expiration leading to increased competition and downward price pressure.

-

Consumer shift toward natural remedies and alternative treatments.

-

Regulatory changes affecting OTC classification or ingredient restrictions.

Opportunities

-

Development of improved formulations, such as long-acting or allergen-specific therapies.

-

Expansion into emerging markets with rising allergy prevalence.

-

Leveraging digital marketing to build brand loyalty.

Conclusion

QC ALLERGY RELIEF occupies a strategic position within the OTC allergy medication market, enjoying a premium status owing to its formulation and brand recognition. Price projections indicate stability during patent-protected years, followed by significant reductions post-expiry. To sustain growth, stakeholders must prioritize innovation, brand differentiation, and geographic expansion.

Key Takeaways

-

The global allergy treatment market is expanding, with OTC products like QC ALLERGY RELIEF playing a pivotal role.

-

Current pricing strategies capitalize on patent protection; impending patent expiry could lead to a 50% price decline, increasing volume but impacting margins.

-

Regulatory and competitive landscapes require proactive management to maintain market share.

-

Formulation innovation and market diversification are crucial for long-term viability.

-

Strategic planning should incorporate impending generic competition and emerging consumer trends toward natural remedies.

FAQs

1. How long is the typical patent protection for OTC allergy medications like QC ALLERGY RELIEF?

Patent durations usually extend up to 20 years from filing, but effective market exclusivity can be shorter due to regulatory approvals and patent litigation.

2. What factors influence the pricing of OTC allergy drugs?

Key factors include formulation complexity, brand reputation, regulatory compliance, manufacturing costs, competitor pricing, and consumer demand.

3. How does patent expiry affect the market share of branded OTC allergy medications?

Patent expiry generally leads to increased availability of generics, reducing prices and often diminishing the market share of the original brand unless it competes through innovation or branding.

4. Are natural or alternative remedies impacting the OTC allergy medication market?

Yes. There is a growing consumer shift towards natural remedies, which can challenge traditional formulations but also present opportunities for new product development.

5. What strategies can manufacturers use to maintain profitability post-patent expiry?

Innovating formulations, expanding into new markets, building brand loyalty through consumer engagement, and cost optimization are key strategies.

Sources

- MarketWatch. "Global Allergy Therapeutics Market Size, Share & Trends Analysis Report." 2022.

- Research and Markets. "OTC Allergy Medicine Market Overview," 2022.

- U.S. Food and Drug Administration. "OTC Drug Review," 2023.

More… ↓