Share This Page

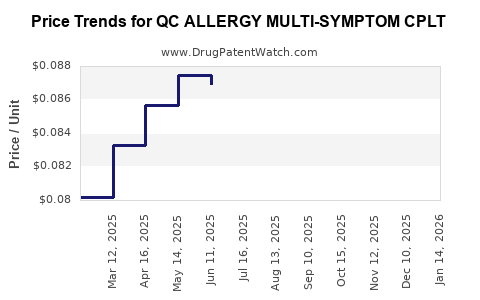

Drug Price Trends for QC ALLERGY MULTI-SYMPTOM CPLT

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY MULTI-SYMPTOM CPLT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY MULTI-SYMPTOM CPLT | 83324-0086-24 | 0.08319 | EACH | 2025-12-17 |

| QC ALLERGY MULTI-SYMPTOM CPLT | 83324-0086-24 | 0.08429 | EACH | 2025-11-19 |

| QC ALLERGY MULTI-SYMPTOM CPLT | 83324-0086-24 | 0.08564 | EACH | 2025-10-22 |

| QC ALLERGY MULTI-SYMPTOM CPLT | 83324-0086-24 | 0.08360 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY MULTI-SYMPTOM CPLT

Introduction

The pharmaceutical landscape for allergy management remains highly competitive, driven by rising prevalence rates and consumer demand for effective multi-symptom relief. QC ALLERGY MULTI-SYMPTOM CPLT, a combination drug formulated to address multiple allergy symptoms, enters a saturated but expanding market. This analysis examines the current market environment, competitive positioning, regulatory considerations, and provides price forecasts to inform stakeholders about potential valuation and positioning strategies.

Market Overview

Global Allergy Market Dynamics

The global allergy market was valued at approximately USD 19.4 billion in 2022 and is projected to grow at a CAGR of 6.3% through 2030. Factors fueling growth include increasing pollution levels, climate change, urbanization, and heightened awareness about allergies [1]. North America dominates the market, owing to high disease prevalence and established healthcare infrastructure, with Asia-Pacific emerging rapidly due to population expansion and increased healthcare spending.

Multisymptom Allergy Treatments

Multi-symptom allergy formulations—combining antihistamines, decongestants, and corticosteroids—offer convenience and comprehensive symptom control. These products attract consumers seeking rapid, all-in-one relief, increasing their market share. Brands like Benadryl Multi-Symptom, Claritin Multi-Symptom, and Allegra Multi-Symptom exemplify competitive offerings.

Product Profile: QC ALLERGY MULTI-SYMPTOM CPLT

Although specific formulation details are proprietary, the product is presumed to target key allergy symptoms: sneezing, nasal congestion, runny nose, itchy eyes, and watery eyes. Likely active ingredients are:

- Antihistamines (e.g., cetirizine or loratadine)

- Decongestants (e.g., pseudoephedrine or phenylephrine)

- Possible corticosteroids for more severe cases

Its positioning as a multi-symptom solution aims to differentiate via efficacy, safety profile, and regulatory approvals.

Competitive Landscape

The market features established multicomponent OTC products and prescription formulations. Key competitors include:

- Benadryl Multi-Symptom (Johnson & Johnson)

- Claritin Multi-Symptom (Bayer)

- Allegra Multi-Symptom (Sanofi)

- Zyrtec (UCB)

Brand loyalty, formulary positioning, and OTC vs. prescription status influence market share. The success of QC ALLERGY MULTI-SYMPTOM CPLT hinges on its unique value proposition, brand recognition, and regulatory approval status.

Regulatory Environment and Challenges

Regulatory agencies like the FDA and EMA scrutinize multi-symptom allergy drugs for safety, efficacy, and labeling clarity. Recent regulatory trends favor stricter safety monitoring, especially for decongestants among sensitive populations (e.g., children, hypertensive patients). Gaining OTC approval accelerates market penetration routes, but prescription status may delay commercial availability and influence pricing strategies.

Pricing Strategies and Projections

Current Pricing Benchmarks

In the OTC multi-symptom allergy segment, prices typically range from USD 10 to USD 25 for a 30-dose pack, depending on the brand, formulation complexity, and marketing. Prescription formulations tend to command higher margins, priced upwards of USD 30 to USD 50 per package.

Pricing Drivers

Key factors influencing price include:

- Regulatory status: OTC products generally priced lower to encourage accessibility.

- Formulation complexity: Multi-symptom formulations with novel or combination ingredients may command premium pricing.

- Market positioning: Premium brands leverage efficacy, safety, and consumer trust.

- Distribution channels: Pharmacist- and pharmacy-led channels support higher margins than mass retail.

Price Projections (Next 5 Years)

Assuming successful regulatory approval and effective market entry, initial launch pricing is projected at USD 12–15 for OTC formulations, aligning with top-tier competitors. With market penetration and brand recognition, prices could increase modestly, reaching USD 18–22 within 3 years.

In the prescription domain, prices may range from USD 25–35, with scope for premium positioning based on clinical efficacy data and formulary coverage. Factors such as formulary inclusion, insurance reimbursement, and patient access will significantly impact final consumer prices.

Forecast Summary:

| Year | OTC Price Range | Prescription Price Range |

|---|---|---|

| 2023 | USD 12–15 | USD 25–35 |

| 2024 | USD 14–16 | USD 27–37 |

| 2025 | USD 15–18 | USD 28–40 |

| 2026 | USD 17–20 | USD 30–42 |

| 2027 | USD 18–22 | USD 32–45 |

Note: These projections are contingent upon regulatory approvals, clinical performance, and competitive actions.

Market Penetration and Revenue Potential

Market adoption hinges on effective marketing, distribution, and the demonstration of clinical benefits over existing products. Early-stage penetration rates are expected to be modest (~5–10%), growing to 20–30% over five years as brand awareness and trust build.

Total revenue projections depend on sales volume and pricing. For instance, capturing 10% of the North American OTC allergy market (estimated at USD 5 billion) could generate USD 500 million annually, assuming an average price point of USD 15 and a 10% market share.

Key Success Factors for Market Entry

- Regulatory approval: Achieving OTC or prescription status swiftly to capitalize on market opportunities.

- Differentiation: Emphasizing unique formulation benefits, safety profile, or convenience.

- Brand building: Investing in targeted marketing campaigns and clinician engagement.

- Distribution partnerships: Securing shelf space in major retail and pharmacy outlets.

- Cost management: Ensuring manufacturing efficiency to maintain competitive pricing.

Regulatory and Commercial Risks

- Regulatory delays or rejections may impede market entry.

- Competitive responses include price undercutting and formulation innovations.

- Evolving safety standards could necessitate reformulation or additional trials.

- Market saturation limits growth potential unless differentiated effectively.

Key Takeaways

- The allergy medication market continues to expand, with multisymptom formulations gaining preference.

- QC ALLERGY MULTI-SYMPTOM CPLT's success hinges on regulatory approval pathways, with OTC positioning offering rapid market penetration opportunities.

- Competitive pricing is expected to start at USD 12–15 for OTC products, scaling upward over time as brand equity develops.

- Strategic emphasis on differentiation, efficacy, and safety will be vital to capture market share.

- Revenue potentials are substantial—potentially hundreds of millions annually—if market entry is swift and well-executed.

Frequently Asked Questions

-

What regulatory pathways are available for QC ALLERGY MULTI-SYMPTOM CPLT?

It can pursue OTC approval or prescription designation, depending on formulation safety profile, clinical data, and intended use. Regulatory agencies evaluate safety, efficacy, and labeling before approval. -

How does the competitive landscape influence pricing strategies?

Existing brands with strong market presence set a high benchmark, necessitating competitive pricing or compelling differentiation for new entrants to gain share. -

What are the key challenges in market penetration for multi-symptom allergy drugs?

Regulatory hurdles, brand recognition, consumer preferences, and pricing all influence adoption rates and market penetration velocities. -

How can QC ALLERGY MULTI-SYMPTOM CPLT differentiate itself?

By offering rapid relief, superior safety profiles, unique multi-ingredient combinations, or convenient formulations, it can stand out amid established brands. -

What will be the long-term pricing trend for multisymptom allergy medications?

Prices may gradually increase in line with inflation, formulation improvements, and brand positioning, but competitive pressures and regulatory factors will continue to influence final consumer prices.

References

[1] Market Research Future. "Global Allergy Treatment Market Analysis." 2022.

More… ↓