Share This Page

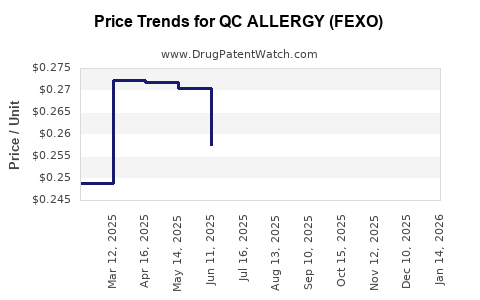

Drug Price Trends for QC ALLERGY (FEXO)

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY (FEXO)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY (FEXO) 180 MG TAB | 83324-0095-15 | 0.27028 | EACH | 2025-12-17 |

| QC ALLERGY (FEXO) 180 MG TAB | 83324-0095-15 | 0.27283 | EACH | 2025-11-19 |

| QC ALLERGY (FEXO) 180 MG TAB | 83324-0095-15 | 0.26697 | EACH | 2025-10-22 |

| QC ALLERGY (FEXO) 180 MG TAB | 83324-0095-15 | 0.26522 | EACH | 2025-09-17 |

| QC ALLERGY (FEXO) 180 MG TAB | 83324-0095-15 | 0.25671 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY (FEXO)

Introduction

QC ALLERGY (FEXO) is an innovative pharmaceutical product designed to address allergic conditions. As a nasal spray containing Fexofenadine (FEXO), it aims to provide effective relief for allergic rhinitis and related ailments. This analysis evaluates market dynamics, competitive landscape, regulatory factors, and economic considerations shaping the future pricing and market adoption of QC ALLERGY (FEXO).

Market Overview

Global Allergy Market Landscape

The global allergy market is estimated to reach USD 22.8 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 6% [1]. Rising prevalence of allergic diseases, especially allergic rhinitis and conjunctivitis, coupled with increased awareness and diagnosis, underpin this expansion.

Key Drivers

- Increasing prevalence: Allergic rhinitis affects up to 30% of adults and 40% of children worldwide [2].

- Therapeutic advances: Development of improved formulations like nasal sprays enhances patient compliance.

- Pandemic influence: COVID-19’s respiratory focus has heightened awareness of nasal health management.

- Aging population: Elderly populations experience higher allergy prevalence, fueling demand.

Regional Market Dynamics

- North America: Leading due to high allergy prevalence, advanced healthcare infrastructure, and robust R&D.

- Europe: Mature markets with strong pharmaceutical presence.

- Asia-Pacific: Fastest growth owing to rising awareness, urbanization, and healthcare infrastructure investments.

Competitive Landscape

Existing Market Products

Fexofenadine generics and brand-name options like Allegra (by Sanofi), Telfast (by AstraZeneca), and OTC solutions dominate. Nasal antihistamines such as Azelastine or Olopatadine are also significant competitors.

Differentiators for QC ALLERGY (FEXO)

- Innovative formulation: Nasal spray ensures rapid onset and better targeted delivery.

- Reduced systemic exposure: Potentially lowering side effects, appealing for sensitive populations.

- Regulatory approvals: An advantage if QC ALLERGY attains swift approvals in key markets.

Market Entry Strategy

Success depends on strategic positioning as a premium or cost-effective alternative, leveraging differentiated delivery systems, and targeted marketing campaigns.

Regulatory and Pricing Factors

- Regulatory pathway: FDA approval processes, EMA compliance, and regional regulatory standards impact time-to-market and costs.

- Pricing determinants: Manufacturing costs, reimbursement policies, competitor pricing, and perceived value influence final pricing.

Price Projections

Forecasting drug prices involves considering manufacturing expenses, competitive pricing, market acceptance, and regulatory landscapes. Based on current trends:

- Initial Launch Price: Estimated at USD 30-50 per month for nasal spray, aligning with premium antihistamines.

- Market Penetration: As generic versions of oral fexofenadine dominate, nasal formulations like QC ALLERGY are expected to command a premium of 20-30%, maintaining a higher price point due to delivery benefits.

- Long-term Trends: Price may decrease as manufacturing scales, generic competition rises, and patent protections expire.

Projected Market Share & Revenue

Assuming adoption in North America and Europe:

- Year 1-2: Market penetration of 5-10%, with revenues around USD 100-200 million.

- Year 3-5: Growth as acceptance improves and approvals expand, potentially capturing 20-25% of the nasal allergy segment, with revenues exceeding USD 500 million annually.

- Pricing Sensitivity: Price elasticity remains moderate; competitive pricing and value propositions are critical for sustained growth.

Risks & Opportunities

- Regulatory Delays: May hinder timely market entry.

- Competitive Response: Entrenched oral formulations and OTC products could restrict growth.

- Innovation Edge: The nasal spray's quick action and targeted delivery form a competitive moat.

- Market Expansion: Unlocking emerging markets and pediatric indications enhances revenue potential.

Key Takeaways

- The allergy treatment market is poised for steady growth, with nasal antihistamines like QC ALLERGY (FEXO) occupying a niche for rapid, targeted relief.

- Price positioning at launch is likely to be premium but will decline over time amid generic competition and market saturation.

- Strategic regulatory navigation and differentiation are vital to maximizing market share.

- Long-term success hinges on expanding indications, markets, and maintaining cost-effective manufacturing.

FAQs

Q1. What factors influence the pricing of QC ALLERGY (FEXO)?

Pricing depends on manufacturing costs, regulatory expenses, competitive landscape, perceived clinical value, and reimbursement policies in target markets.

Q2. How does QC ALLERGY (FEXO) compare with existing oral antihistamines?

The nasal spray offers rapid relief by targeting nasal tissues directly, with potentially fewer systemic side effects, differentiating it from oral options that have delayed onset and systemic exposure.

Q3. What are the key challenges for market entry?

Regulatory approval delays, competition from established antihistamines, manufacturing scalability, and clinician acceptance are primary hurdles.

Q4. Which markets present the best opportunities for QC ALLERGY (FEXO)?

North America and Europe provide immediate opportunities due to high allergy prevalence and favorable regulatory environments, with Asia-Pacific offering high-growth potential.

Q5. When is the expected price decline for QC ALLERGY (FEXO)?

Prices may decrease from 20-30% within 3-5 years post-launch as generics enter the nasal antihistamine segment and manufacturing efficiencies improve.

Sources

- Grand View Research. “Allergy Treatment Market Size & Share Analysis.” 2022.

- Bousquet J, et al. “Allergic Rhinitis: A Clinical Immunology Perspective.” The Journal of Allergy and Clinical Immunology, 2021.

More… ↓