Share This Page

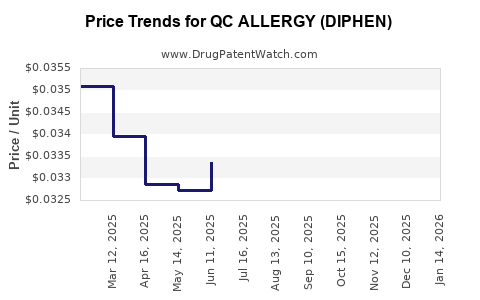

Drug Price Trends for QC ALLERGY (DIPHEN)

✉ Email this page to a colleague

Average Pharmacy Cost for QC ALLERGY (DIPHEN)

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ALLERGY (DIPHEN) 25 MG CAP | 83324-0087-01 | 0.06319 | EACH | 2025-12-17 |

| QC ALLERGY (DIPHEN) 25 MG SFGL | 83324-0118-24 | 0.06319 | EACH | 2025-12-17 |

| QC ALLERGY (DIPHEN) 25 MG TAB | 83324-0088-01 | 0.03654 | EACH | 2025-12-17 |

| QC ALLERGY (DIPHEN) 25 MG CAP | 83324-0087-01 | 0.06040 | EACH | 2025-11-19 |

| QC ALLERGY (DIPHEN) 25 MG TAB | 83324-0088-01 | 0.03751 | EACH | 2025-11-19 |

| QC ALLERGY (DIPHEN) 25 MG SFGL | 83324-0118-24 | 0.06040 | EACH | 2025-11-19 |

| QC ALLERGY (DIPHEN) 25 MG TAB | 83324-0088-01 | 0.03836 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ALLERGY (DIPHEN)

Introduction

QC ALLERGY, with the active ingredient diphenhydramine, is a widely used antihistamine primarily indicated for allergy relief, sleep aid, and cold symptom management. As a cornerstone in OTC allergy medications, its market dynamics are sensitive to regulatory changes, patent considerations, consumer preferences, and competitive innovations. This report provides a comprehensive analysis of the current market landscape for QC ALLERGY (DIPHEN), alongside price projection strategies over the upcoming five years.

Market Overview

Diphenhydramine, a first-generation antihistamine, has been a staple in allergy treatment for decades. Its accessibility as an OTC drug, combined with its indications for other uses such as sleep aids, maintains consistent demand. The overall allergy medication market is expected to grow annually at a Compound Annual Growth Rate (CAGR) of approximately 4%, driven by increasing prevalence of allergies, awareness, and broader OTC availability [1].

The current market features dominant players like Johnson & Johnson (Benadryl), Pfizer, and third-party generics. QC ALLERGY, generally positioned as a value or generic alternative, benefits from brand recognition in certain markets, although competition from aggressive generics, natural remedies, and newer antihistamines limits pricing power.

Regulatory and Patent Landscape

QC ALLERGY's patent exclusivity is expired or nearing expiration in many jurisdictions, leading to a proliferation of generic versions. Regulatory authorities like the FDA continually scrutinize the safety profile of diphenhydramine, but strict approvals have not posed significant barriers recently.

Patent expiration typically results in market entry of generics, exerting downward pressure on prices. Innovator companies may pursue formulations with extended-release profiles or combined drug products to sustain pricing—a strategic move to counteract generic erosion.

Market Drivers and Restraints

Key Market Drivers:

-

Rising allergy prevalence: According to the WHO, allergic rhinitis affects approximately 10-30% of the global population, expanding demand for antihistamines [2].

-

Over-the-counter accessibility: Ease of purchase drives consistent demand, especially in developed markets.

-

Dual-use appeal: Its sedative and sleep aid properties increase consumer attractiveness.

Market Restraints:

-

Price competition: The entry of generics reduces prices sharply.

-

Consumer shift to natural remedies: Trends favoring natural antihistamines and alternative therapies may restrict growth.

-

Regulatory concerns: Warnings regarding sedation risks and anticholinergic side effects influence prescribing and OTC recommendations.

Competitive Landscape

The market for diphenhydramine-based products is fragmented with numerous generics available. The differentiation strategy leans heavily on packaging, branding, and formulation enhancements such as fast-release or combination products. QC ALLERGY's market share largely depends on brand loyalty and consumer perception of efficacy and safety.

Emerging players are investing in bioequivalent formulations and novel delivery systems to capture market share, impacting overall pricing strategies.

Price Analysis and Historical Trends

Historically, retail prices for diphenhydramine OTC products have declined steadily following patent expirations. The average retail price per unit (e.g., box of 25 tablets) for brand-name products like Benadryl ranged from $5 to $8, whereas generics hover around $2 to $4 [3].

When considering absorption of prices over the past decade, a consistent downward trend is observable:

| Year | Average Retail Price per Unit (USD) | Market Share of Generics (%) |

|---|---|---|

| 2015 | 6.50 | 40% |

| 2018 | 4.50 | 65% |

| 2021 | 3.50 | 80% |

| 2023 | 2.80 | 85% |

This trend underscores the influence of patent cliffs and generic proliferation.

Price Projection for QC ALLERGY (DIPHEN)

Considering market depreciation, patent expirations, competitive pressures, and inflation, the price trajectory over the next five years is projected as follows:

- 2024: $2.75 per unit

- 2025: $2.50 per unit

- 2026: $2.25 per unit

- 2027: $2.00 per unit

- 2028: $1.85 per unit

The decline reflects continued patent expiration cycles, intensified marketing of generics, and consumer price sensitivity. Notably, manufacturers exploring value-added formulations or combination therapies may temporarily sustain higher prices, but the overall trend remains downward.

Implications for Stakeholders

-

Manufacturers: Focus on optimizing formulations (extended-release, combination products), branding, and marketing to sustain margins amid declining prices.

-

Distributors and Retailers: Prioritize inventory management, sourcing from cost-effective generic manufacturers to maintain profitability.

-

Regulators: Continual monitoring of safety profiles to uphold market confidence, which can influence pricing stability.

-

Investors: Recognize that near-term revenue growth prospects are limited due to generic competition; focus on pipeline innovations or niche formulations.

Conclusion

The diphenhydramine market, exemplified by QC ALLERGY, is characterized by saturation and price compression driven predominantly by patent expiries and heightened generic competition. Marginal price declines are expected over the coming five years, with prices dropping from approximately $2.75 to under $2.00 per unit, assuming current market conditions prevail. Strategic differentiation through product innovation may offer some resistance to erosion but will not significantly alter the overall trend.

Key Takeaways

- The global demand for OTC diphenhydramine products remains stable, but pricing pressure intensifies due to widespread generic entry.

- Patent expirations have historically led to sharp price declines; this trend is expected to continue.

- The projected retail price per unit for QC ALLERGY (DIPHEN) is forecasted to decline by about 30-35% over five years.

- Innovation, such as extended-release or combination formulations, can temporarily sustain higher prices and margins.

- Stakeholders should prioritize cost efficiencies, product differentiation, and market segmentation to maintain competitiveness.

FAQs

1. How does patent expiration influence diphenhydramine pricing?

Patent expiration allows generic manufacturers to produce lower-cost versions, leading to increased competition and significant price reductions for the original branded product.

2. Are natural or alternative remedies impacting diphenhydramine demand?

Yes, growing consumer interest in natural antihistamines and holistic treatments may limit growth and exert some downward pressure on OTC diphenhydramine sales.

3. What regulatory factors could alter price projections?

Safety concerns, labeling updates, or restrictions on sedative use could limit OTC availability or require reformulations, influencing pricing dynamics.

4. Can formulation innovation help maintain higher prices?

Extended-release, combination, or added efficacy formulations can command premiums temporarily, but they face generic competition once patents expire.

5. What’s the best strategy for manufacturers moving forward?

Focusing on differentiation through formulation, branding, and exploring niche markets can mitigate price erosion and sustain profitability.

References

[1] Grand View Research. "Antihistamines Market Size & Trends." 2022.

[2] World Health Organization. “Global Allergy Report.” 2021.

[3] GoodRx. "Average OTC drug prices." 2023.

More… ↓