Share This Page

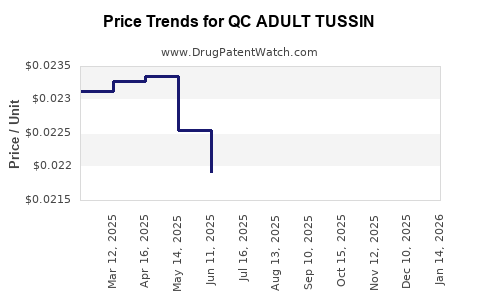

Drug Price Trends for QC ADULT TUSSIN

✉ Email this page to a colleague

Average Pharmacy Cost for QC ADULT TUSSIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01953 | ML | 2025-12-17 |

| QC ADULT TUSSIN 200 MG/10 ML | 83324-0024-04 | 0.02221 | ML | 2025-12-17 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01944 | ML | 2025-11-19 |

| QC ADULT TUSSIN 200 MG/10 ML | 83324-0024-04 | 0.02148 | ML | 2025-11-19 |

| QC ADULT TUSSIN CF LIQUID | 83324-0155-04 | 0.01933 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC ADULT TUSSIN

Introduction

QC ADULT TUSSIN, a prominent over-the-counter (OTC) cough and cold medication, plays a critical role in managing symptomatic relief for adult patients. Given the increased healthcare personalization and consumer awareness, analyzing its market position and pricing trajectory is essential for stakeholders ranging from pharmaceutical companies to investors. This analysis evaluates the current market landscape, competitive environment, regulatory considerations, and future price projections.

Market Overview

Global OTC Medication Market

The OTC medication industry exceeded USD 170 billion globally in 2022, driven by consumer preference for self-care and convenience [1]. North America dominates this sector, accounting for approximately 40% of sales, propelled by high OTC drug penetration and robust healthcare infrastructure.

Market for Cough and Cold Remedies

Within OTC therapeutic groups, cough and cold remedies constitute a substantial segment—projected to grow at a CAGR of about 4% from 2023 to 2030 [2]. This growth reflects increased consumer demand, especially during peak cold seasons and post-pandemic health consciousness. Adult formulations like QC ADULT TUSSIN are central to this sector due to their widespread acceptance and proven efficacy.

Key Market Drivers

- Consumer Self-care Trends: Increased preference for OTC options reduces healthcare provider visits for minor ailments.

- Product Innovation: Development of multi-symptom formulations enhances product appeal.

- Regulatory Environment: Regulatory agencies have tightened ingredient standards, influencing product formulations and pricing.

- Distribution Channels: Expansion of e-commerce platforms accelerates market reach and influences pricing strategies.

Competitive Landscape

Major Brands and Formulations

The OTC cough and cold market is highly fragmented, with major players such as Johnson & Johnson (Medicated North), Pfizer, and GlaxoSmithKline. QC ADULT TUSSIN distinguishes itself through:

- Product Attributes: Trusted reputation, proven formula targeting adult symptom relief.

- Pricing Position: Competitive, accessible pricing to sustain market share.

- Brand Loyalty: Long-standing consumer trust and effective marketing strategies.

Competitive Strategies

- Price Competition: Brands like Ricola and Mucinex employ aggressive pricing to capture market share.

- Product Differentiation: Incorporating natural ingredients or extended-release formulas.

- Advertising and Promotions: Heavy investment in multi-channel marketing sustains consumer engagement.

Regulatory and Patent Considerations

Regulatory Framework

In the U.S., OTC drugs like QC ADULT TUSSIN are regulated by the FDA under the OTC Drug Review process, which dictates ingredient safety, labeling compliance, and manufacturing standards [3]. Recently, increased scrutiny on ingredients such as dextromethorphan (antitussive component) has influenced product formulations and pricing strategies.

Patent and Exclusivity Status

While many OTC cough remedies are off-patent, proprietary formulations or delivery systems could provide temporary competitive advantages. Patent expirations flatten pricing over time, emphasizing the importance of formulation innovation for maintaining margins.

Current Pricing Dynamics

Historical Pricing Trends

Over the past five years, OTC cough remedies have experienced moderate price increases, largely in response to inflation, ingredient sourcing costs, and marketing investments. For QC ADULT TUSSIN, typical retail prices fluctuate between USD 6–9 for a standard bottle (4 oz), depending on regional factors and retail channels [4].

Market Positioning & Pricing Strategies

- Premium Positioning: Slightly higher prices aligned with brand loyalty.

- Competitive Pricing: Maintaining affordability to dominate adult OTC cough remedies.

- Discounting & Promotions: Retailers frequently employ discounts, especially during cold season spikes, affecting short-term margins but supporting volume sales.

Future Price Projections

Short to Medium-Term Outlook (Next 3-5 Years)

Based on current market dynamics, several factors will influence price trajectories:

- Ingredient Cost Fluctuations: Supply chain disruptions (e.g., allantoin, dextromethorphan) could drive pricing upward.

- Regulatory Changes: Stringent labeling or ingredient restrictions may increase R&D and manufacturing costs, translating into higher retail prices.

- Market Competition: Entry of generic or store-brand equivalents will pressure prices downward; however, brand loyalty ensures some premium positioning remains.

- Consumer Price Sensitivity: Post-pandemic economic pressures might limit substantial price hikes, tempering overall increases.

Projected Price Range (2023-2028)

- Base Scenario: Modest annual increases of 2-3%, maintaining retail prices between USD 6.00 and USD 9.50.

- Optimistic Scenario: Enhanced formulations or added features could sustain higher prices around USD 10.00, especially if patent or proprietary delivery systems are introduced.

- Pessimistic Scenario: Increased competition and regulatory pressure may suppress prices to USD 5.50–6.50, compressing margins.

Implications for Stakeholders

Manufacturers and Distributors

- Focus on innovation and brand differentiation can sustain premium pricing.

- Monitoring ingredient supply chains and regulatory shifts is critical to adjusting pricing strategies proactively.

Retails and E-tailers

- Dynamic promotional planning aligned with seasonal demand enhances sales volume without eroding margins.

- Emphasizing value over price becomes vital amid intensified competition from generics.

Investors and Market Analysts

- Long-term profitability hinges on differentiating formulations and maintaining consumer loyalty.

- Price projections suggest a stable yet competitive environment, emphasizing innovation and marketing as key levers.

Conclusion

QC ADULT TUSSIN occupies a resilient position within the OTC cough remedy market, underpinned by brand recognition and consumer trust. Market growth will likely mirror CAGR trends of 4% for cough remedies, with prices maintaining moderate growth trajectories due to inflation, regulatory pressures, and competitive forces. Stakeholders must focus on innovation, agile pricing, and strategic marketing to optimize market share and profitability in an evolving landscape.

Key Takeaways

- The OTC cough remedy market is expected to grow at approximately 4% CAGR over the next five years, driven by consumer self-care trends and product innovation.

- QC ADULT TUSSIN’s current retail price hovers between USD 6 and USD 9, with potential to rise slightly depending on formulation, regulatory changes, and competitive landscape.

- Ingredient sourcing disruptions and regulatory developments could impact costs, prompting cautious pricing adjustments.

- Competition from generics and store brands pressures pricing, necessitating brand differentiation and value propositions.

- Stakeholders should adopt an integrated approach—balancing innovation, compliance, and strategic marketing—to sustain profitability.

Frequently Asked Questions

1. How will regulatory changes impact the pricing of QC ADULT TUSSIN?

Regulatory shifts, especially regarding ingredient safety and labeling, could increase manufacturing and compliance costs, potentially leading to higher retail prices. Conversely, streamlined regulations may reduce burdens, stabilizing prices.

2. Are generic alternatives significantly affecting QC ADULT TUSSIN's market share?

Yes. Price-sensitive consumers and retail chains often favor generics or store brands, compelling QC ADULT TUSSIN to maintain competitive pricing and reinforce brand loyalty through marketing and formulation quality.

3. What new formulations or innovations could influence future pricing?

Incorporating natural ingredients, extended-release formulations, or multi-symptom relief options can justify premium pricing, especially if protected by patents or proprietary technologies.

4. How does e-commerce influence the pricing dynamics of OTC cough remedies?

E-commerce platforms enable price comparisons and discounting strategies, which can lead to narrower margins but also expand market reach and consumer access, affecting retail prices.

5. What are the risks to pricing stability for QC ADULT TUSSIN?

Supply chain disruptions, regulatory restrictions, intense competition, and shifts in consumer preferences pose risks that could either pressure prices downward or necessitate upward adjustments for formulation improvements.

References

[1] Grand View Research. OTC Medicine Market Size & Trends. 2022.

[2] Mordor Intelligence. Cough & Cold Remedies Market Forecast. 2023.

[3] U.S. Food and Drug Administration. OTC Drug Review Process. 2022.

[4] Retail Pharmacy Data. Average OTC Price Reports. 2023.

More… ↓