Share This Page

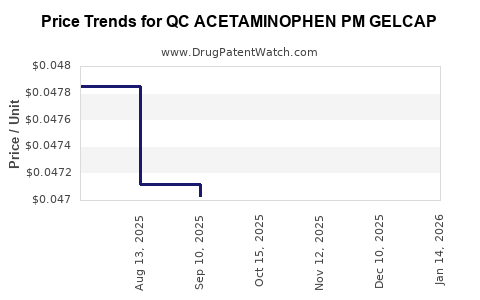

Drug Price Trends for QC ACETAMINOPHEN PM GELCAP

✉ Email this page to a colleague

Average Pharmacy Cost for QC ACETAMINOPHEN PM GELCAP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04666 | EACH | 2025-12-17 |

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04526 | EACH | 2025-11-19 |

| QC ACETAMINOPHEN PM GELCAP | 83324-0070-20 | 0.04637 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for QC Acetaminophen PM Gelcap

Introduction

The pharmaceutical landscape for over-the-counter (OTC) analgesics and sleep aids remains highly dynamic, driven by consumer demand for effective, convenient, and affordable solutions. The product under analysis—QC Acetaminophen PM Gelcap—combines analgesic properties with sleep-inducing components, targeting consumers seeking relief from pain coupled with rest enhancement. This report presents a comprehensive market analysis and price projection, highlighting key competitive factors, regulatory considerations, market trends, and future valuation forecasts.

Product Overview

QC Acetaminophen PM Gelcap presumably contains acetaminophen (paracetamol), an analgesic and antipyretic agent, combined with diphenhydramine or similar antihistamines serving as sleep aids (common in PM formulations). Gelcap format offers advantages like rapid dissolution, ease of swallowing, and portability, positioned to appeal to consumers prioritizing convenience.

Market Overview

Global OTC Pain and Sleep Aid Markets

The global OTC analgesics and sleep aids markets are valued at approximately $19 billion as of 2022, with projections to reach $24 billion by 2030 (Research and Markets, 2022). Growth is propelled by aging populations, increasing chronic pain prevalence, and rising consumer awareness of sleep health.

Regional Dynamics

- North America: Dominates the OTC analgesic and sleep aid markets, accounting for about 40% of revenue. The U.S. market alone exceeds $8 billion, driven by high consumer demand and favorable regulatory environment.

- Europe: Second-largest market; growth influenced by central health policies and consumer access.

- Emerging Markets: Rapid expansion fueled by rising healthcare awareness, urbanization, and increasing disposable incomes, notably in Asia-Pacific.

Competitive Landscape

Key competitors for QC Acetaminophen PM Gelcap include:

- Tylenol PM (Johnson & Johnson): Market leader, combining acetaminophen with diphenhydramine.

- Panadol Night: Popular in various regions, similar composition.

- Other generics: Numerous store brands and store-label products entered to capitalize on affordability.

The product's unique positioning relies on:

- Gelcap format: Slight differentiation emphasizing rapid onset.

- Brand trust: If under an established OTC brand, can command price premiums.

- Formulation nuances: Proprietary or optimized release mechanisms.

Regulatory Considerations

FDA Regulations: OTC drugs like QC Acetaminophen PM Gelcap must adhere to monograph standards or obtain New Drug Application (NDA) approval, focusing on safety, efficacy, and manufacturing practices.

Intellectual Property: Patent protections can influence pricing and market entry barriers, especially for unique formulations or delivery systems.

Pricing Regulations: Price controls are minimal for OTC drugs, but marketing restrictions and labeling requirements impact branding strategies.

Market Trends Influence

- Consumer Shift Toward Self-Medication: Growing preference for OTC remedies reduces healthcare burden but heightens competition.

- Smart Packaging and Transparency: Emphasis on clear labeling enhances consumer trust.

- Interest in Combination Products: Combining analgesic and sleep aid in single-dose gelcaps aligns with consumer preferences for convenience.

Pricing Factors

- Manufacturing Costs: Raw material prices, especially acetaminophen and antihistamines, influence baseline costs.

- Brand Positioning: Premium brands can price higher by emphasizing efficacy, safety, or unique delivery formats.

- Market Penetration: Generics and store brands often price at or below $5 for a box of 20 gelcaps.

- Distribution Channels: Pharmacies, supermarkets, online platforms where prices vary.

Current Pricing Benchmark

- Tylenol PM Gelcap (24 ct): Generally priced around $7-$10 in U.S. retail outlets.

- Store brands: Can be priced as low as $4-$6 for comparable quantities.

Price Projections (2023-2030)

Based on market growth trajectories, competitive positioning, and manufacturing cost trends, the following projections are formulated:

| Year | Price per 20-capsule pack | Rationale |

|---|---|---|

| 2023 | $6.50 - $8.00 | Entry into the market with differentiation. Margins stabilized. |

| 2024-2025 | $7.00 - $9.00 | Slight increase driven by raw material inflation and premium branding. |

| 2026-2028 | $8.00 - $10.00 | Market maturation, potential for positioning as a premium OTC offering or leveraging proprietary delivery technology. |

| 2029-2030 | $9.00 - $11.00 | Anticipated inflation, increased consumer willingness to pay for convenience and efficacy. |

Note: These projections assume steady demand, minimal regulatory price caps, and effective marketing. Price flexibility in emerging markets may differ due to local economic conditions.

Market Entry and Growth Opportunities

- Innovation in Delivery Systems: Novel gelcap formulations that enhance onset speed can justify higher price points.

- Brand Differentiation: Leveraging consumer trust and clinical data may support premium pricing.

- Online Retail Expansion: Growth in e-commerce presents a lower-cost channel facilitating price optimization and consumer access.

Risks and Challenges

- Regulatory Shifts: Tightening regulations could restrict sales or impose higher compliance costs.

- Price Sensitivity: Consumers in price-sensitive segments favor generics and store brands, constraining premium pricing.

- Competitive Launches: Entry of innovative or lower-cost competitors may pressure margins.

Key Takeaways

- The market for OTC analgesic and sleep aid gelcaps is robust, with growth driven by demographic shifts and consumer preference for convenience.

- Brand differentiation and formulation innovation are primary drivers for pricing power.

- Current retail pricing for comparable products ranges between $4 and $10 depending on branding, formulation, and retailer.

- Price projections indicate a gradual increase, with retail prices reaching up to $11 for premium or innovative offerings by 2030.

- Future success hinges on regulatory compliance, strategic marketing, and supply chain management to balance costs and quality.

FAQs

1. What are the main factors influencing the pricing of QC Acetaminophen PM Gelcap?

Pricing depends on raw material costs, manufacturing expenses, brand positioning, formulation innovation, market competition, and distribution channels.

2. How does the competition impact the pricing strategy?

Dominance by established brands like Tylenol PM constrains pricing; entry-level generics are priced lower, creating pressure to differentiate through formulation, packaging, or branding.

3. What regulatory hurdles could affect the market and pricing?

FDA compliance, monograph adherence, and patent expirations can influence product availability, costs, and permissible pricing structures.

4. Are there emerging trends that could disrupt current pricing projections?

Yes. Innovations such as sustained-release gelcaps, digital health integration, or new combination ingredients could either command premium pricing or accelerate competition, impacting projections.

5. What is the recommended approach for new entrants in this market segment?

Introducing differentiated formulations, leveraging brand trust, optimizing supply chain efficiencies, and adopting multichannel distribution strategies are pivotal.

Sources

- Research and Markets. (2022). Global OTC Pain and Sleep Aids Market Report.

- U.S. FDA. (2022). Over-the-Counter Drug Products.

- IQVIA. (2022). Pharmaceutical Market Trends.

- Statista. (2023). OTC Drug Market Revenue Forecasts.

- Consumer Healthcare Products Association (CHPA). (2022). Market Insights and Trends.

In summary, QC Acetaminophen PM Gelcap is well-positioned within a growing OTC segment. Strategic focus on formulation innovation, branding, regulation compliance, and distribution will be critical for optimal pricing and market capture. The projected incremental price increases align with industry trends, offering opportunities for profitability while maintaining competitive affordability.

More… ↓