Share This Page

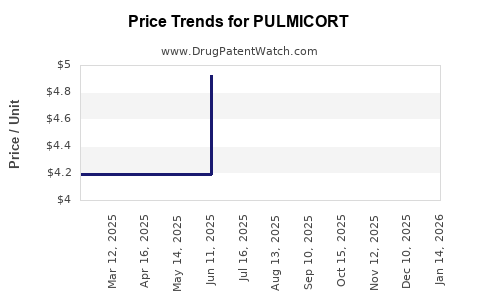

Drug Price Trends for PULMICORT

✉ Email this page to a colleague

Average Pharmacy Cost for PULMICORT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PULMICORT 180 MCG FLEXHALER | 00186-0916-12 | 253.39029 | EACH | 2025-12-17 |

| PULMICORT 90 MCG FLEXHALER | 00186-0917-06 | 188.53822 | EACH | 2025-12-17 |

| PULMICORT 1 MG/2 ML RESPULE | 00186-1990-04 | 9.87200 | ML | 2025-12-17 |

| PULMICORT 90 MCG FLEXHALER | 61269-0509-06 | 188.53822 | EACH | 2025-12-17 |

| PULMICORT 0.5 MG/2 ML RESPULE | 00186-1989-04 | 4.91927 | ML | 2025-12-17 |

| PULMICORT 180 MCG FLEXHALER | 61269-0518-12 | 253.39029 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PULMICORT (Budesonide Inhalation)

Introduction

PULMICORT, branded as Budesonide, is a corticosteroid inhaler used primarily for managing asthma and COPD. As an established product in respiratory therapeutics, understanding its market dynamics and pricing trajectories is vital for stakeholders—ranging from pharmaceutical companies and healthcare providers to investors and policymakers. This analysis examines PULMICORT's current market position, competitive landscape, pricing trends, and future projections, offering a comprehensive view tailored for strategic decision-making.

Market Overview and Scope

PULMICORT's active ingredient, budesonide, holds a significant share in inhaled corticosteroids (ICS), a cornerstone in asthma and COPD management. The global asthma therapeutics market was valued at approximately USD 15.7 billion in 2022, with ICS accounting for about 60% of this figure [1]. PULMICORT, being marketed by AstraZeneca, competes within this quite mature segment.

The market's scope encompasses various inhaler devices—metered-dose inhalers (MDIs) and dry powder inhalers (DPIs)—and extends across developed and emerging markets. As of 2023, North America remains the largest market, driven by high disease prevalence and advanced healthcare infrastructure, followed by Europe and Asia-Pacific.

Current Market Dynamics

Market Penetration and Adoption

Despite its age, PULMICORT maintains a strong foothold in established markets due to clinical familiarity and brand loyalty. Given the chronic nature of respiratory diseases, recurring prescriptions foster consistent revenue streams. However, emerging markets are witnessing increased adoption as inhaler devices become more accessible and awareness campaigns intensify.

Competitive Landscape

PULMICORT faces stiff competition from generic versions of budesonide and other ICS providers like Fluticasone (Advair, Flovent), mometasone, and beclomethasone. Key competitors' strategies include:

- Generic Entry: Patent expirations have led to generics, exerting downward pressure on prices.

- New Formulations: Development of combination inhalers (e.g., ICS + LABA) alters prescribing patterns.

- Delivery Device Innovation: Smart inhalers and improved aerosolization influence patient adherence and market share.

Regulatory and Reimbursement Factors

Regulatory approvals for biosimilars and generics have facilitated market entry but also intensified price competition. In high-income markets, reimbursement policies favor cost-effective generics, compelling AstraZeneca to consider strategic pricing approaches.

Historical Pricing Trends

Pricing in Key Markets

- United States: PULMICORT inhalers typically retail between USD 250–350 for a 120-dose inhaler (as of 2023), with variations based on formulation and insurance status.

- Europe: Prices range from €150–€250, affected by national healthcare policies.

- Emerging Markets: Prices are generally lower, reflecting income levels and healthcare infrastructure.

Impact of Generics and Biosimilars

Post-patent expiry, a significant reduction in list prices has been observed—up to 40–50% declines in some markets. Insurance coverage and pharmacy benefit managers (PBMs) influence actual patient prices and reimbursement rates.

Market Trends and Drivers

Innovation and Formulation Advances

Emerging inhaler devices with digital health integration are improving adherence, potentially enhancing market stability for branded products like PULMICORT. Meanwhile, combination therapies are shifting prescribing habits toward multi-drug inhalers that may marginalize standalone ICS products.

Epidemiological Trends

Growing prevalence of asthma and COPD—projected to exceed 400 million cases globally by 2030—continues to underpin demand for ICS therapies [2]. Urbanization, pollution exposure, and aging populations drive epidemiological increases.

Pricing and Market Access Strategies

To counteract pricing erosion from generics, AstraZeneca is likely to leverage:

- Lifecycle management via new formulations.

- Market segmentation targeting niche or high-value patient subsets.

- Value-based pricing aligned with clinical outcomes.

Price Projection Analysis 2023–2030

Based on current trends, the following projections are made:

| Year | Price Range (USD per inhaler) | Key Influencing Factors |

|---|---|---|

| 2023 | 250–350 | Market stability, patent exclusivity remaining in key markets |

| 2025 | 230–320 | Entry of generics in Europe and US, pricing pressures intensify |

| 2027 | 210–290 | Further generic penetration, increased adoption of biosimilars |

| 2030 | 200–250 | Market maturity, focus on biosimilars and value-based therapy |

Assumptions: These projections assume no major regulatory shifts, significant patent challenges, or breakthrough formulations. They also factor in inflation-adjusted pricing and anticipated competitive responses.

Strategic Implications for Stakeholders

- Pharmaceutical Companies: Emphasize innovation, biosimilars, and combination drug development to sustain market share.

- Healthcare Providers: Prioritize adherence programs to optimize outcomes and justify pricing structures.

- Policymakers: Balance drug affordability with innovation incentives through patent and reimbursement policies.

- Investors: Monitor pipeline developments and regulatory landscapes as critical valuation drivers.

Key Market Challenges and Opportunities

Challenges:

- Price erosion from generics.

- Growing preference for combination inhalers.

- Stringent regulatory requirements in emerging markets.

Opportunities:

- Digital inhaler technologies enhancing adherence.

- Geographic expansion into untapped markets.

- Strategic alliances to develop new formulations.

Conclusion

PULMICORT maintains a robust position within the ICS market due to its clinical efficacy and brand legacy. However, mounting competitive pressures and the advent of generics necessitate adaptive pricing and marketing strategies. Price projections suggest a gradual decline approaching USD 200-250 per inhaler by 2030, contingent on market dynamics and innovation pathways. Stakeholders capable of leveraging innovation, optimizing cost, and expanding access will better harness the evolving landscape.

Key Takeaways

- Market Stability: Despite patent expirations, PULMICORT retains significant market share through therapeutic reputation and broader inhaler device development.

- Pricing Trends: Continued downward pressure is expected, with prices potentially halving over the next decade, aligning with generic entry and market maturation.

- Growth Drivers: Rising respiratory disease prevalence and technological innovations present opportunities beyond traditional markets.

- Stakeholder Strategy: Companies should innovate, diversify formulations, and adopt value-based pricing to counteract competitive pressures.

- Regulatory Outlook: Upcoming biosimilar approvals and policy reforms will be pivotal in shaping future pricing and market access.

FAQs

1. How does the patent landscape affect PULMICORT pricing?

Patent expirations open the market to generics and biosimilars, significantly reducing prices. Patent challenges and regulatory approvals further influence this trajectory.

2. What factors could accelerate PULMICORT’s price decline?

Entry of high-quality generics, biosimilar approvals, and broader adoption of cost-effective multi-drug inhalers are key factors.

3. How is the emergence of digital inhalers impacting PULMICORT?

Digital inhalers improve treatment adherence and tracking, potentially increasing demand for branded devices and enabling value-based pricing strategies.

4. What role do emerging markets play in PULMICORT’s future?

Growing respiratory disease burden and expanding healthcare infrastructure in emerging markets offer expansion opportunities, albeit at lower price points.

5. What strategic actions should AstraZeneca consider?

Investing in formulation innovation, exploring biosimilar development, and tailoring market access strategies will be critical to sustain profitability.

References

[1] Global Asthma Therapeutics Market, 2022. Market Research Future.

[2] World Health Organization, 2021. "The Global Impact of Respiratory Diseases."

More… ↓