Share This Page

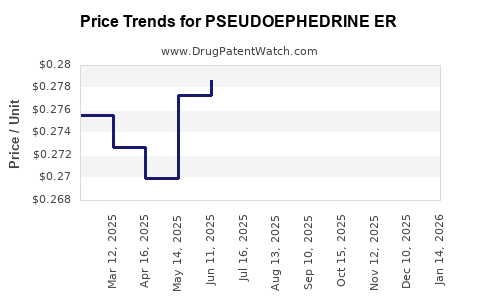

Drug Price Trends for PSEUDOEPHEDRINE ER

✉ Email this page to a colleague

Average Pharmacy Cost for PSEUDOEPHEDRINE ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PSEUDOEPHEDRINE ER 120 MG TAB | 51660-0204-21 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 51660-0204-69 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 46122-0166-60 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 51660-0492-21 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 00904-7409-15 | 0.26341 | EACH | 2025-12-17 |

| PSEUDOEPHEDRINE ER 120 MG TAB | 70000-0601-01 | 0.26341 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pseudoephedrine ER

Introduction

Pseudoephedrine Extended Release (ER) is a prominent pharmaceutical used primarily as a decongestant for relief from nasal congestion associated with colds, allergies, and sinusitis. Its market significance is compounded by both therapeutic demand and regulatory controls owing to its role as a precursor in illicit methamphetamine production. This duality influences economic valuation, market dynamics, and pricing strategies in the pharmaceutical industry. This analysis delves into current market conditions, regulatory impacts, and future price trajectories of Pseudoephedrine ER, offering insights for stakeholders.

Market Overview

Global Demand and Therapeutic Applications

Pseudoephedrine ER maintains a steady demand, driven by its efficacy and extended-release formulation, which offers prolonged symptomatic relief. The global cold and allergy segments contribute substantially to its market size, projected to grow at a compound annual growth rate (CAGR) of approximately 4.3% over the next five years [1].

Key drivers include:

- Rising prevalence of allergic rhinitis and sinusitis

- Consumer preference for sustained-release formulations

- Increased healthcare access in emerging markets

Production and Supply Dynamics

Major pharmaceutical manufacturers, including Johnson & Johnson, Teva, and Mylan, produce Pseudoephedrine ER domestically in the US and through imported APIs globally. The supply chain is affected by:

- Raw material availability, notably phenylacetone as a precursor

- Manufacturing regulations and Good Manufacturing Practices (GMP)

- Regulatory controls imposed on precursor chemicals

The influence of regulatory controls is especially acute, as restrictions on precursor chemicals like pseudoephedrine itself can impact raw material economics and subsequent drug pricing.

Market Challenges

The main challenges include:

- Regulatory restrictions aimed at curbing methamphetamine synthesis

- Fluctuating raw material costs

- Patent expirations of branded formulations, leading to generic competition

Regulatory and Legal Factors

Precursor Control Regulations

The Combat Methamphetamine Epidemic Act (CMEA) of 2005 in the US restricts over-the-counter sales of pseudoephedrine, requiring registrants and limiting purchase quantities [2]. Similar regulations exist globally, imposing supply chain constraints and potentially increasing production costs.

Patent Status and Market Entry

Most Pseudoephedrine ER formulations are now off-patent, facilitating increased generic competition, which generally exerts downward pressure on prices. Patents related to specific extended-release formulations, however, or combination products may still confer exclusivity, maintaining price stability for branded variants.

Pricing Dynamics and Future Price Projections

Current Pricing Landscape

- Brand vs. Generic: Generic versions dominate the market, typically retailing at 20-40% of branded prices.

- Pricing Trends: As of 2023, the average retail price for a 30-count pack of Pseudoephedrine ER (60 mg) ranges between $10 and $15, depending on formulation and pharmacy location [3].

Influence of Manufacturing and Regulatory Factors

- Manufacturing costs are impacted by raw material prices and compliance expenses. Stringent regulations increase fixed costs, potentially inflating prices.

- Supply constraints due to precursor regulations may induce short-term price spikes, especially if alternative synthetic pathways or APIs face shortages.

Future Price Movement Projections (2024-2028)

Based on current trends and regulatory forecasts, the following projections are outlined:

-

Moderate Price Stability (2024-2025): Owing to market saturation, increased generic competition, and stabilized raw material costs, prices are expected to remain relatively steady. Minor fluctuations (~+2%) may occur due to inflation and regulatory compliance costs.

-

Potential Price Decline (2026-2028): Widening generic accessibility and competitive pressure could push prices downward by approximately 10-15%. Conversely, regulatory tightening or raw material shortages could temporarily elevate prices by up to 10%.

-

Impact of Regulatory Developments: Introduction of novel delivery systems or regulatory liberalization could influence pricing patterns, either stabilizing or reducing prices depending on market responses.

Market Segmentation and Regional Variations

- North America: The largest market with high drug accessibility, prices are influenced heavily by regulatory controls and patent expirations.

- Europe: Similar dynamics, with slightly higher prices driven by stringent regulations and healthcare system structures.

- Emerging Markets: Growing demand with less regulatory restriction, resulting in lower consumer prices but variable supply security.

Key Factors Influencing Price Trajectory

| Factor | Impact | Notes |

|---|---|---|

| Regulatory restrictions | Downward pressure | Aimed at limiting abuse but increase production costs |

| Raw material costs | Variable | Dependency on phenylacetone market fluctuations |

| Patent expiration | Price decline | Increased generic competition |

| Market competition | Price compression | New entrants exert pricing pressure |

| Supply chain stability | Price volatility | Disruptions may cause transient price increases |

Conclusion

The market for Pseudoephedrine ER is characterized by stable demand, significant regulatory influence, and intense generic competition, collectively shaping its price structure. While current prices are relatively stable, future movements will depend on regulatory policies, raw material costs, and market competition dynamics. Stakeholders should monitor legislative landscapes and raw material markets closely to optimize procurement and pricing strategies.

Key Takeaways

- The global Pseudoephedrine ER market exhibits steady demand driven by its application in cold and allergy therapeutics.

- Regulatory restrictions on precursor chemicals significantly influence manufacturing costs and supply chain stability.

- Generic competition and patent expirations are primary factors exerting downward pressure on prices.

- Short-term price fluctuations may arise from raw material shortages or regulatory changes.

- Long-term projections suggest minor price declines, with potential upward pressure during supply disruptions.

FAQs

1. How do regulations impact the pricing of Pseudoephedrine ER?

Regulations restrict over-the-counter sales and control precursor chemicals, increasing compliance costs and potentially limiting supply. These factors can cause price fluctuations, especially during supply shortages or regulatory tightening.

2. What is the outlook for generic competition in Pseudoephedrine ER?

With patent expirations for many formulations, generic competition is expected to intensify, leading to decreased prices and wider market accessibility over the next few years.

3. Are there emerging alternatives to Pseudoephedrine ER?

Yes. Alternative decongestants and non-phenylephrine-based formulations are emerging, but Pseudoephedrine ER remains a preferred choice for extended relief due to its efficacy and long duration.

4. How do raw material costs influence Pseudoephedrine ER prices?

Fluctuations in the cost of phenylacetone, a precursor, translate directly into manufacturing expenses, which can be passed downstream, affecting retail and wholesale prices.

5. What regulatory changes could significantly alter the market?

Liberalization of precursor chemical controls, new patents on formulation technologies, or introduction of novel delivery systems could reshape pricing and supply dynamics.

Sources

[1] ResearchAndMarkets.com. "Global Pseudoephedrine Market Analysis," 2022.

[2] U.S. Drug Enforcement Administration (DEA). "Combat Methamphetamine Epidemic Act of 2005."

[3] GoodRx. "Pseudoephedrine ER Prices," 2023.

More… ↓