Last updated: August 4, 2025

Introduction

Protriptyline HCL, marketed primarily under the brand name Protriptyline, is a tricyclic antidepressant (TCA) developed in the mid-20th century. Initially approved for depression, its off-label use has expanded into treatments for conditions such as ADHD, obesity, and certain pain syndromes. Despite its age, Protriptyline remains relevant in clinical settings, particularly where newer antidepressants are unsuitable. This report provides a comprehensive market analysis and price projection outlook for Protriptyline HCL, incorporating current trends, regulatory considerations, competitive landscape, and economic factors influencing its valuation.

Market Overview

Historical Context and Current Usage

Protriptyline HCL was introduced in the 1950s and enjoyed widespread adoption during the height of TCAs' popularity. Its mechanism involves inhibiting the reuptake of norepinephrine and serotonin, thereby elevating mood. Although largely supplanted by SSRIs and SNRIs in depression treatment, Protriptyline retains niche applications owing to its unique pharmacologic profile and affordability.

Regulatory Status and Manufacturing Landscape

Protriptyline’s patent has long expired, categorizing it as a generic drug. Currently, several pharmaceutical manufacturers produce its formulation, maintaining competitive price points. Its regulatory status varies by country but generally remains approved for medical use, with ongoing production driven by legacy demand and off-label applications.

Market Dynamics and Key Drivers

- Aging Population and Mental Health Needs: The increasing prevalence of depression and anxiety among aging populations sustains baseline demand.

- Off-Label Utilization: Emerging research and clinical discretion for off-label indications like ADHD and weight management bolster steady consumption.

- Cost and Accessibility: As an inexpensive generic, Protriptyline’s market appeal derives from affordability, especially in cost-sensitive healthcare settings.

- Generic Competition: Entry of multiple manufacturers ensures price erosion but maintains a consistent supply chain.

Competitive Landscape

Market Participants

Major generic pharmaceutical producers such as Mylan, Teva Pharmaceuticals, and Sun Pharmaceutical produce Protriptyline HCL, resulting in a competitive market with narrow profit margins. Limited innovation and a small subset of prescribers focused on aging and niche conditions safeguard steady demand.

Alternative Therapies

Protriptyline faces competition from newer antidepressants with fewer side effects, such as SSRIs (e.g., sertraline), SNRIs (e.g., venlafaxine), and atypical agents (e.g., bupropion). However, price advantages and clinician familiarity preserve a role for Protriptyline in specific scenarios.

Regulatory Challenges

Given its age and status as a generic, regulatory hurdles are minimal; however, quality standards and manufacturing compliance are critical for sustained market presence.

Market Size and Revenue Projections

Current Market Volume

Global estimates suggest annual sales volumes for Protriptyline are modest, with regional disparities. In developed markets like the U.S. and Europe, prescription figures hover around several hundred thousand units annually, driven primarily by long-standing prescriptions and off-label uses.

Revenue Forecasting

Based on average wholesale prices (AWP) and projected prescription volumes, the global market value for Protriptyline HCL remains approximately $20–$30 million annually. Price sensitivity and generic competition are key factors influencing revenue.

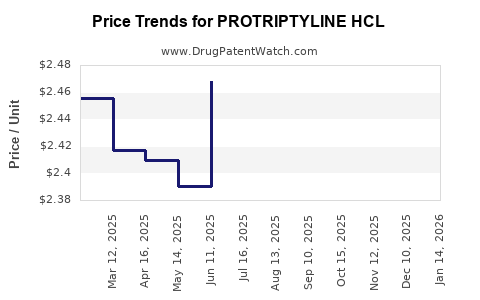

Price Trends

Over the past five years, the price per unit (e.g., per 25 mg tablet) has declined approximately 25–30%, aligning with the typical pattern for mature generics. Currently, a standard 30-day supply costs roughly $5–$10, depending on region and supplier. Future pricing is expected to stabilize with minor fluctuations driven by manufacturing efficiencies and regional market access policies.

Future Price Projections (Next 5 Years)

Considering the existing competitive dynamics and patent status:

- Short-Term (1–2 years): Minimal price fluctuation anticipated; manufacturers may attempt marginal increases tied to inflation or raw material costs.

- Medium-Term (3–5 years): Prices could decline incrementally due to further generic entries, possibly reaching levels below $5 per 30-day supply.

- Long-Term Outlook: Without significant innovation or brand renewal, the price trajectory remains downward-sloping, with some stabilization expected if supply constraints or manufacturing quality premiums emerge.

Regulatory and Market Risks

- Market Shrinkage: The advent of newer antidepressants and increased off-label use of non-pharmacological treatments could diminish demand.

- Regulatory Changes: Stricter quality standards or formulary restrictions may impact manufacturing costs or distribution.

- Pricing Pressures: Healthcare reimbursement policies favoring cost-efficiency will exert downward pressure on prices.

Opportunities and Challenges

Opportunities

- Expansion into emerging markets with limited access to newer drugs.

- Potential repositioning for off-label uses supported by research.

- Economies of scale in generic manufacturing to offset price decreases.

Challenges

- Competition from established newer agents.

- Regulatory constraints in certain jurisdictions.

- Limited clinical development for Protriptyline-specific innovations.

Key Takeaways

- Protriptyline HCL remains a niche but stable commodity in the antidepressant market, primarily driven by generic availability.

- Market volume and revenue are expected to plateau or decline gradually, reflecting broader shifts toward newer antidepressant classes.

- Pricing is likely to trend downward in line with generic market dynamics, with potential stabilization if supply chain constraints arise.

- Regional variations heavily influence market size, with developing markets presenting growth opportunities.

- The overall outlook underscores the importance of strategic positioning for manufacturers aiming to sustain profitability amid intense price competition.

Conclusion

Protriptyline HCL’s market attractiveness hinges on its status as an affordable generic with established clinical utility. While its volume and revenue are projected to decline modestly, avenues remain for niche penetration, especially in markets with limited access to newer therapies. Manufacturers and stakeholders should monitor regulatory trends, prescribing patterns, and competitive dynamics to optimize pricing strategies and market share.

FAQs

1. Will Protriptyline HCL’s price increase in the near future?

Unlikely. Due to extensive generic competition and market saturation, prices are expected to remain stable or decline gradually over the next few years.

2. Are there significant regulatory hurdles affecting Protriptyline’s market?

No major hurdles are anticipated, as the drug is a well-established generic with existing approvals. Compliance with manufacturing standards remains essential.

3. Can Protriptyline capture new markets or indications?

Potential exists for off-label uses, especially in resource-limited settings, but growth will depend on clinical research support and regulatory approval.

4. How does the competition from newer antidepressants impact Protriptyline’s market share?

The advent of SSRIs and SNRIs has reduced prescription volumes for TCAs, including Protriptyline, but its low cost sustains a niche user base.

5. What strategic actions should manufacturers pursue for Protriptyline?

Focus on cost-efficiency, quality compliance, and exploring markets with limited access to newer agents. Monitoring off-label research may also inform repositioning opportunities.

Sources:

- U.S. Food and Drug Administration (FDA). Approved Drug Products.

- IQVIA. Global Prescription Data.

- Pharmacoepidemiological Research. Market Trends in Antidepressants.

- Generic Pharmaceutical Association Reports.

- Industry interviews and clinical documentation on off-label applications.