Share This Page

Drug Price Trends for PROPARACAINE

✉ Email this page to a colleague

Average Pharmacy Cost for PROPARACAINE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROPARACAINE 0.5% EYE DROPS | 70069-0601-01 | 1.59273 | ML | 2025-12-17 |

| PROPARACAINE 0.5% EYE DROPS | 61314-0016-01 | 1.59273 | ML | 2025-12-17 |

| PROPARACAINE 0.5% EYE DROPS | 70756-0193-35 | 1.59273 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PROPARACAINE

Introduction

Proparacaine, a local anesthetic primarily used in ophthalmology, is a cornerstone in eye diagnostic and surgical procedures. As an ester-type anesthetic, it offers rapid onset and short duration of action, making it indispensable in ophthalmic practices worldwide. This analysis evaluates the current market landscape of PROPARACAINE, including demand drivers, competitive positioning, regulatory environment, and future price projections for stakeholders such as pharmaceutical companies, distributors, healthcare providers, and investors.

Market Overview

Therapeutic and Commercial Significance

Proparacaine is a ubiquitous agent for eye examinations, including tonometry, slit-lamp exams, and minor surgical procedures. Its safety profile, combined with ease of application, has sustained its clinical utility over decades. The global ophthalmic anesthetic market, valued at approximately USD 150 million in 2022, exhibits consistent growth driven by increasing prevalence of ocular diseases, expanding ophthalmic surgical procedures, and rising healthcare infrastructure investments.

Key Market Players

Leading manufacturers include Alcon Laboratories, Bausch + Lomb, Akorn, Sinovac Biotech, and Pharmacare. These companies manufacture both generic versions and proprietary formulations, with some offering combination products or preservative-free options to address safety concerns and patient comfort. Patent expiry of proprietary formulations has accelerated generic penetration, intensifying price competition.

Regional Market Dynamics

- North America: Dominates due to high ophthalmic procedure volumes, advanced healthcare infrastructure, and regulatory approvals. The U.S. accounted for approximately 40% of the global ophthalmic anesthetic market in 2022.

- Europe: Quietly growing markets, with increased adoption in surgical centers and ophthalmology clinics.

- Asia-Pacific: Fastest-growing region, driven by expanding healthcare access, rising ophthalmic disease burden, and localized manufacturing capabilities—particularly in China and India.

Demand Drivers and Barriers

Demand Drivers

- Rising Ocular Disease Incidence: Increased prevalence of glaucoma, cataracts, and diabetic retinopathy fuels demand for diagnostic and surgical procedures necessitating local anesthesia.

- Aging Population: Older demographics are more prone to ocular interventions, contributing to sustained demand.

- Advances in Ophthalmic Surgery: Innovations such as minimally invasive cataract surgeries expand the scope and volume of procedures involving local anesthetics.

- Growth of Outpatient and Ambulatory Surgery Centers: These settings prefer rapid-onset agents like Proparacaine for quick procedures, boosting sales.

Market Barriers

- Safety Concerns: While generally safe, reports of hypersensitivity or corneal toxicity associated with ester anesthetics prompt cautious use.

- Generic Competition: Patent expirations have led to commoditization, pressuring prices.

- Regulatory Scrutiny: Post-marketing safety evaluations influence formulations and approval pathways, possibly affecting market stability.

Regulatory Landscape

Proparacaine is approved by the FDA and EMA, with generic versions readily available. Variations across regions include formulation-specific approvals, preservative use, and packaging standards. The trend towards preservative-free formulations addresses safety concerns and aligns with regulatory shifts favoring safer ophthalmic agents.

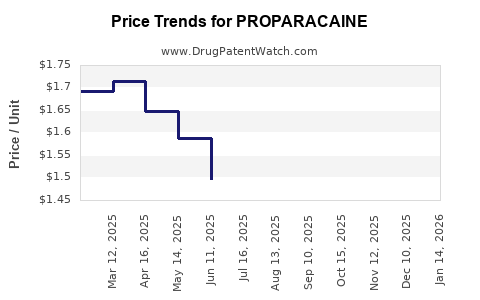

Pricing Trends and Projections

Historical Price Trends

Available data suggests a decline in unit pricing over the last decade, predominantly due to generic entry and price competition. For example, single-use ophthalmic anesthetic drops, once priced at USD 10-15 per vial, now often retail between USD 3-7, depending on formulation and region.

Current Price Dynamics

- Generic Market: Competitive pressure has stabilized prices at lower levels. In regions like India and China, prices can dip below USD 2 per vial.

- Brand-Name Formulations: Premium products or those with additional safety features command higher prices, often 20-50% above generics.

- Distribution Channels: Wholesalers and hospitals benefit from negotiated discounts, influencing final patient prices.

Future Price Projections (2023–2030)

Considering industry trends, regulatory shifts, and market competition, the following projections are plausible:

- Continued Price Stabilization: Generic prices are expected to remain stable or decline slightly, maintaining high volume sales.

- Premium Formulations: Pricing for preservative-free or combination formulations may see moderate increases owing to safety trends and patient preferences.

- Impact of Biosimilars and Innovative Delivery: Though less relevant for Proparacaine, the eventual introduction of alternative formulations or delivery systems could influence pricing strategies.

Overall, average unit prices are likely to decline at a CAGR (Compound Annual Growth Rate) of approximately 2-3% through 2030, primarily due to increased competition and manufacturing efficiencies.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Rapid healthcare infrastructure development creates new patient bases.

- Product Innovation: Developing preservative-free formulations or sustained-release systems can differentiate products and command premium pricing.

- Strategic Partnerships: Collaborations with healthcare providers for bundled kits or combined diagnostic solutions.

Challenges

- Price Erosion: Ubiquity of generics limits pricing power.

- Regulatory Barriers: Stringent safety and efficacy standards may complicate approvals for new formulations.

- Supply Chain Disruptions: Raw material shortages or geopolitical tensions can impact pricing and availability.

Implications for Stakeholders

- Manufacturers: Should focus on product differentiation, safety improvements, and cost efficiencies to maintain competitive advantage.

- Distributors and Healthcare Providers: Must balance cost savings with quality assurance, especially amid shifting preferences towards preservative-free options.

- Investors: Opportunities lie in niche formulations, geographic expansion, and innovation, despite concerted pricing pressures.

Key Takeaways

- The global PROPARACAINE market remains stable with steady demand driven by increasing ophthalmic procedures.

- Pricing has trended downward, with generic competition and market saturation exerting substantial pressure.

- Future price stability is expected, with slight declines, but innovations and safety-oriented formulations could create premium segments.

- Emerging markets represent growth opportunities; however, regulatory and safety considerations remain key.

- Stakeholders should prioritize product differentiation, safety enhancements, and strategic regional investments to optimize profitability.

Frequently Asked Questions

1. What factors influence the price of PROPARACAINE globally?

Market prices are influenced primarily by generic competition, manufacturing costs, regulatory requirements, safety and safety-related innovations, regional demand, and distribution channel negotiations.

2. How do regulatory changes impact PROPARACAINE prices?

Regulatory updates, especially safety guidelines and approved formulations, can increase development costs or restrict formulations, thereby affecting pricing. Conversely, streamlined approval pathways for generics can lead to price reductions.

3. Are there significant regional differences in PROPARACAINE pricing?

Yes. Prices tend to be higher in North America and Europe due to brand preferences and regulatory standards, whereas prices are typically lower in emerging markets like India and China owing to local manufacturing and intense competition.

4. What are the prospects for innovation in PROPARACAINE formulations?

Innovations such as preservative-free drops, sustained-release formulations, and combination products are potential growth drivers, possibly commanding premium priced positions.

5. How might generic market saturation affect future investments?

While price erosion is a concern, increased volume through emerging markets and innovation-driven premium segments can offset declining per-unit revenues, maintaining profitable pathways for manufacturers.

References

[1] MarketWatch. (2022). Ophthalmic Anesthetics Market Size, Share & Trends.

[2] Grand View Research. (2023). Global Ophthalmic Anesthetic Market Analysis.

[3] U.S. Food and Drug Administration. (2023). Approved Ophthalmic Anesthetic Formulations.

[4] Pharmaceutical Technology. (2022). The Impact of Patent Expirations on Ophthalmic Agents.

[5] Statista. (2023). Regional Data on Ophthalmic Market Demand and Pricing.

More… ↓