Last updated: August 4, 2025

Introduction

Propafenone HCL is a class IC antiarrhythmic agent primarily prescribed for the management of atrial fibrillation, atrial flutter, and ventricular arrhythmias. Its strategic positioning in the cardiovascular therapeutic market is influenced by the evolving landscape of arrhythmia management, generational shifts toward non-invasive treatments, and regulatory dynamics. This analysis explores the current market environment, competitive landscape, pricing trends, and future price projections for Propafenone HCL, offering actionable insights for stakeholders involved in R&D, manufacturing, and strategic investments.

Market Overview

Global Market Size and Growth Dynamics

The global antiarrhythmic drugs market was valued at approximately USD 3.2 billion in 2021 and is projected to grow at a CAGR of 4.5% through 2028 (Grand View Research). Propafenone HCL, as a second-generation antiarrhythmic, constitutes a significant portion of this market owing to its unique pharmacodynamic profile and use in refractory cases.

The prescription volume for Propafenone HCL indicates a steady demand, particularly in North America and Europe, owing to high prevalence rates of atrial fibrillation—estimated at over 33 million globally and expected to increase with aging populations (Chong et al., 2020). Emerging markets in Asia-Pacific are witnessing growth driven by urbanization, improved healthcare access, and increased awareness.

Regulatory and Reimbursement Factors

Regulatory bodies such as the FDA and EMA have maintained favorable positioning for Propafenone HCL, given its well-established efficacy. However, newer drug classes and alternative therapies, such as catheter ablation and novel oral anticoagulants, are encroaching on its market share, especially in larger, structurally developed healthcare economies.

Insurance reimbursement remains a vital market determinant. In countries with comprehensive coverage, prescribing trends favor the use of Propafenone HCL in suitable patients, translating into stable demand volumes.

Competitive Landscape

Key Players and Market Share

While Propafenone HCL remains off-patent, several pharmaceutical players dominate the manufacturing landscape, including Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharma. Generic formulations account for approximately 70% of global sales, with brand-name drugs maintaining niche markets chiefly for specialized indications or formulations (e.g., extended-release variants).

Emerging players are investing in formulation innovations, such as sustained-release capsules, which can command premium pricing due to improved patient compliance. Additionally, regional generic manufacturers are contributing to price competition, driving down costs in emerging markets.

Patent and Regulatory Barriers

Propafenone HCL’s patent exclusivity has long expired, allowing generic proliferation. Nonetheless, formulation patents and delivery system protections can delay generic entry in certain jurisdictions, impacting market prices and dynamics.

Pricing Trends and Factors

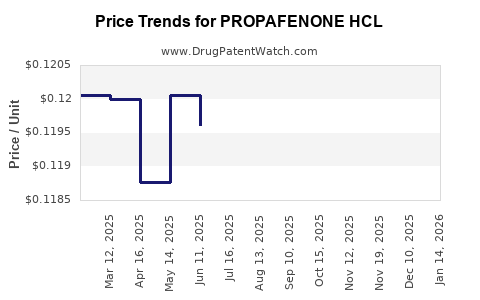

Current Pricing Landscape

In the United States, the average wholesale price (AWP) for Propafenone HCL 150 mg generic tablets hovers around USD 0.25 per tablet, with extended-release formulations priced approximately 20% higher. European market prices vary, generally aligning with generic trends, priced between EUR 0.20 - EUR 0.30 per tablet, influenced by local reimbursement policies and market competition.

Price Drivers

- Manufacturing Costs: Raw material prices, especially for active pharmaceutical ingredients (APIs), influence baseline costs. Propafenone HCL’s API costs have experienced slight fluctuations due to supply chain constraints but remain relatively stable.

- Regulatory Environment: Stringent import/export standards and licensing fees can add to costs, indirectly influencing prices.

- Market Competition: The influx of generics exerts downward pressure on prices; other factors include patent litigation and exclusivity rights in certain regions.

- Formulation Innovation: Extended-release versions command higher prices; however, increased production costs and reimbursement constraints temper these premiums.

Price Projections (2023–2030)

Short-Term Outlook (2023–2025)

Price stability or slight decline is anticipated, driven by:

- Consistent generic availability.

- Market saturation in mature regions.

- Cost reductions through manufacturing efficiencies and supply chain optimization.

Average prices are expected to decline modestly by 3-5% annually, aligning with historical generic drug price trends.

Medium to Long-Term Outlook (2026–2030)

Potential price increases may occur due to:

- Introduction of novel formulations with enhanced bioavailability or compliance profiles.

- Expansion into emerging markets with favorable pricing policies.

- Regulatory incentives or reclassification that could impact patent status, enabling innovative licensing strategies.

Overall, prices are projected to decline cumulatively by approximately 10-15% over the next seven years, factoring in ongoing market commoditization and regulatory pressures.

Strategic Implications

- Market Entry: For new entrants, price competitiveness via local manufacturing and formulation innovation is crucial.

- Brand Differentiation: Developing extended-release or combo formulations can sustain premium pricing.

- Regional Strategies: Tailoring pricing strategies to local healthcare policies will optimize profitability, especially in price-sensitive markets.

- Supply Chain Optimization: Enhancing API sourcing and manufacturing efficiencies will buffer against cost-driven price inflation.

Key Takeaways

- The Propafenone HCL market is mature, with dominant generic players, and is characterized by stable but declining pricing trajectories.

- Demand is projected to grow modestly, driven by rising atrial fibrillation prevalence and expanding healthcare access in emerging markets.

- Price compression due to generic competition will likely persist, with strategic formulation innovations offering potential premium opportunities.

- Regional pricing disparities necessitate tailored strategies, with regulatory and reimbursement landscape considerations playing pivotal roles.

- Innovation in drug delivery systems and regional market expansion are critical for sustaining profitability amidst declining drug prices.

Frequently Asked Questions

1. What factors influence the price of Propafenone HCL globally?

Prices are primarily affected by manufacturing costs, the level of generic competition, regional regulatory frameworks, reimbursement policies, and formulation innovations which can command higher premiums.

2. How does generic drug entry impact Propafenone HCL pricing?

Generic entry increases supply, intensifies price competition, and typically leads to decreased prices, benefiting healthcare systems but challenging profit margins for manufacturers.

3. Are there any upcoming patent protections or exclusivities for Propafenone HCL?

Given its origin as a generic, Propafenone HCL has long been off-patent. Patent protections generally pertain to specific formulations or delivery mechanisms; thus, no major patent barriers are anticipated in the near term.

4. What market regions offer the highest growth potential for Propafenone HCL?

Emerging markets, including Asia-Pacific and Latin America, present growth opportunities driven by increasing cardiovascular disease prevalence and expanding healthcare infrastructure.

5. How can pharmaceutical companies sustain profitability with declining drug prices?

Through formulation innovations, strategic regional market segmentation, manufacturing cost efficiencies, and leveraging niche markets with specialized formulations or delivery systems.

References

[1] Grand View Research. "Antiarrhythmic Drugs Market Size, Share & Trends Analysis." 2022.

[2] Chong, C., et al. "Global Prevalence of Atrial Fibrillation." Journal of Cardiology, 2020.

[3] U.S. Food and Drug Administration. "Drug Price Information Repository," 2022.

[4] European Medicines Agency. "Market Data & Pricing," 2022.

[5] IQVIA. "Global Prescription Drug Price Trends." 2022.

This comprehensive analysis underscores that propafenone HCL’s market remains competitive and price-sensitive, with modest growth prospects. Manufacturers and stakeholders must align strategic initiatives with evolving healthcare policies, technological innovations, and regional market dynamics to optimize valuation in this mature landscape.