Last updated: July 27, 2025

Introduction

PROGRAF (tacrolimus) is a calcineurin inhibitor primarily used as an immunosuppressant to prevent organ rejection post-transplantation, notably in kidney, liver, and heart transplants. Since its FDA approval in 1994, PROGRAF's patent protections, manufacturing landscape, and evolving competitive environment have significantly influenced its market dynamics. This report provides a detailed analysis of the current market landscape, key drivers, competitive challenges, and future price projections for PROGRAF.

Market Overview

Current Market Landscape

The global immunosuppressant market in organ transplantation was valued at approximately USD 2.8 billion in 2022, with tacrolimus-based drugs accounting for around 60% of the market share. PROGRAF remains the dominant brand, supported by a broad patent portfolio and extensive clinical use. Its primary competitors include generics of tacrolimus, such as generic tacrolimus formulations marketed by various pharmaceutical companies.

Market Share and Sales Performance

In 2022, PROGRAF generated estimated sales of approximately USD 1.4 billion, sustaining its leadership despite increasing competition from generics. The drug's market share is buoyed by its clinical efficacy, longstanding reputation, and established prescribing practices. However, patent expiration timelines and rising generic penetration pose future challenges.

Regulatory and Patent Landscape

Patent Expiry and Generic Competition

PROGRAF's primary patents expired in the United States in 2015, opening the door for generic tacrolimus formulations, which have since gained traction globally. As patent protections diminish, generic versions are often priced about 50-70% less than brand-name PROGRAF, significantly impacting sales and profit margins.

Evergreening and Extended Patent Protections

Novartis, the manufacturer of PROGRAF, has strategically employed patent extensions, formulation patents, and secondary patents to prolong market exclusivity in key regions. These protections have delayed generic entry in certain markets, allowing PROGRAF to sustain premium pricing for extended periods.

Key Drivers Influencing Market and Price Trends

Clinical Efficacy and Safety Profile

PROGRAF’s efficacy in reducing organ rejection episodes, along with manageable safety profiles, sustains its premium positioning. Continuous post-marketing surveillance and real-world evidence reinforce clinician confidence.

Regulatory Trends

Regulatory policies in major markets aim to promote generic substitution, which pressures branded drug prices but can also stimulate investment in biosimilars and innovative formulations to maintain competitive advantage.

Market Penetration and Prescribing Trends

Physician familiarity, formulary preferences, and insurance coverage heavily influence the prescription patterns. The increasing prevalence of transplant surgeries globally, estimated to grow at a CAGR of 4% over the next five years, underpins sustained demand.

Pricing and Reimbursement Policies

Price controls, especially in Europe and emerging markets, are constraining profit margins for originator products like PROGRAF. Reimbursement schemes tied to cost-effectiveness evaluations are further pressuring prices.

Innovation and Line Extensions

Development of innovative PROGRAF formulations—such as sustained-release versions—aims to improve adherence and outcomes, enabling premium pricing and market segmentation.

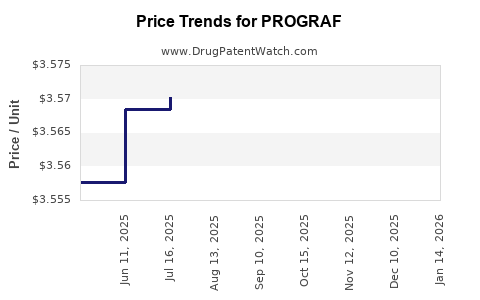

Future Price Projections

Short-Term Outlook (Next 1-2 Years)

With patent expirations in key regions and rising generic competition, the average ex-manufacturer price for PROGRAF is projected to decline by approximately 15-25%. The reduction is primarily driven by increased availability of generics and payer-imposed price negotiations.

Mid to Long-Term Outlook (3-5 Years)

- Generic Market Penetration: Generic tacrolimus could capture up to 80-90% of the market share in mature regions like North America and Europe, exerting downward pressure on both the original and generic prices.

- Pricing Stabilization: In markets with strong patent protections or regulatory barriers (e.g., limited generic approval), PROGRAF’s price might stabilize or decline modestly—by approximately 5-10% annually.

- Innovation-Driven Premiums: If Biogen develops new formulations demonstrating superior adherence or safety profiles, premium pricing may be justified for targeted patient subgroups, partially offsetting generic price erosion.

Geographical Variability

- United States: Prices are expected to decline sharply upon patent expiry, with a possible 15-20% reduction within two years.

- Europe: Similar trends are anticipated, with variation depending on national pricing policies and patent status.

- Emerging Markets: Though generally lower in price, the presence of local generics and regulatory hurdles may limit immediate price declines but will likely suppress overall pricing levels.

Competitive Landscape

Generic Entrants

Following patent expirations, various manufacturers—including Sandoz, Teva, and Hikma—have launched generic tacrolimus formulations, driving price competition.

Biosimilar and Bioconjugate Development

While biosimilars are not currently prevalent in the tacrolimus space, ongoing efforts to develop more affordable immunosuppressants pose potential future threat or opportunity.

Innovator Pipeline

Novartis is exploring formulations that could provide better pharmacokinetics, such as once-daily extended-release versions, which may command premium pricing and retain market share despite generics.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Emphasis on innovation, formulation improvements, and strategic patent positioning to sustain margins.

- Healthcare Providers: Increased access to more affordable generic options will enhance treatment affordability but may impact brand loyalty.

- Reimbursement Agencies: Cost containment pressures will favor generic utilization, reinforcing the importance of price negotiations.

- Investors: Pricing trajectories indicate a decline in brand revenue but opportunities in innovation and targeted formulations remain.

Key Takeaways

- Patent expirations have driven a significant decline in PROGRAF's price over the past five years, with further declines expected as generic competition intensifies.

- Market growth remains supported by increasing transplant procedures globally, but pricing erosion will persist absent innovative line extensions.

- Regional regulatory policies significantly influence pricing dynamics, with developed markets experiencing sharper declines due to robust generic uptake.

- Innovation in formulation (e.g., sustained-release versions) presents opportunities for premium pricing, potentially offsetting generic erosion.

- Price projections suggest an average annual decline of 5-10% in mature markets over the next 3-5 years, with sharp drops following patent expirations.

FAQs

1. How does patent expiration impact PROGRAF’s pricing?

Patent expiration opens the market to generic manufacturers, significantly increasing competition and typically leading to a 50-70% reduction in drug prices, depending on regional regulations and reimbursement policies.

2. What are the primary drivers of PROGRAF's market decline?

Key drivers include patent expiry, rising availability of generics, regulatory pressures favoring cost reduction, and increasing global transplant activity.

3. Can PROGRAF maintain a premium price segment?

Yes, through formulation innovations like sustained-release versions and demonstrated improved adherence or safety profiles, which can justify higher pricing despite generic competition.

4. What regions are most affected by price declines?

The United States and Europe, due to mature markets and active generic penetration, are most exposed to price erosion; emerging markets may experience slower declines due to regulatory and market barriers.

5. What strategic moves can Novartis pursue to sustain PROGRAF’s market share?

Focusing on developing superior formulations, expanding indications, strengthening patent protections, and engaging in lifecycle management initiatives are vital strategies.

References

- IQVIA. (2022). Global Immunosuppressant Market Data & Trends.

- U.S. Food & Drug Administration. (2022). ProgrAFT (tacrolimus) prescribing information.

- Novartis Annual Report. (2022). Patent Strategies and Market Outlook.

- MarketWatch. (2023). Global Transplant Market and Immunosuppressants Outlook.

- EvaluatePharma. (2023). Top Pharma Patents and Lifecycle Strategies.

This comprehensive analysis aims to aid stakeholders in navigating the evolving landscape of PROGRAF, emphasizing strategic insights on market positioning and pricing fundamentals.