Share This Page

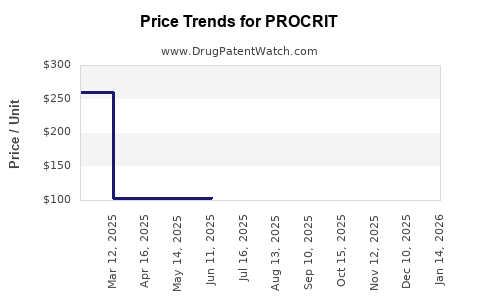

Drug Price Trends for PROCRIT

✉ Email this page to a colleague

Average Pharmacy Cost for PROCRIT

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROCRIT 10,000 UNITS/ML VIAL | 59676-0310-01 | 260.01400 | ML | 2025-11-19 |

| PROCRIT 20,000 UNITS/ML VIAL | 59676-0320-04 | 519.18857 | ML | 2025-11-19 |

| PROCRIT 40,000 UNITS/ML VIAL | 59676-0340-01 | 1031.40750 | ML | 2025-11-19 |

| PROCRIT 4,000 UNITS/ML VIAL | 59676-0304-01 | 104.19738 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PROCRIT (Epoetin alfa)

Introduction

PROCRIT (epoetin alfa) is a recombinant human erythropoietin used primarily to treat anemia associated with chronic kidney disease (CKD), chemotherapy, and certain surgeries. Since its approval by the FDA in 1989, it has become a cornerstone therapy in hematology and nephrology, with extensive patent and biosimilar landscapes shaping its market dynamics. This analysis explores current market conditions, competitive landscape, regulatory factors, and future price projections for PROCRIT.

Market Overview

Historical and Current Market Size

The global erythropoiesis-stimulating agent (ESA) market, encompassing drugs like PROCRIT, Epogen, and Aranesp, was valued at approximately USD 4.8 billion in 2022 and is projected to reach USD 6.8 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of about 4.5% [1]. North America dominates this market, accounting for almost 50% of sales, driven by high prevalence of CKD and robust healthcare infrastructure.

PROCRIT maintains substantial market share within this sector, especially in the United States, where its established efficacy, safety profile, and patent protections historically supported premium pricing. However, biosimilar entries, evolving guidelines, and pricing pressures increasingly influence its market positioning.

Key Market Drivers

-

Prevalence of CKD and Oncology-Related Anemia: CKD affects over 700 million globally, with 10%–15% of the population having some form of kidney disease [2]. Cancer-related anemia is also common among chemotherapy patients.

-

Advancements in Hematology: Improved diagnostics and treatment protocols bolster ESA utilization.

-

Regulatory Policies: Reimbursement policies, particularly Medicare and private insurers, significantly influence prescribing behaviors and pricing strategies.

Market Challenges

-

Safety Concerns: Elevated risks of mortality, cardiovascular events, and tumor progression have led to tightened guidelines and reduced dosing.

-

Biosimilar Competition: FDA-approved biosimilars such as Retacrit (GP430) have entered the market, increasing price competition.

-

Regulatory Restrictions: Post-2019 FDA warnings and evolving clinical guidelines have targeted ESA overuse and high dosing, constraining revenue expansion.

Competitive Landscape

Patent and Biosimilar Dynamics

PROCRIT’s original patents expired in the late 2010s, paving the way for biosimilar development and market entry. biosimilar epoetin alfa products have demonstrated potential economic benefits; however, market penetration has been gradual due to prescriber inertia, mild immunogenicity concerns, and regulatory hurdles.

Major Competitors

-

Erythropoiesis-stimulating agents: Aranesp (darbepoetin alfa), recently facing patent expiration and biosimilar entries.

-

Biosimilars: Retacrit (GP430), marketed by Pfizer, and others like Binocrit and Abseamed.

Manufacturers increasingly price biosimilars below PROCRIT's historically premium prices to gain market share. Consequently, the average price of branded PROCRIT has declined by approximately 20–30% over the past five years.

Market Share and Distribution

In the U.S., PROCRIT remains a leading ESA, especially among long-term dialysis patients. Nonetheless, biosimilar uptake remains limited (~15–20%) due to prescriber hesitancy, reimbursement complexities, and perceived switching barriers. Specialty pharmacies and infusion centers significantly influence distribution channels.

Regulatory and Reimbursement Factors

The U.S. FDA mandates stringent post-marketing surveillance due to prior safety controversies. The FDA’s risk evaluation and mitigation strategies (REMS) and updated labeling influence prescribing patterns. Payers, particularly CMS and private insurers, have implemented coverage restrictions favoring lower-cost biosimilars, reducing PROCRIT’s price premium.

Recent policies aim to curb ESA overuse, emphasizing minimal effective dosing. These shifts have depressed prices and reduced revenue growth prospects.

Price Projections

Short-Term Outlook (Next 1–3 Years)

Prices are projected to stabilize but remain under downward pressure. The average wholesale price (AWP) for PROCRIT has declined by approximately 10% annually over the last three years, driven by biosimilar competition, payor restrictions, and safety-driven dose reductions.

Considering these factors, the average price per unit (in terms of cost per international unit, IU) is expected to decrease by an additional 5–7% over the next three years. Industry sources estimate current AWP for PROCRIT at around USD 2.50–3.00 per 1,000 IU, with biosimilars priced approximately 15–20% lower [3].

Long-Term Outlook (4–10 Years)

The long-term trajectory depends on several variables:

-

Biosimilar Market Penetration: Increased biosimilar adoption could further depress average prices, potentially reducing PROCRIT’s market share to around 40–50%.

-

Innovation and New Formulations: The development of longer-acting formulations or alternative delivery mechanisms might command premium prices, partially offsetting generic competition.

-

Regulatory and Safety Trends: Stringent safety oversight could limit dose escalation, impacting revenue.

-

Reimbursement Policies: Shifts towards value-based care and cost containment will favor biosimilars, exerting downward pricing pressure.

Forecasting models suggest a gradual decline in unit pricing by approximately 10–15% over the next decade. However, for established clinical use, PROCRIT could maintain a brand premium if safety profiles and clinical convenience are perceived as superior.

Pricing Strategies

Pharmaceutical companies are likely to adopt tiered pricing strategies, with branded PROCRIT targeting niche or high-acuity patient populations, while biosimilars capture volume in broader markets. Additionally, value-based contracts and outcomes-based reimbursement models may influence effective pricing.

Implications for Stakeholders

- Manufacturers: Need to innovate formulations, improve safety profiles, and develop value-based value propositions.

- Healthcare Providers: Must weigh safety, efficacy, and cost, particularly amid increasing biosimilar acceptance.

- Payers and Policymakers: Will continue pushing for biosimilar utilization to reduce healthcare costs.

- Investors: Should anticipate revenue pressures but also opportunities in biosimilar market segments.

Key Takeaways

-

Market Maturity and Competition: PROCRIT's effective market has transitioned from innovation dominance to a highly competitive environment characterized by biosimilar entries and stringent safety guidelines.

-

Pricing Trends: Expect continued modest declines in PROCRIT's unit pricing (5–15%) over the next decade, exacerbated by biosimilar proliferation and payor-driven cost containment.

-

Regulatory Impact: Evolving clinical guidelines aiming to reduce ESA overuse and concerns about safety will restrict dosing and, consequently, revenue streams.

-

Strategic Focus: Differentiation through improved safety profiles, new formulations, and value-added services will be key to sustaining pricing power.

-

Forecast Uncertainty: Long-term price projections hinge on biosimilar adoption rates, regulatory developments, and healthcare policy shifts, requiring ongoing market monitoring.

Conclusion

PROCRIT remains a vital therapy in anemia management, but its price landscape faces headwinds from biosimilar competition, regulatory constraints, and shifting reimbursement paradigms. While short-term prices are expected to stabilize or decline modestly, long-term innovation and strategic positioning will shape its fiscal outlook. Stakeholders must adapt to a landscape emphasizing cost-effectiveness, safety, and value.

FAQs

1. How will biosimilar epoetin alfa products impact PROCRIT’s pricing?

Biosimilars introduce competitive pressure, typically leading to a 15–20% reduction in list prices for the reference product and increased market share for biosimilars, resulting in further price declines for PROCRIT.

2. Are there opportunities for premium pricing in the future?

Yes, if PROCRIT introduces longer-acting formulations, novel delivery methods, or demonstrates superior safety and efficacy profiles, it may command higher prices in specialized markets.

3. What are the major regulatory barriers affecting PROCRIT prices?

Regulatory agencies emphasize safety, leading to tighter dosing guidelines, REMS programs, and restrictions on high-dose use, all of which restrain revenue growth and influence pricing strategies.

4. How do reimbursement policies influence the price of PROCRIT?

Payers increasingly favor biosimilars and impose coverage restrictions on branded products, leading to lower reimbursement rates and incentivizing price reductions.

5. Will emerging therapies replace ESAs like PROCRIT?

Emerging treatment modalities, such as hypoxia-inducible factor (HIF) stabilizers, are showing promise but are still under evaluation. Their adoption could further reshape the market, impacting PROCRIT’s market share and pricing.

References

[1] Grand View Research. Erythropoiesis Stimulating Agents Market Size, Share & Trends Analysis Report. 2022.

[2] Kidney Disease: Improving Global Outcomes (KDIGO). KDIGO 2012 Clinical Practice Guideline for Anemia in CKD.

[3] IQVIA. Global Trends in Biosimilar Market, 2022.

More… ↓