Share This Page

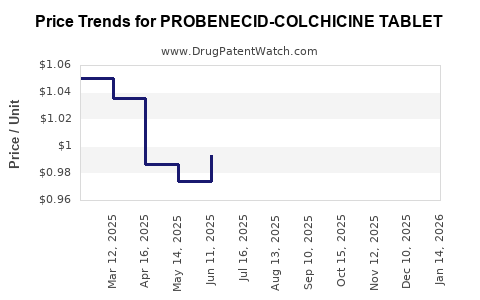

Drug Price Trends for PROBENECID-COLCHICINE TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for PROBENECID-COLCHICINE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PROBENECID-COLCHICINE TABLET | 00591-5325-01 | 0.82975 | EACH | 2025-12-17 |

| PROBENECID-COLCHICINE TABLET | 16571-0832-01 | 0.82975 | EACH | 2025-12-17 |

| PROBENECID-COLCHICINE TABLET | 50742-0263-01 | 0.82975 | EACH | 2025-12-17 |

| PROBENECID-COLCHICINE TABLET | 00591-5325-01 | 0.81740 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Probenecid-Colchicine Tablets

Introduction

Probenecid-Colchicine combination tablets are integral in managing gout and familial Mediterranean fever, among other indications. This analysis delineates the market landscape, competitive dynamics, regulatory factors, and price projections, equipping stakeholders with strategic insights into this pharmaceutical segment’s future trajectory.

Market Overview

Therapeutic Indications and Demand Dynamics

Probenecid inhibits renal tubular secretion of uric acid, facilitating its excretion, thus managing hyperuricemia. Colchicine is primarily used for gout flares and familial Mediterranean fever. The combination enhances therapeutic effectiveness, particularly in patients with recurrent gout or those refractory to monotherapy.

The global gout treatment market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.8% between 2023 and 2030 [1]. This growth is driven by increasing prevalence rates, aging populations, and a shift towards targeted therapies.

Market Size and Segmentation

Geographic Analysis

-

United States: The largest market, buoyed by high prevalence of gout (~4%) and advanced healthcare infrastructure. The FDA’s approval of generic and branded formulations sustains market activity.

-

Europe: Significant demand driven by aging demographics and comprehensive healthcare systems.

-

Asia-Pacific: Rapid growth potential owing to rising gout incidence, increasing health awareness, and expanding healthcare access.

Competitive Landscape

Key players include GlaxoSmithKline, Teva Pharmaceuticals, and Sun Pharmaceutical Industries, among others. While Probenecid and Colchicine are available as monotherapies, fixed-dose combination tablets are gaining preference for adherence and efficacy [2].

Regulatory Environment

Efforts by health authorities to streamline approval pathways and promote generic entry influence market dynamics. The U.S. FDA has approved several generic Probenecid-Colchicine formulations, intensifying competition [3].

Regulatory considerations also extend to quality control standards, labeling, and safety updates, which affect market entry and product positioning.

Price Analysis

Current Pricing Landscape

-

Brand-name formulations: Typically priced higher, with retail costs around $250-$400 per month depending on dosing and location.

-

Generic versions: Significantly more affordable, ranging from $15-$50 per month [4].

Pricing varies based on factors such as manufacturing costs, market competition, patent status, and healthcare reimbursement policies.

Patent and Market Exclusivity

Most patents for combination tablets have expired or are nearing expiration, facilitating generic competition. This trend exerts downward pressure on prices, especially in price-sensitive markets.

Distribution Channels

-

Retail pharmacies: Major point of sale, with pricing influenced by insurance coverage and patient assistance programs.

-

Hospital and specialty clinics: Often dispense branded or compounded formulations with different pricing dynamics.

Price Projections (2023–2030)

Short-term (2023-2025):

The market will experience a stabilization in pricing, with minor reductions owing to increased generic competition. The average monthly retail price for generics is projected to hover around $10-$20, keeping affordability high in emerging markets.

Mid-term (2026-2028):

With patent expiries and increased market entry of generics, prices are expected to decline by approximately 10-15% annually in developed markets. Competitive pressures could push prices toward $8-$15 per month, enhancing accessibility.

Long-term (2029-2030):

Market saturation and technological advancements might further compress prices, especially with biosimilar and alternative therapies emerging. Prices could reach $5-$10 per month in most markets, contingent on healthcare policies favoring cost containment.

Factors Influencing Future Pricing

-

Regulatory approvals: Faster pathways for generics and biosimilars can accelerate price declines.

-

Market penetration: Increased adoption in emerging economies expands volume, potentially stabilizing prices due to scale.

-

Healthcare reimbursement: Policies favoring generic substitution and formulary inclusion influence final patient costs.

-

Innovations: Development of novel formulations or delivery mechanisms may temporarily sustain higher prices.

Conclusion

The Probenecid-Colchicine tablet market exhibits a shifting landscape characterized by increasing competition, regulatory facilitation of generics, and evolving pricing strategies. While short-term prices are relatively stable, a consistent downward trend is projected throughout the next decade, driven by patent expiries, market expansion in emerging regions, and healthcare affordability initiatives.

Key Takeaways

- The growth in gout and familial Mediterranean fever treatments sustains demand for Probenecid-Colchicine tablets.

- Patent expiries and generic competition are primary drivers of declining prices.

- In developed markets, prices are expected to decrease by 10-15% annually over the next five years.

- Emerging markets offer substantial growth opportunities, potentially stabilizing prices due to higher volumes.

- Regulatory and reimbursement policies are critical factors influencing future market pricing trajectories.

FAQs

1. What are the main factors influencing the price of Probenecid-Colchicine tablets?

Patent status, generic entry, manufacturing costs, regulatory approvals, competitive market dynamics, and reimbursement policies significantly affect pricing.

2. How will patent expiries impact the market?

Patent expiries will facilitate generic manufacturing, increasing supply and suppressing prices, leading to more affordable options for patients.

3. Are there emerging alternatives to Probenecid-Colchicine therapy?

Yes, newer urate-lowering drugs like febuxostat and biologic agents for gout are emerging, which may influence long-term demand and pricing.

4. What is the growth outlook for this market in Asia-Pacific?

The region exhibits high growth potential due to increasing disease prevalence, expanding healthcare infrastructure, and improving access, which encourages market expansion and pricing adjustments.

5. How do healthcare policies affect drug pricing?

Policies promoting generic substitution, price negotiations, and formulary management effectively lower patient costs and can expedite price declines for Probenecid-Colchicine tablets.

References

[1] Global Market Insights. (2022). Gout Treatment Market Trends & Forecasts.

[2] MarketWatch. (2023). Industry Competitive Landscape of Gout Drugs.

[3] U.S. Food & Drug Administration. (2022). Approvals and Labeling Information for Gout Medications.

[4] GoodRx. (2023). The Cost of Gout Medications in the U.S.

More… ↓