Share This Page

Drug Price Trends for PREVACID DR

✉ Email this page to a colleague

Average Pharmacy Cost for PREVACID DR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREVACID DR 15 MG SOLUTAB | 64764-0543-30 | 13.15598 | EACH | 2025-12-17 |

| PREVACID DR 30 MG SOLUTAB | 64764-0544-11 | 13.23344 | EACH | 2025-12-17 |

| PREVACID DR 30 MG SOLUTAB | 64764-0544-30 | 13.23344 | EACH | 2025-12-17 |

| PREVACID DR 30 MG CAPSULE | 64764-0046-13 | 13.25327 | EACH | 2025-12-17 |

| PREVACID DR 15 MG SOLUTAB | 64764-0543-11 | 13.15598 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREVACID DR

Introduction

PREVACID DR (lansoprazole delayed-release capsules) is a proton pump inhibitor (PPI) primarily prescribed for managing gastroesophageal reflux disease (GERD), erosive esophagitis, and Zollinger-Ellison syndrome. The drug's extended-release formulation aims to enhance patient compliance compared to immediate-release alternatives. Understanding its market dynamics and pricing trajectory is crucial for pharmaceutical stakeholders, healthcare providers, and investors aiming to navigate the competitive landscape effectively.

Market Overview

Global and U.S. Market Size

The global demand for PPIs, including PREVACID DR, is substantial, driven by the increasing prevalence of acid-related disorders. According to a report by Grand View Research, the global PPI market was valued at approximately USD 20 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 4-5% through 2030 [1]. The U.S. remains the dominant market, accounting for nearly 50%, propelled by high healthcare spending, widespread GERD awareness, and the aging population.

Market Drivers

- Rising Incidence of GERD and Erosive Esophagitis: Lifestyle factors, obesity, and aging contribute to a steady increase in acid-related disorders [2].

- Shift Toward Proton Pump Inhibitors: PPIs are preferred over H2 receptor antagonists due to superior efficacy and safety profiles.

- Generic Entry and patent expirations: While PREVACID (lansoprazole) faced generic competition post-2015, the delayed-release formulations and branded versions still hold market niches, particularly for patients needing specific dosing forms.

Market Challenges

- Generic Competition: The expiration of PREVACID's patents has led to a saturated market with multiple generics available at lower prices.

- Off-label Use and Over-the-counter (OTC) Sales: Increased OTC availability of PPIs has reduced prescription volumes.

- Emerging Alternatives and Biosimilars: Newer agents and formulation innovations continue to challenge traditional PPIs’ market share.

Competitive Landscape

Key Players

- Pfizer: Historically the originator of PREVACID, although generic competitors dominate.

- Teva, Mylan, Sandoz, and other generic manufacturers: Significant price competition introduced post-patent expiry.

- Innovative formulations: New drug delivery systems, including once-daily or combination therapies, influence clinical preferences.

Market Share Trends

While generic formulations hold over 80% of prescriptions, certain niche segments, such as pediatric indications or specific formulations like PREVACID DR, retain some demand owing to their unique release profiles and dosing regimens.

Pricing Analysis and Projections

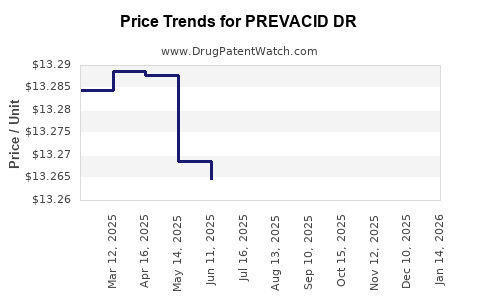

Historical Pricing Trends

The retail price for PREVACID DR has declined substantially since patent expiration, aligning with generic market trends. In 2015, branded PREVACID DR capsules typically retailed at approximately USD 300-400 per month’s supply. Currently, generic lansoprazole capsules are available at USD 20-30 wholesale, with retail prices often below USD 50 per month, reflecting increased competition and cost pressures.

Factors Influencing Future Pricing

- Patent and Exclusive Rights Lifecycle: As primary patents expired, price erosion accelerated. No significant new patents or exclusivity periods for PREVACID DR are anticipated, indicating continued downward price pressure.

- Market Penetration of Generics: The competitive landscape ensures commoditization, which suppresses premium pricing.

- Formulation Innovations: Limited pipeline development for PREVACID DR-specific formulations suggests minimal upward price adjustments in the near term.

- Reimbursement Policies and Insurance Coverage: Payers’ preference for cost-effective generic options exerts downward influence on retail prices.

Projected Price Trajectory

Given existing market trends, prices for PREVACID DR are expected to stabilize at generic levels over the next 2-3 years. While branded versions may command slight premiums where clinically justified, significant price increases are unlikely without new patent protections or unique indications.

Factors such as healthcare reforms, value-based pricing models, and supply chain dynamics could further influence pricing. Notably, the increasing emphasis on formulary management and generic substitution policies favors sustained low prices.

Market Entry and Future Outlook

Potential for Brand Revivals

Although unlikely in the immediate future, strategic repositioning or the development of novel formulations (such as dual-action PPIs or combination therapy) could create niche markets, allowing for premium pricing.

Emergence of Biosimilars and Next-Generation PPIs

Research into more selective or long-acting PPIs continues. The introduction of biosimilars or innovative molecules targeting acid suppression may erode current market shares further, pushing prices downward.

Regulatory and Patent Landscape

The patent expiry timeline for PREVACID enhances generics’ market share but also discourages further investments into costly branding unless new formulations or indications are pursued.

Concluding Remarks

The current and foreseeable future landscape for PREVACID DR demonstrates a mature, highly competitive market characterized by significant price compression. The drug’s position as a branded, delayed-release PPI diminishes with the proliferation of generics, placing substantial downward pressure on prices.

Key Takeaways

- The global PPI market is expanding, but branded PREVACID DR faces intense generic competition, driving prices downward.

- Historically, prices have declined by over 80% since patent expiration, with minimal prospects for significant upward movements without new patent protections or formulations.

- Market saturation, reimbursement trends, and OTC availability are critical factors suppressing future pricing.

- Strategic opportunities may include niche indication development or combination therapies but require substantial investment.

- Stakeholders should focus on cost-effective prescribing and monitor generic market shifts, considering the dominant trend toward commoditization.

FAQs

-

Will PREVACID DR regain market exclusivity or increase in price?

Unlikely. Without new patents or approved indications, PREVACID DR will continue to face generic competition, constraining pricing. -

What factors could influence the price of PPIs like PREVACID DR in the coming years?

Market entry of biosimilars, regulatory changes, formulary restrictions, and innovations in drug delivery are key influences. -

Are generic versions of lansoprazole significantly cheaper than branded PREVACID DR?

Yes. Generic lansoprazole can be obtained at 80-90% lower prices than branded PREVACID DR, affecting prescribing preferences. -

Is there potential for branded PREVACID DR to command premium prices in specific markets?

Only in niche areas with unique formulations or patient-specific needs; otherwise, price premiums are unlikely due to market saturation. -

How might healthcare policy changes impact PREVACID DR pricing?

Policies favoring cost containment and increased generic substitution will likely suppress prices further; conversely, restrictions on generics could temporarily stabilize or increase prices.

Sources

[1] Grand View Research, "Proton Pump Inhibitors Market Size, Share & Trends," 2022.

[2] National Institutes of Health, "GERD and the Increasing Prevalence of Acid-Related Disorders," 2021.

More… ↓