Share This Page

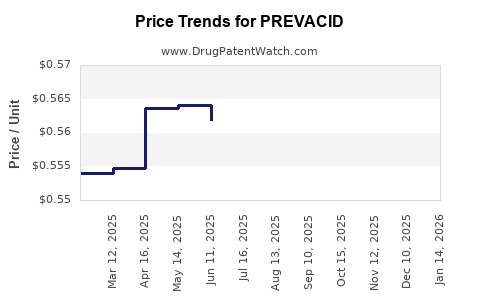

Drug Price Trends for PREVACID

✉ Email this page to a colleague

Average Pharmacy Cost for PREVACID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREVACID DR 30 MG CAPSULE | 64764-0046-13 | 13.25327 | EACH | 2025-12-17 |

| PREVACID DR 30 MG SOLUTAB | 64764-0544-11 | 13.23344 | EACH | 2025-12-17 |

| PREVACID DR 30 MG SOLUTAB | 64764-0544-30 | 13.23344 | EACH | 2025-12-17 |

| PREVACID DR 15 MG SOLUTAB | 64764-0543-11 | 13.15598 | EACH | 2025-12-17 |

| PREVACID DR 15 MG SOLUTAB | 64764-0543-30 | 13.15598 | EACH | 2025-12-17 |

| PREVACID DR 15 MG SOLUTAB | 64764-0543-30 | 13.19264 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREVACID

Introduction

PREVACID (lansoprazole) is a proton pump inhibitor (PPI) widely prescribed for conditions related to excess stomach acid, including gastroesophageal reflux disease (GERD), peptic ulcer disease, and Zollinger-Ellison syndrome. Since its initial approval in 1995, PREVACID has established a significant foothold within the gastroenterology therapeutics market. This analysis provides a comprehensive examination of PREVACID’s current market landscape, competitive positioning, regulatory environment, and forecasted pricing trends for the coming years.

Market Landscape Overview

The global proton pump inhibitors market was valued at approximately USD 9.8 billion in 2022, with a compound annual growth rate (CAGR) of around 4.8% projected through 2030 [1]. PREVACID's market share has experienced fluctuations amid the proliferation of generic alternatives; however, it maintains relevance due to its patient familiarity and patented formulations.

Key Market Drivers

- Growing Prevalence of Acid-Related Disorders: GERD affects an estimated 20% of the U.S. population, driving ongoing demand for effective acid suppression therapies [2].

- Chronic Disease Management: A significant subset of patients requires long-term management, fostering consistent prescription patterns.

- Pharmacovigilance and Formulation Differentiation: PREVACID’s early introduction and established safety profile strengthen its position, especially in markets with regulatory sensitivities toward newer PPIs.

Market Challenges

- Generic Competition: Since patent expiry, multiple generic versions have significantly compromised PREVACID’s pricing power.

- Emergence of New Therapies: Novel agents with improved safety profiles, such as potassium-competitive acid blockers (PCABs), threaten traditional PPI markets.

- Regulatory and Reimbursement Dynamics: Variations across different regions influence price setting and market penetration.

Competitive Landscape

The market is highly fragmented, predominated by generics from companies like Teva, Mylan, and Sandoz. Patented formulations of PREVACID, such as delayed-release capsules, demand premium pricing. Brand loyalty persists in certain regions, especially where prescriber familiarity influences prescribing behaviors.

Regulatory Environment

PREVACID's original patent expired in the early 2000s, leading to widespread generic availability. The U.S. Food and Drug Administration (FDA) maintains an observatory stance on PPIs, emphasizing safety concerns—particularly risks associated with long-term use, such as nutrient malabsorption and osteoporosis-related fractures [3]. Such regulatory considerations influence price policies and reimbursement frameworks.

In emerging markets, regulatory approval delays can impact availability, limiting immediate price competition and allowing for premium pricing in certain regions.

Pricing Dynamics

Current Pricing Landscape

In the U.S., the retail cost for branded PREVACID (brand-name) capsules approximates USD 375–USD 450 for a 30-day supply. Conversely, generic versions are significantly cheaper, with prices averaging USD 15–USD 35 per month, driven by intense competition.

Insurance and Reimbursement Impact

Insurance coverage plays a pivotal role; insured patients often access generic PPIs at minimal co-pays, suppressing overall drug revenue. Conversely, uninsured patients or those under certain reimbursement schemes face higher out-of-pocket costs, sustaining a residual premium for branded formulations.

Pricing Trends and Forecasts

Anticipated price evolution hinges on several factors:

- Market Penetration of Generics: Continued dominance of generics will exert downward pressure on prices over the next 3–5 years.

- New Formulations or Indications: The development of modified release or combination formulations could command premium prices, especially if patent protections or market exclusivities are obtained.

- Regulatory and Safety Considerations: Ongoing safety concerns linked to long-term PPI use may limit upward pricing potential, as prescribers and payers prioritize safety profiles.

Projected pricing for PREVACID’s branded form is expected to decline modestly by 5–10% annually, stabilizing around USD 200–USD 300 for a 30-day supply by 2030, predominantly in markets with high generic penetration.

Future Market and Price Projections

1. Market Consolidation and Patent Scenarios:

Given the patent expiries and increasing generic competition, the U.S. market will likely see a significant price erosion for PREVACID’s brand-name formulations. However, niche formulations, combination drugs, or delivery system innovations could sustain higher prices in select segments.

2. Emerging Markets:

In regions with delayed regulatory approvals and limited generic presence, PREVACID may retain a premium pricing model, with average prices remaining in the USD 250–USD 400 range per month.

3. Impact of Alternative Therapies:

The advent of PCABs (e.g., vonoprazan), which potentially offer superior efficacy and safety, could accelerate price declines for traditional PPIs due to decreased prescriber and patient preference.

4. Price Stabilization Strategies:

Manufacturers might employ tiered pricing, patient assistance programs, or value-based pricing mechanisms to optimize revenue streams amid competitive pressures.

Key Market Opportunities

- Formulation Innovation: Developing patient-friendly delivery formats could command premium pricing.

- Expanded Indications: Seeking approval for additional indications enhances market footprint.

- Regional Expansion: Entering underpenetrated markets with limited generic presence provides immediate revenue opportunities.

Regulatory and Policy Impacts

Policy shifts toward deprescribing, safety warnings, and reimbursement reforms could influence future pricing dynamics, emphasizing the need for strategic positioning and value demonstration.

Key Takeaways

- The global PREVACID market is under significant pressure from generic competitors, with prices declining steadily.

- Branded PREVACID prices are projected to decrease by approximately 5–10% annually over the next five years, stabilizing in the USD 200–USD 300 range in mature markets.

- Emerging markets with delayed generic entry may sustain higher prices longer, presenting region-specific opportunities.

- Innovations in drug formulations and expanding indications could sustain premium pricing segments despite broader generics-driven erosion.

- Regulatory and safety considerations are critical factors influencing both market access and pricing strategies.

FAQs

1. What factors primarily influence PREVACID’s market price?

Market price is influenced by patent status, generic competition, formulation innovations, regional regulatory policies, and insurance reimbursement dynamics.

2. How does generic competition affect PREVACID's pricing trajectory?

Widespread availability of generics drives significant price reductions, limiting the revenue potential for branded formulations.

3. Are there premium markets for PREVACID?

Yes, in regions with delayed generic entry or where branded formulations are preferred, PREVACID can command higher prices, particularly with specialized formulations or indications.

4. What future developments could impact PREVACID’s pricing?

Introduction of novel delivery systems, expansion into new indications, or approval of alternative acid suppression therapies could influence pricing by altering market demand.

5. How do safety concerns impact PREVACID’s market?

Safety warnings related to long-term use may restrict prescribing patterns, thereby impacting volumes and pricing strategies to mitigate potential liabilities.

Sources

[1] Market Research Future, “Proton Pump Inhibitors Market Analysis,” 2022.

[2] American Gastroenterological Association, “Gastroesophageal Reflux Disease (GERD) Statistics,” 2021.

[3] U.S. Food and Drug Administration, “Proton Pump Inhibitors: Safety Review,” 2020.

More… ↓