Share This Page

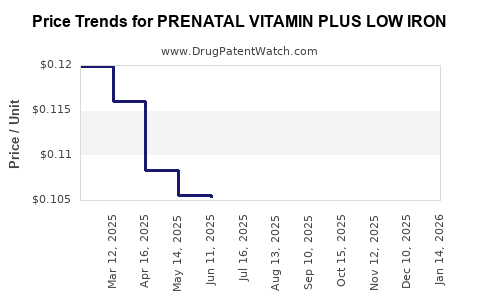

Drug Price Trends for PRENATAL VITAMIN PLUS LOW IRON

✉ Email this page to a colleague

Average Pharmacy Cost for PRENATAL VITAMIN PLUS LOW IRON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.12023 | EACH | 2025-12-17 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.12086 | EACH | 2025-11-19 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.11985 | EACH | 2025-10-22 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.11751 | EACH | 2025-09-17 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.11852 | EACH | 2025-08-20 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.11137 | EACH | 2025-07-23 |

| PRENATAL VITAMIN PLUS LOW IRON | 39328-0106-10 | 0.10531 | EACH | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Prenatal Vitamin Plus Low Iron

Introduction

Prenatal vitamins constitute a vital segment of the nutritional supplement industry, tailored to support maternal and fetal health during pregnancy. Among these, Prenatal Vitamin Plus Low Iron products address a specific need for women who either have iron sensitivities or require reduced iron supplementation due to medical advice. As the global demand for prenatal health products rises, understanding market dynamics and price projections becomes essential for pharmaceutical companies, manufacturers, and investors seeking strategic insights.

Market Overview

Global Market Size and Growth Dynamics

The prenatal vitamins market was valued at approximately $2.3 billion in 2022, with compounded annual growth rates (CAGR) forecasted at around 6.2% from 2023 to 2030 (source: Grand View Research [1]). The growth stems from increasing awareness of maternal health, extending prenatal care access, and a surge in pregnant women seeking dietary supplementation.

Specifically, the niche segment for low-iron prenatal vitamins is gaining traction, driven primarily by women with conditions such as hemochromatosis or iron overload disorders, and those advised to limit iron intake by healthcare professionals. The segment’s growth aligns with the broader trend of personalized healthcare and tailored supplement formulations.

Key Market Drivers

-

Rising maternal health awareness: Governments and health organizations promote prenatal health, emphasizing supplementation for fetal development (WHO, 2020).

-

Preventive healthcare focus: Growing preference for preventive health measures among pregnant women enhances demand for specialized prenatal vitamins.

-

Increasing prevalence of anemia and micronutrient deficiencies: While iron deficiency anemia remains prevalent globally, awareness is shifting toward personalized supplementation to mitigate risks associated with excessive iron intake.

-

Regulatory support: Favorable regulatory environments in North America and Europe facilitate the commercialization of specialized prenatal formulations.

Regional Market Insights

- North America dominates the market, accounting for roughly 45% of the global share, driven by high consumer awareness and advanced healthcare infrastructure.

- Europe holds approximately 25%, with Germany, the UK, and France leading the region.

- Asia-Pacific shows rapid growth, expected to expand at 8.7% CAGR over the next seven years, propelled by rising maternal age and improving healthcare standards in countries like China and India.

Competitive Landscape

Major players include Mead Johnson Nutrition (now Reckitt Benckiser), Pfizer, Bayer, Gilead Sciences, and several generics manufacturers. These companies leverage extensive R&D, broad distribution networks, and brand recognition to dominate the market.

Emerging entrants focusing exclusively on specialized formulations, such as low-iron variants, are gaining market share through targeted marketing and partnerships with healthcare providers.

Pricing Landscape

Current Pricing Trends

Prices for prenatal vitamin products vary based on formulation complexity, branding, and distribution channels. For a standard Prenatal Vitamin Plus Low Iron:

- Over-the-counter (OTC) retail prices typically range from $10 to $25 per 30-count bottle.

- Pharmacy chains may offer price discounts or bundled offers, bringing costs down to $8 to $20.

- Online distributors often provide the most competitive prices, with some products priced as low as $7 for similar quantities, owing to direct-to-consumer sales models.

Pricing Factors Influencing Variance

- Formulation complexity: Products with added nutrients or organic certifications demand premium pricing.

- Brand reputation: Established brands command higher prices due to perceived quality and trust.

- Packaging and presentation: Larger bottles or eco-friendly packaging increase costs.

- Regulatory certifications: Organic, non-GMO, or gluten-free certifications increase product value and price.

Price Projections and Future Outlook

Short-term (2023-2025)

Given current market trends, prices for Prenatal Vitamin Plus Low Iron are expected to stabilize with slight increases corresponding to inflation and production costs:

- Average retail price: Projected to remain within $10 to $25 per 30-count bottle.

- Premium formulations: Could command prices up to $30 due to added organic or specialty ingredients.

Medium- to Long-term (2026-2030)

- Market expansion and increased competition will likely exert downward pressure on prices, especially in the online sales channel.

- Innovation in formulations—such as liquid, chewable, or allergen-free variants—may sustain premium pricing.

- Regulatory developments requiring quality audits and certifications might temporarily boost prices but will ultimately promote price normalization.

Overall, prices for Prenatal Vitamin Plus Low Iron are expected to exhibit a compound annual growth rate of 1.5% to 3% over the next five years, reflecting market maturity and competitive pricing pressures.

Implications for Stakeholders

- Manufacturers should focus on product differentiation through organic certifications, unique nutrient blends, and eco-friendly packaging to justify premium pricing.

- Retailers can capitalize on growing demand by offering bundled deals and subscription models to enhance customer loyalty.

- Investors should monitor regulatory developments and consumer trends that influence pricing and market penetration.

Key Takeaways

- The global prenatal vitamins market, especially the low-iron segment, is positioned for steady growth driven by increasing maternal health awareness.

- Prices for Prenatal Vitamin Plus Low Iron products are expected to stay within a competitive range of $10 to $25, with premium variants reaching $30.

- Market expansion in Asia-Pacific and online sales growth are likely to exert downward pressure on prices, but innovation and branding can sustain premium pricing.

- Regulatory and certification developments will influence pricing strategies, favoring high-quality, differentiated products.

- Strategic formulation improvements and distribution expansion remain critical for manufacturers seeking to optimize revenues in this niche.

FAQs

1. What factors most influence the pricing of Prenatal Vitamin Plus Low Iron products?

Formulation complexity, brand reputation, packaging, certifications (organic, gluten-free), and distribution channels significantly impact product pricing.

2. How is the demand for low-iron prenatal vitamins projected to evolve?

Demand is expected to grow steadily, driven by personalized healthcare trends, increased awareness of iron overload conditions, and expanding prenatal care awareness in emerging markets.

3. Which regions offer the most opportunity for growth in this segment?

The Asia-Pacific region presents the highest growth potential, supported by rising maternal ages, improving healthcare infrastructure, and increased supplement adoption.

4. How might regulatory changes impact the prenatal vitamin market?

Enhanced regulations on supplement safety, quality control, and ingredient sourcing could raise manufacturing costs but also create opportunities for premium product positioning.

5. What product innovations could influence future pricing strategies?

Developments such as organic formulations, allergen-free options, liquids, and delivery formats like chewables could enable premium pricing and market differentiation.

Sources

- Grand View Research. Prenatal Vitamins Market Size, Share & Trends Analysis Report. 2023.

More… ↓