Share This Page

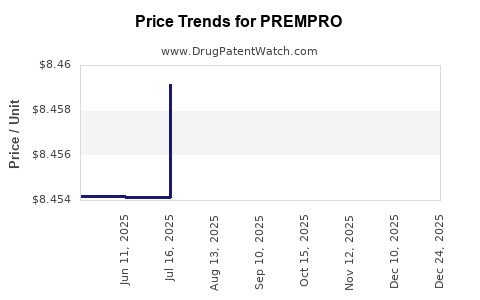

Drug Price Trends for PREMPRO

✉ Email this page to a colleague

Average Pharmacy Cost for PREMPRO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREMPRO 0.3 MG-1.5 MG TABLET | 00046-1105-11 | 8.45570 | EACH | 2025-11-19 |

| PREMPRO 0.625-2.5 MG TABLET | 00046-1107-11 | 8.45628 | EACH | 2025-11-19 |

| PREMPRO 0.45-1.5 MG TABLET | 00046-1106-11 | 8.45951 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for PREMPRO

Introduction

PREMPRO, a combination hormone therapy (HT) product, combines conjugated estrogens and medroxyprogesterone acetate to treat menopausal symptoms in women with a uterus, as approved by the U.S. Food and Drug Administration (FDA). Since its initial approval, PREMPRO has established a significant position in the hormone replacement therapy (HRT) market. This analysis evaluates its current market landscape, competitive positioning, regulatory environment, pricing strategies, and future price projections relevant for stakeholders including pharmaceutical companies, healthcare providers, and investors.

Market Landscape for PREMPRO

Market Size and Demand Drivers

The global hormone replacement therapy market was valued at approximately USD 2.2 billion in 2022 and is projected to reach around USD 3.4 billion by 2030, exhibiting a CAGR of about 6.1% (source: Grand View Research). The primary demand catalyst is a growing population of menopausal women, particularly in aging Western populations, driven by increased life expectancy and heightened awareness of menopausal health management.

In the U.S., an estimated 6 million women experience menopause annually, with a significant subset opting for pharmacological management (source: CDC). The demand for combination products like PREMPRO remains robust due to their efficacy in managing vasomotor symptoms, osteoporosis prevention, and other menopausal concerns.

Competitive Landscape

PREMPRO faces competition from several generic and branded hormone therapies, including:

- Estrogen-only products (e.g., Estrace, Cenestin)

- Progestin-only products (e.g., Prometrium)

- Other combination therapies (e.g., Femhrt, Angeliq)

Generic formulations have substantially eroded the market share of the originator, which was initially marketed by Wyeth/Astellas (now part of Pfizer). Patent expiration for PREMPRO's active components has opened avenues for generics, intensifying price competition.

Regulatory and Patent Considerations

The original PREMPRO patent expired globally by the mid-2010s, leading to an influx of generic versions globally, although specific formulations bear different patent protections depending on jurisdiction. The FDA's biosimilar and generic approval pathways facilitate price pressures but also provide opportunities for market segmentation based on formulation, delivery device, or label indications.

Pricing Dynamics and Strategies

Current Pricing Environment

As of 2023, brand-name PREMPRO typically retails at approximately USD 700–800 per month (per patient), depending on pharmacy and insurance coverage. Generic versions sell at a significant discount, often between USD 50–150 per month, reflecting price erosion following patent expiry.

Insurance coverage heavily influences out-of-pocket costs, with Medicare and private insurers preferring lower-cost generics to contain expenditure. Nonetheless, brand-name versions maintain premium pricing among certain demographic segments, such as patients seeking specific formulations or brand loyalty.

Market Segmentation and Price Differentiation

Manufacturers adopt multi-tiered pricing strategies:

- Premium pricing for branded formulations with perceived higher quality or unique benefits.

- Competitive pricing for generics, aiming to maximize volume sales.

- Bulk discounts and formularies to manage insurance and hospital procurement deals.

Pharmaceutical companies increasingly leverage patient assistance programs and subscription models to retain market share against generics, influencing overall pricing trends.

Future Price Projections

Factors Influencing Price Trends

-

Patent and Exclusivity Status: Loss of patent protection has historically precipitated price reductions. While original formulations are now largely generic, any reformulations or improved delivery systems could create new patents, temporarily stabilizing prices.

-

Market Penetration of Generics: Generics are expected to dominate, driving prices further downward. The WHO predicts generic penetration in HRT to exceed 85% by 2025, which correlates with reduced prices for indications similar to PREMPRO.

-

Regulatory and Reimbursement Policies: Policies favoring cost-effective therapies will likely pressure prices downward, especially in publicly funded healthcare systems.

-

Emerging Biosimilars and New Formulations: The advent of biosimilar estrogen or progestin products can further compress pricing levels, similar to trends observed in other therapeutic areas.

Projected Price Trajectory (2024–2030)

Based on current trends and market dynamics:

- Generic versions of PREMPRO are expected to stabilize around USD 30–70 per month, potentially decreasing further as market saturation occurs.

- Brand-name PREMPRO could maintain prices of USD 600–700 per month in niche markets or through patient assistance programs but are expected to decline gradually, approaching USD 400–500 by 2030.

Impact of Emerging Alternatives

Introduction of non-hormonal therapies for menopausal symptoms, such as selective serotonin reuptake inhibitors (e.g., paroxetine), and novel delivery methods (transdermal patches, vaginal rings) could fragment the market, exerting downward pressure on PREMPRO prices and sales volume.

Implications for Stakeholders

-

Pharmaceutical Companies: Prioritize development of proprietary formulations or delivery technologies to extend market exclusivity and justify premium pricing.

-

Healthcare Providers: Emphasize selecting cost-effective therapies aligned with efficacy to optimize treatment affordability.

-

Payers: Negotiate formulary inclusion with focus on generics to reduce overall expenditure, potentially limiting access to brand-name drugs.

-

Investors: Monitor patent statuses, regulatory approvals, and emerging generics/biosimilars to assess long-term profitability.

Conclusion

The PREMPRO market is undergoing the typical lifecycle transition post-patent expiration, with generics dominating and exerting downward pressure on prices. While current brand-name prices remain high, future projections suggest a continued decline, reaching affordability levels conducive to widespread adoption. Strategic focus on formulation innovation, patent strategies, and market segmentation will be essential for maintaining profitability in this mature market landscape.

Key Takeaways

- The global HRT market, driven by aging populations, supports sustained demand for products like PREMPRO.

- Patent expirations have led to a surge of generics, significantly lowering prices.

- Future projections indicate generic prices will stabilize near USD 30–70/month, with branded PREMPRO declining toward USD 400–500/month by 2030.

- Competitive pressures from biosimilars, innovative formulations, and alternative therapies will further influence price trajectories.

- Stakeholders should align strategies to capitalize on market shifts, focusing on innovation, cost management, and regulatory navigation.

FAQs

-

What factors primarily influence PREMPRO's pricing trends?

Patent status, generic competition, regulatory policies, market demand, and reimbursement frameworks are key drivers shaping long-term pricing. -

How does the entry of generics affect the overall market for PREMPRO?

Generics significantly reduce prices, increase market accessibility, and shift patient preferences toward more affordable options, often leading to a decline in brand-name sales. -

Are there any upcoming formulations or innovations that could extend PREMPRO's market exclusivity?

Yes, reformulations, improved delivery systems, or combination therapies with novel indications could potentially secure new patents, creating exclusivity periods. -

What is the outlook for healthcare providers in prescribing PREMPRO?

Providers will likely favor cost-effective options, leaning toward generics to optimize patient adherence and reduce overall treatment costs. -

How might policy changes impact the future pricing of PREMPRO?

Reimbursement reforms, price regulation, and increased emphasis on biosimilars and generics will likely sustain downward pressure on prices, making affordable hormone therapy more accessible.

Sources:

[1] Grand View Research. Hormone Replacement Therapy Market Size, Share & Trends Analysis. 2022.

[2] CDC. Menopause and aging statistics. 2022.

[3] FDA. Approved Drug Products for Menopausal Hormone Therapy. 2023.

More… ↓