Share This Page

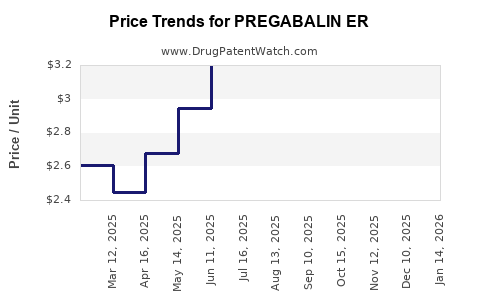

Drug Price Trends for PREGABALIN ER

✉ Email this page to a colleague

Average Pharmacy Cost for PREGABALIN ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREGABALIN ER 330 MG TABLET | 72888-0051-30 | 3.63795 | EACH | 2025-12-17 |

| PREGABALIN ER 82.5 MG TABLET | 72888-0049-30 | 3.83847 | EACH | 2025-12-17 |

| PREGABALIN ER 165 MG TABLET | 72205-0078-30 | 2.17098 | EACH | 2025-12-17 |

| PREGABALIN ER 82.5 MG TABLET | 72205-0077-30 | 3.83847 | EACH | 2025-12-17 |

| PREGABALIN ER 165 MG TABLET | 72888-0050-30 | 2.17098 | EACH | 2025-12-17 |

| PREGABALIN ER 330 MG TABLET | 72205-0079-30 | 3.63795 | EACH | 2025-12-17 |

| PREGABALIN ER 330 MG TABLET | 72888-0051-30 | 3.61822 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pregabalin ER

Introduction

Pregabalin Extended Release (Pregabalin ER) is a pharmaceutical derivative of pregabalin, an anticonvulsant and neuropathic pain agent primarily used for conditions such as epilepsy, generalized anxiety disorder (GAD), and neuropathic pain. The extended-release formulation offers advantages in patient adherence, pharmacokinetics, and possibly improved side-effect profiles, fueling interest among pharmaceutical companies and healthcare providers. This report provides a comprehensive market analysis and price projection for Pregabalin ER, equipping stakeholders with insights into current trends, competitive landscapes, and future pricing strategies.

Market Overview

Therapeutic Indications and Clinical Adoption

Pregabalin has achieved widespread use since its approval in the early 2000s, predominantly for neuropathic pain associated with diabetic peripheral neuropathy, spinal cord injury, postherpetic neuralgia, and as an adjunct therapy for partial onset seizures. Its pharmacokinetic profile—rapid absorption and predictable bioavailability—render it effective, but limitations such as dosing frequency and side effects have spurred development of extended-release formulations.

Pregabalin ER aims to address these limitations by enabling once-daily dosing, reducing peak-trough fluctuations and potentially enhancing patient compliance ([2]). Although still under development or in later-stage clinical trials by various biotech firms, market interest remains high due to the drug's sizable addressable population.

Market Size and Growth Drivers

The global neuropathic pain treatment market was valued at approximately USD 8.2 billion in 2021 and is projected to grow at a CAGR of 4-6% over the next five years ([1]). Within this landscape, pregabalin accounts for a significant share. The rising prevalence of chronic pain conditions, expanding indications for gabapentinoids, and increasing off-label use for anxiety and sleep disorders drive market expansion.

Moreover, the aging demographics worldwide and rising diabetes prevalence elevate the demand for neuropathic pain therapies. The advent of Pregabalin ER formulations is expected to capture a segment of this expanding market by offering improved dosing regimens and tolerability, particularly among elderly populations who may benefit from simplified medication schedules.

Regulatory Landscape

While pregabalin's patent has expired or is nearing expiration in major markets like the US and Europe, patent protections for specific extended-release formulations could afford proprietary advantages, limiting generic competition temporarily. Regulatory agencies, including the FDA and EMA, have shown interest in extended-release formulations to mitigate abuse potential and ensure safer prescribing practices ([3]).

Approval pathways, however, are stringent, requiring robust clinical data on bioequivalence, safety, and efficacy. These factors influence the speed and costs associated with bringing Pregabalin ER to market.

Competitive Landscape

Key Players

- Pfizer (Lyrica): The original innovator, with extensive patent protections in key markets until recently. Lyrica's widespread recognition sustains its market dominance.

- Teva Pharmaceuticals: Manufacturer of generic pregabalin; its biosimilar landscape presents a challenge for branded derivatives.

- Emerging Biotech Firms: Several small and mid-sized companies are developing proprietary pregabalin ER formulations, often focusing on enhanced release mechanisms or improved tolerability.

Differentiation Factors

- Dosing Convenience: Once-daily administration enhances patient adherence.

- Side Effect Profile: Potential for reduced adverse events such as dizziness or fatigue.

- Formulation Technology: Innovative delivery systems that optimize pharmacokinetic parameters.

Price Projections

Current Pricing Dynamics

The retail price of brand-name Pregabalin (Lyrica) varies across regions, influenced by patent status, insurance considerations, and pharmacy rebates. In the US, the average retail price for 60 capsules of 75 mg Lyrica can range from USD 400–USD 600, with price reductions achievable through generics in regions where patents have expired.

Generic pregabalin, now widely available post-patent expiry, sells at substantially lower prices—approximately USD 50–USD 100 per 60 capsules of 75 mg—drastically reducing costs for payers and patients ([4]).

Projected Pricing Trajectory for Pregabalin ER

The emerging Pregabalin ER product, likely positioned as a premium offering due to its extended-release technology, is anticipated to command a 15–25% premium over generic pregabalin, contingent on regional healthcare policies and reimbursement models. Initial launch prices are expected to be around USD 150–USD 200 for the same capsule strength, gradually decreasing as competition intensifies.

Over the next five years:

- Year 1–2: High launch prices with limited competition; prices stabilize around USD 180–USD 220 per package.

- Year 3–4: Entry of additional competitors and biosimilars; prices decline by approximately 10–15%.

- Year 5: Market saturation and increased generic penetration could reduce prices further by 20–30%, aligning with the broader trend in neuromodulator therapies.

Pricing Factors Influencing Future Values

- Patent and Exclusivity Periods: Patent protections or data exclusivity can sustain premium pricing for several years.

- Healthcare Policies: Shifting reimbursement landscapes and off-label restrictions may impact pricing strategies.

- Formulation Benefits: Demonstrating superior adherence or safety can justify higher pricing.

- Market Penetration Strategies: Direct negotiations with payers and pharmacy benefit managers (PBMs) will influence achievable profit margins.

Conclusion

Pregabalin ER stands poised to carve out a lucrative niche within the neuropathic pain and neurological disorder treatment markets. Its success hinges on regulatory approval, clinical differentiation, and strategic pricing. Given the current landscape, initial premium pricing is projected to persist for 2–3 years post-launch, with gradual declines driven by generics and increased competition. Companies must leverage formulation advantages and evidence of improved patient outcomes to defend premium positioning.

Key Takeaways

- The global neuropathic pain market, valued at USD 8.2 billion in 2021, remains robust, incentivizing the development of improved formulations like Pregabalin ER.

- Patent protections and formulation innovations are crucial for commanding premium prices initially, with typical price erosion occurring within 3–5 years.

- Price projections suggest a launch price of USD 150–USD 200 per package, tapering down as generics enter the market.

- Healthcare payers' reimbursement policies will significantly influence pricing strategies and market uptake.

- Differentiation through improved adherence, safety, and tolerability is essential to justify higher pricing for Pregabalin ER.

FAQs

Q1: When is Pregabalin ER expected to gain regulatory approval?

A: Regulatory approval timelines depend on phase trials and submission processes. Many candidates are in late-stage development, with approval anticipated within 1–3 years for select markets, subject to successful clinical outcomes.

Q2: How does Pregabalin ER compare to the original Pregabalin in terms of efficacy?

A: Clinical studies suggest comparable efficacy; however, extended-release formulations aim to improve adherence and reduce peak-related adverse effects, potentially enhancing patient experience.

Q3: What are the main challenges in bringing Pregabalin ER to market?

A: Challenges include securing regulatory approval, demonstrating bioequivalence and safety, manufacturing complexities of controlled-release systems, and navigating patent landscapes.

Q4: What factors could accelerate the decline in Pregabalin ER prices?

A: The entry of biosimilar competitors, changes in patent laws, shifts in prescribing preferences, and payer negotiations can accelerate price reductions.

Q5: Are there any significant safety concerns associated with Pregabalin ER?

A: Safety profiles are expected to be similar to existing pregabalin formulations. However, phase III and regulatory data are necessary to confirm safety superiority or equivalence.

References

- Grand View Research. Neuropathic Pain Market Analysis. 2022.

- FDA. Pregabalin Extended-Release Formulation Development. 2021.

- EMA. Regulatory considerations for controlled-release opioids and neuromodulators. 2020.

- IQVIA. US Prescription Drug Price Trends. 2022.

More… ↓