Share This Page

Drug Price Trends for PREDNISOLONE SOD PH

✉ Email this page to a colleague

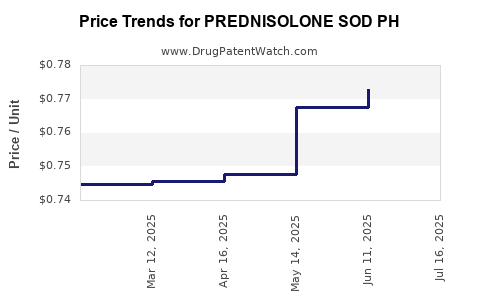

Average Pharmacy Cost for PREDNISOLONE SOD PH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PREDNISOLONE SOD PH 25 MG/5 ML | 42799-0816-01 | 0.78812 | ML | 2025-07-23 |

| PREDNISOLONE SOD PH 25 MG/5 ML | 44523-0182-08 | 0.78812 | ML | 2025-07-23 |

| PREDNISOLONE SOD PH 25 MG/5 ML | 44523-0182-08 | 0.77277 | ML | 2025-06-18 |

| PREDNISOLONE SOD PH 25 MG/5 ML | 42799-0816-01 | 0.77277 | ML | 2025-06-18 |

| PREDNISOLONE SOD PH 25 MG/5 ML | 44523-0182-08 | 0.76765 | ML | 2025-05-21 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Prednisolone Sod Ph

Introduction

Prednisolone Sod Ph (Prednisolone Sodium Phosphate) is a synthetic glucocorticoid widely prescribed for its anti-inflammatory and immunosuppressive effects. Its applications span various medical indications, including allergic conditions, autoimmune diseases, and certain inflammatory disorders. As a critical staple within corticosteroid therapies, the drug market's trajectory hinges on factors such as global disease prevalence, emerging biosimilar competition, regulatory developments, and manufacturing dynamics. This analysis delves into current market landscapes and offers data-driven price projections.

Market Overview

Therapeutic Demand and Global Use

Prednisolone Sod Ph's versatility has sustained steady global demand. It primarily targets conditions such as asthma exacerbations, rheumatoid arthritis, and dermatological inflammations, alongside off-label uses. According to Market Research Future (MRFR), the corticosteroids market, driven by high prevalence rates of autoimmune and allergic diseases, is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5-6% through 2030[1].

Emerging markets, notably Asia-Pacific, are witnessing increased steroid prescriptions driven by expanding healthcare infrastructure and rising disease burden. Advanced economies, including North America and Europe, maintain significant market shares, buoyed by chronic disease management and aging populations.

Regulatory Environment & Patent Landscape

Prednisolone products are generally off-patent, enabling numerous manufacturers to produce generic formulations. The absence of patent exclusivity accelerates market penetration by biosimilars and generics, intensifying competitive pricing pressures. Regulatory pathways for approval remain streamlined, although safety updates and label modifications influence market access.

Manufacturing & Supply Chain Dynamics

Major producers include Pfizer, Mylan, Teva, and local regional manufacturers. Supply chain robustness—especially during geopolitical upheavals like COVID-19—has become a critical determinant of market supply stability. Pricing is affected by raw material costs, manufacturing capacity, and distribution logistics.

Market Segmentation

By Formulation

- Oral tablets: Predominant in outpatient management.

- Injectable phosphate solutions: Critical for acute hospital settings.

By Disease Indication

- Autoimmune diseases: Rheumatoid arthritis, lupus.

- Allergic conditions: Asthma, dermatitis.

- Others: Inflammatory bowel diseases, certain cancers.

By Geography

- North America: Largest market share, driven by high healthcare expenditure.

- Europe: Significant growth, influenced by aging demographics.

- Asia-Pacific: Fastest-growing region owing to rising disease prevalence and healthcare development.

- Latin America & Middle East: Emerging markets with expanding access.

Competitive Landscape

Market competition is heavily influenced by generic manufacturers. Several players hold dominant segments, with price competition being fierce due to minimal patent protection. The entrance of biosimilars and emerging local manufacturers further diversifies the landscape.

Key companies include:

- Pfizer

- Mylan (now part of Viatris)

- Teva Pharmaceuticals

- Sandoz

- Local regional producers

Note: The commoditized nature of prednisolone formulations limits differentiation, primarily impacting pricing strategies.

Price Analysis

Current Pricing Benchmarks

In the United States, the average wholesale acquisition cost (WAC) for a 5 mg prednisolone tablet hovers around $0.07 to $0.10 per tablet, with considerable variation based on the supplier. Injectable formulations command higher prices, approximately $0.50 to $1.50 per milliliter, reflecting formulation complexity and manufacturing inputs.

Globally, generic competition results in significant price reductions; in emerging markets, pricing can be as low as $0.01 per tablet, driven by intense competition and cost-effective manufacturing.

Pricing Trends

- Downward Pressure: Due to increasing generic competition and biosimilar entries.

- Consolidation Impact: Larger pharmaceutical groups leverage economies of scale, further reducing prices.

- Market Demand Shifts: Rising demand in endemic regions sustains volume growth, partially offsetting price declines.

Forecasting Price Trajectories (2023-2030)

Based on current industry trajectories, the following projections are outlined:

Short-term (2023-2025)

- Price stabilization: Slight reductions (2-3%) in mature markets due to new biosimilar approvals and intensified competition.

- Emerging markets: Prices remain low but exhibit slight upward trends as demand increases and local manufacturing capacity improves.

Medium-term (2026-2028)

- Gradual decline: Expect a 5-8% decline annually, influenced by further biosimilar market penetration and regulatory shifts favoring off-patent drugs.

- Premium products: Injectable formulations may see marginal premium pricing in institutional settings.

Long-term (2029-2030)

- Market maturity plateau: Prices stabilize at reduced levels, with a possible slight uptick driven by supply disruptions or regulatory interventions.

- Innovation impact: Limited, owing to the drug’s commoditized nature; hence, price changes remain predominantly driven by market dynamics rather than new product developments.

Strategic Insights for Stakeholders

- Manufacturers should optimize production efficiencies to remain competitive amid declining prices.

- Investors should monitor biosimilar approvals and regulatory changes impacting price dynamics.

- Healthcare payers ought to evaluate cost-saving opportunities through formulary management and biosimilar substitution.

Key Takeaways

- Market growth remains steady, driven by high prevalence of corticosteroid-responsive conditions and expanding healthcare access globally.

- Price pressures are intense, largely due to generic competition, with downward trends projected over the next decade.

- Emerging markets present opportunities for volume growth at lower price points, but with margins constrained.

- Biosimilar entries are expected to accelerate price reductions after mid-2020s, emphasizing the importance of strategic positioning for producers.

Conclusion

Prednisolone Sod Ph maintains its pivotal role in managing inflammatory and autoimmune conditions worldwide. While global demand is resilient, the commoditized nature of its formulations ensures relentless price competition and downward pressure. Stakeholders must adapt to a landscape characterized by rapid generics proliferation, regulatory evolutions, and expanding markets. The interplay of these factors will dictate pricing and profitability trajectories through 2030.

FAQs

1. What factors most influence the price of prednisolone Sod Ph?

Market competition, the number of generic manufacturers, regulatory approvals, manufacturing costs, and regional demand influence prices. Biosimilar entrants accelerate price declines.

2. How does regional demand affect prednisolone pricing?

Emerging markets with rising demand and lower manufacturing costs tend to have significantly lower prices compared to mature markets, where established competition drives prices down.

3. Are biosimilars impacting prednisolone Sod Ph prices?

Yes. While biosimilars are more prominent in biologics, overlapping generic competition from biosimilar manufacturing processes further intensifies price competition for corticosteroids.

4. What is the outlook for injectable prednisolone sod phosphate?

Injectable formulations will likely experience slower price declines due to specialized manufacturing and higher demand in hospital settings, preserving some premium pricing.

5. How should pharmaceutical companies strategize around prednisolone markets?

Focus on optimizing manufacturing efficiencies, exploring regional market expansion, and engaging with regulatory pathways to introduce cost-effective generic options.

Sources

[1] Market Research Future (MRFR). “Corticosteroids Market Report, 2020-2030.”

More… ↓