Last updated: July 27, 2025

Introduction

Prednisolone, a synthetic glucocorticoid, plays a pivotal role in managing inflammatory, allergic, and autoimmune conditions. Its broad therapeutic spectrum ensures sustained demand across global healthcare landscapes, including hospitals, clinics, and outpatient settings. Given its longstanding clinical utility, understanding its market dynamics and price trends is crucial for investors, pharmaceutical companies, and healthcare policymakers.

Market Overview

Prednisolone’s global market has maintained steady growth over the past decade, propelled by increasing incidences of autoimmune diseases such as rheumatoid arthritis, asthma, and inflammatory bowel disease [1]. Its versatility, cost-effectiveness, and extensive clinical approval history sustain high consumption levels. The key drivers include:

- Rising prevalence of chronic inflammatory and autoimmune disorders.

- Growing adoption in developing countries due to affordability.

- Expanding indications and off-label uses.

- Increasing awareness about corticosteroid therapies among healthcare providers.

Regionally, North America and Europe dominate the market, driven by well-established healthcare infrastructure and high disease prevalence. However, Asia-Pacific exhibits significant growth potential due to increasing healthcare expenditure and expanding pharmaceutical manufacturing capabilities.

Market Size & Segmentation

In 2022, the global prednisolone market was valued at approximately USD 1.2 billion, with an anticipated CAGR of around 4.5% through 2030 [2]. The market is segmented by formulation, application, and end-user:

-

Formulation Types: Oral tablets, injectable solutions, topical preparations.

-

Applications: Autoimmune diseases, allergic conditions, inflammatory diseases.

-

End-Users: Hospitals, retail pharmacies, clinics.

Oral prednisolone formulations dominate the market, accounting for roughly 70% of sales, given their convenience and widespread use.

Competitive Landscape

The market comprises several established pharmaceutical manufacturers, including:

- Mylan Pharmaceuticals

- Lupin Ltd.

- Sandoz (Novartis)

- Teva Pharmaceuticals

- Pfizer

Generic versions constitute a substantial share of the market, driving prices downward but ensuring broad accessibility. Patent expirations have historically led to price compression and increased competition.

Regulatory and Patent Environment

As a generic drug, prednisolone faces limited patent protections, facilitating rapid market entry by numerous manufacturers. However, regional regulatory requirements influence drug approval timelines and, consequently, pricing strategies. Differences in regulatory standards between regions like the U.S., EU, and emerging markets impact market dynamics.

Price Trends and Projections

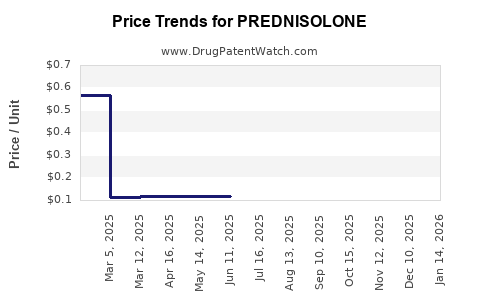

Historical Pricing Trends

Over the past decade, the price per unit for prednisolone has declined significantly, mainly due to generic competition and manufacturing efficiencies. For example:

- Oral tablets: The average retail price per 20 mg tablet decreased from approximately USD 0.50 in 2010 to USD 0.10 in 2022.

- Injectable forms: Prices have seen a similar decline, although with less volatility, due to smaller market sizes and production complexities.

Projected Price Movements (2023-2030)

- Stability in Generic Markets: Given high competition, prices for oral prednisolone are expected to decline marginally, with a projected CAGR of approximately -1% to -2%. This trend reflects ongoing price erosion due to new entrants and manufacturing efficiencies.

- Premium Formulations: Price stabilization or slight increases may occur for specialized formulations or controlled-release versions, with projected CAGR of 0% to 1%.

- Regional Variations: Emerging markets may experience slower price declines owing to regulatory barriers and procurement practices, potentially maintaining higher prices.

Impact of Brexit and Regulatory Harmonization: Industry trends suggest that regional regulatory measures may influence pricing, with potential short-term increases due to compliance costs but long-term stabilization owing to standardization.

Potential Influences on Future Pricing:

- Supply Chain Disruptions: Global events like pandemics can temporarily elevate prices due to supply constraints.

- Regulatory Changes: Stringent quality standards may slightly increase manufacturing costs, impacting prices.

- Market Entry of Biosimilars or New Formulations: Could disrupt pricing, although currently limited for a small molecule like prednisolone.

Future Market Drivers and Challenges

Drivers

- Global aging populations increasing demand for corticosteroids.

- Expansion of healthcare infrastructure in emerging markets.

- Rising prevalence of allergic and autoimmune diseases.

- Cost-effective treatment options encouraging wide adoption.

Challenges

- Price erosion due to generic competition.

- Stringent regulatory requirements prolong approval processes.

- Concerns about steroid-related adverse effects, possibly limiting yet expanding indications.

- Potential shifts towards alternative therapies or biologics with targeted action.

Opportunities and Risks

Opportunities:

- Expansion into combination products for enhanced therapeutic efficacy.

- Development of injectable or sustained-release formulations addressing niche markets.

- Strategic partnerships expanding supply to emerging markets.

Risks:

- Patent challenges or regulatory hurdles limiting generic proliferation.

- Pricing pressures from healthcare payers aiming for cost containment.

- Market saturation in mature regions.

Key Takeaways

- Prednisolone remains a cornerstone corticosteroid, with stable demand driven by its efficacy and affordability.

- The global market is projected to grow modestly, but pricing will trend downward mainly due to price competition.

- The average price per unit has declined substantially over the last decade, with further marginal decreases expected.

- Price stabilization may occur for specialized formulations, with regional variation influenced by regulatory environments.

- Strategic opportunities exist in developing niche formulations and expanding into emerging markets, whereas competitive pressures and regulatory hurdles pose ongoing challenges.

FAQs

1. What factors primarily influence prednisolone's market prices?

Market prices are chiefly affected by generic competition, manufacturing costs, regulatory compliance, and regional procurement policies.

2. How will patent expirations impact prednisolone prices?

Patent expirations facilitate increased generic entries, intensifying competition and driving prices downward.

3. Are there therapeutic innovations expected to alter prednisolone's market?

While new delivery systems and combination therapies may create niche markets, no major therapeutic innovations are anticipated to replace prednisolone broadly soon.

4. What regional differences exist in prednisolone pricing?

Pricing varies significantly, with developed regions demonstrating lower price declines due to mature competition, whereas emerging markets may sustain higher prices due to regulatory and supply chain factors.

5. What is the outlook for prednisolone amid increasing healthcare costs?

Prednisolone’s cost-effectiveness sustains its demand; however, increasing healthcare costs may pressure prices further, especially where governmental and insurance payers favor more expensive, targeted therapies.

Sources

- Grand View Research. Corticosteroids Market Size, Share & Trends Analysis Report. 2022.

- MarketWatch. Prednisolone Market Forecast & Industry Trends. 2023.

This comprehensive analysis equips stakeholders with insights into prednisolone's current market trajectory and future pricing outlook, enabling informed decision-making in pharmaceutical development, procurement, and healthcare policy.