Last updated: July 27, 2025

Introduction

Prazosin, an alpha-1 adrenergic receptor antagonist primarily prescribed for hypertension and off-label uses such as post-traumatic stress disorder (PTSD), remains a critical drug in cardiovascular therapy. As the demand shifts influenced by evolving treatment paradigms and patent dynamics, understanding prazosin’s market landscape and pricing forecasts is essential for stakeholders across pharmaceutical manufacturing, investment, and healthcare sectors.

Current Market Overview

Manufacturing and Patent Status

Prazosin’s patent expiration in the early 2000s has led to a significant rise in generic competition, resulting in a substantial price decline and increased accessibility globally. Today, multiple generic manufacturers produce prazosin, contributing to a highly competitive market environment. The drug’s active pharmaceutical ingredient (API) is manufactured predominantly in India and China, which supply a large segment of the global market at lower costs.

Market Demand and Usage Trends

The global antihypertensive market continues to expand amid rising cardiovascular disease prevalence. Prazosin remains a secondary option, often reserved for patients with specific indications such as benign prostatic hyperplasia (BPH) or PTSD-related nightmares, especially in the United States. The off-label usage for PTSD considerably influences demand numbers, notably in military and veteran healthcare sectors.

Regulatory Environment

In the United States, the Food and Drug Administration (FDA) recognizes prazosin as a generic-listed drug, which facilitates market entry and price competition. However, regulatory controls still impact manufacturing practices and distribution logistics, especially amid recent efforts to streamline generic approvals.

Market Drivers and Restraints

Drivers

- Rising Prevalence of Hypertension: Global hypertension prevalence projected to reach 1.28 billion by 2025, underpinning demand for antihypertensives including prazosin.

- Off-label Applications: Growing acceptance of prazosin for PTSD and BPH, especially in military health services, sustains demand.

- Cost-Effectiveness: The availability of low-cost generics makes prazosin a preferred choice for healthcare systems aiming for affordable treatment options.

Restraints

- Market Competition: Numerous generic formulations have suppressed pricing, limiting profit margins.

- Emerging Therapies: Newer antihypertensives with improved safety profiles and efficacy, such as angiotensin receptor blockers, threaten prazosin’s market share.

- Limited Patent Protection: Absence of patent exclusivity reduces incentives for innovation and marketing investments.

Price Trends and Forecasts

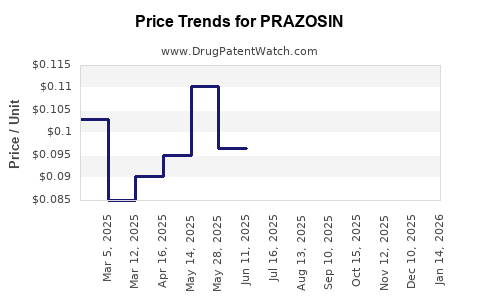

Historical Pricing Data

Since the patent expiration, prazosin’s average retail price in the United States has drastically fallen. Data from recent years illustrate a stabilization at approximately $0.03-$0.10 per 25 mg tablet, depending on manufacturer and procurement channels [1].

Projected Price Movements

Over the next five years, prices are expected to remain relatively flat or continue to decline slightly due to sustained generic competition. Advanced manufacturing efficiencies and procurement negotiations, especially within government programs, are likely to further suppress prices.

- Short-term (1-2 years): Prices are predicted to stabilize around $0.02-$0.05 per tablet.

- Medium-term (3-5 years): Slight downward pressure could reduce prices to approximately $0.01-$0.03, contingent on market consolidations and supply chain dynamics.

Influencing Factors

- Global Supply Chain Dynamics: Disruptions, such as those experienced during COVID-19, could temporarily affect prices.

- Regulatory Changes: Streamlined generic approval processes might increase manufacturing capacity, further lowering prices.

- Emergence of Biosimilars or New Sedatives: While less likely given prazosin’s chemical nature, competition from alternative therapies may influence demand and prices.

Regional Market Insights

United States

The U.S. remains the largest market owing to the high prevalence of hypertension and PTSD. The widespread availability of generics ensures competitive pricing, with minimal margins for pricing increases. Government-funded programs like Medicaid and Medicare have negotiated lower procurement prices, effectively driving prices down.

Europe

European markets mirror U.S. trends but with more regulated pricing frameworks and tender-based procurement systems. Price forecasting indicates stability with minor declines driven by increased generic penetration.

Emerging Markets

Markets in Asia, Latin America, and Africa exhibit increasing adoption due to expanding healthcare access and affordability. Price projections suggest potential for further reductions owing to local manufacturing proliferation.

Competitive Landscape

The market features several key generic manufacturers, including Indian companies such as Dr. Reddy's Laboratories, Sun Pharmaceutical, and Aurobindo Pharma, alongside Chinese entities. Brand-name versions have largely exited the market, except for niche indications. Ongoing generic consolidations may influence supply chain stability and pricing strategies.

Conclusion

The prazosin market is characterized by robust generic competition, leading to sustained low price points globally. While demand driven by hypertension and off-label applications persists, emerging therapies and healthcare system efficiencies are likely to exert continued downward pressure on prices. Stakeholders should monitor regulatory developments and manufacturing trends to adapt procurement and distribution strategies accordingly.

Key Takeaways

- Prazosin’s patent expiry has resulted in a highly competitive, price-sensitive market.

- Prices are projected to remain stable or decline slightly over the next five years, influenced by generics proliferation and supply chain factors.

- The drug’s primary market remains the U.S., with emerging markets offering growth potential due to increasing healthcare access.

- The introduction of newer antihypertensive medications and off-label use in PTSD sustains demand, though not significantly impacting pricing.

- Cost-effective generics continue to make prazosin a viable treatment option globally, especially for resource-constrained healthcare systems.

FAQs

1. What factors influence prazosin’s pricing trajectory?

Manufacturing costs, generic competition, regulatory policies, supply chain stability, and alternative therapies directly impact prazosin’s price movements.

2. How does patent expiration affect prazosin’s market?

It enables multiple companies to produce generics, increasing supply and driving prices down while reducing barriers to entry.

3. Are there any emerging therapies that could replace prazosin?

While newer antihypertensives and PTSD medications are available, prazosin retains niche uses. However, advancements may eventually erode its market share.

4. What regions offer the most growth potential for prazosin?

Emerging markets in Asia and Latin America, where healthcare access is expanding, present opportunities for increased utilization and sales.

5. How do regulatory policies influence prazosin pricing?

Streamlined approval processes for generics and procurement regulations in key markets foster increased competition, further lowering prices.

Sources

[1] U.S. Food and Drug Administration (FDA) Orange Book, 2023.