Share This Page

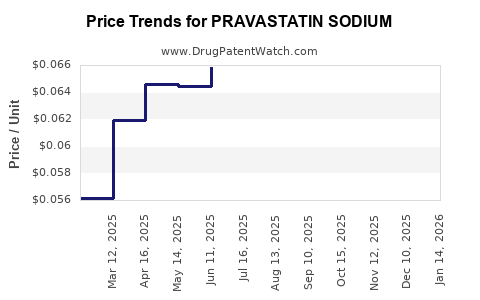

Drug Price Trends for PRAVASTATIN SODIUM

✉ Email this page to a colleague

Average Pharmacy Cost for PRAVASTATIN SODIUM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| PRAVASTATIN SODIUM 80 MG TAB | 84386-0034-99 | 0.16005 | EACH | 2025-11-19 |

| PRAVASTATIN SODIUM 80 MG TAB | 84386-0034-90 | 0.16005 | EACH | 2025-11-19 |

| PRAVASTATIN SODIUM 40 MG TAB | 84386-0033-99 | 0.08716 | EACH | 2025-11-19 |

| PRAVASTATIN SODIUM 40 MG TAB | 84386-0033-90 | 0.08716 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Pravastatin Sodium

Introduction

Pravastatin Sodium, a widely prescribed statin medication, plays a crucial role in managing hyperlipidemia and preventing cardiovascular disease. Its extensive use across global markets underscores its significance in pharmaceutical portfolios. This analysis examines the current market landscape, competitive positioning, and future pricing trends for Pravastatin Sodium, delivering strategic insights for industry stakeholders.

Market Overview

Global Prevalence and Demand Drivers

The prevalence of cardiovascular diseases (CVD), the primary indication for Pravastatin Sodium, continues to rise globally. According to the World Health Organization (WHO), CVD accounts for approximately 17.9 million deaths annually, positioning lipid-lowering agents as essential therapeutic options ([1]). Increasing awareness, aging populations, and lifestyle changes propel demand, particularly in North America, Europe, and parts of Asia.

Regulatory Landscape

Patents and regulatory exclusivity often influence availability and pricing. Pravastatin Sodium, initially protected under patent until marketed generics became widespread, now largely exists in generic form worldwide. Regulatory approvals from agencies like the FDA, EMA, and PMDA have standardized safety and efficacy profiles, facilitating global distribution.

Market Size and Segmentation

The global statins market, valued at approximately USD 13 billion in 2022, features Pravastatin Sodium as a significant segment owing to its established safety profile and cost-effectiveness. The segment is anticipated to grow at a compound annual growth rate (CAGR) of 3-4% over the next five years, driven by expanding indications and increasing cardiovascular risk management.

Competitive Landscape

Manufacturers and Market Share

Multiple pharmaceutical companies manufacture Pravastatin Sodium, including Bristol-Myers Squibb (original patent holder), Teva Pharmaceuticals, Mylan, Sandoz (Novartis), and Apotex. The shift to generics has intensified price competition, resulting in a fragmented market with low individual market shares but high aggregate volume.

Pricing Strategies

Generic manufacturers primarily compete through price reduction, with regional variations. In mature markets such as the U.S. and Europe, pricing is heavily influenced by insurance reimbursements and formulary placements. Emerging markets, including parts of Asia and Latin America, often feature lower prices due to limited healthcare spending and regulatory harmonization.

Current Pricing Trends

Pricing in Developed Markets

In the United States, the average retail price for a 30-day supply of Pravastatin Sodium (40 mg) ranges from USD 15 to USD 25, significantly discounted from branded prices due to generics. Biosimilar competition is minimal, maintaining stable price levels.

Pricing in Emerging Markets

In regions like India and Brazil, the same dosage can cost as low as USD 0.50 to USD 2 per month, reflecting low manufacturing costs and competitive bidding. Such pricing dynamics foster widespread access but may limit profit margins for manufacturers.

Impact of Patent Expiry and Generics

Patent expiration around the early 2010s catalyzed the influx of generics, precipitating a dramatic price decline. This trend is expected to stabilize, though occasional price erosion occurs with market entrants and price cuts prompted by healthcare policies.

Future Price Projections (Next 5-10 Years)

Factors Influencing Price Trends

- Market Maturity: As most markets feature multiple generics, further significant price declines are unlikely; instead, prices may stabilize or slightly decrease.

- Regulatory Environment: Price control policies in countries like India or Mexico may impose caps, limiting upward price movement.

- Biosimilars and Innovative Formulations: Introduction of new formulations or biosimilars could exert pressure, but as Pravastatin is a small molecule, biosimilar emergence is unlikely.

- Healthcare Access and Insurance Coverage: Expansion in healthcare coverage could lead to increased demand, potentially exerting upward price pressure in some regions.

Projected Price Range (2023–2033):

- Developed Markets: Prices are expected to hover around USD 10–USD 20 for a 30-day supply, with minimal fluctuations due to generic saturation.

- Emerging Markets: Prices could further decline slightly, with ranges stabilizing at USD 0.30–USD 1 per month for equivalent dosages.

- Overall Trend: Minor downward adjustments in prices are anticipated, driven by market saturation and regulatory policies, with potential stabilization.

Market Growth and Price Optimization Opportunities

Pharmaceutical companies may leverage differentiated formulations, such as combination pills or sustained-release versions, to command premium pricing. Additionally, value-added services like personalized dosing or digital adherence programs could create premium segments and justify higher prices.

Regulatory and Market Access Dynamics

Pricing strategies are increasingly influenced by government negotiations, health technology assessments (HTAs), and reference pricing mechanisms. Countries incorporating HTA findings are likely to maintain strict price controls, impacting profit margins. Conversely, markets with less regulatory oversight may offer higher price potential for innovative or differentiated Pravastatin formulations.

Key Challenges and Risks

- Market Saturation: The dominance of generics limits price growth; innovation in formulation or delivery mechanisms is required for premium pricing.

- Regulatory Pressures: Price caps and reimbursement restrictions can diminish profit margins.

- Competitive Entry: Market entry by low-cost producers threatens existing pricing stability.

- Drug Shortages or Supply Disruptions: These can temporarily impact pricing and market shares.

Conclusion

The Pravastatin Sodium market is mature, with pricing predominantly driven by generic competition. Near-term outlook indicates stable to slightly declining prices across regions, with minimal upside unless novel formulations or value-added services are introduced. Industry players should focus on differentiation and market access strategies to optimize profitability amid ongoing price pressures.

Key Takeaways

- Market maturity leads to stabilized prices, with most regions experiencing low-cost generic availability.

- Pricing in developed markets remains relatively stable, constrained by insurance and formulary dynamics.

- Emerging markets offer opportunities for low-cost access, though profit margins are limited.

- Future price reductions are unlikely, barring disruptive innovations or policy changes.

- Differentiation through value-added services may provide premium pricing pathways in a competitive landscape.

FAQs

1. How has patent expiration impacted Pravastatin Sodium pricing?

Patent expiry marginalized branded prices, leading to a surge in generic competitors and significant price reductions, especially in mature markets.

2. Are biosimilars or next-generation formulations expected for Pravastatin Sodium?

Given its small-molecule structure, biosimilars are unlikely. Future innovations may include combination therapies or novel delivery systems, but widespread biosimilar development for Pravastatin is improbable.

3. What regional factors influence Pravastatin Sodium pricing?

Regulatory policies, healthcare infrastructure, market competition, and reimbursement schemes impact regional prices. Developed countries typically see higher prices due to insurance, while emerging markets maintain lower costs.

4. How can manufacturers maintain profitability amidst price competition?

Through product differentiation, value-added services, entering niche markets, or leveraging regulatory exclusivities for specific formulations.

5. What is the long-term outlook for Pravastatin Sodium’s market price?

Prices are expected to stabilize with minimal fluctuations over the next decade, with slight declines due to market saturation and pricing pressures.

References

- World Health Organization. Cardiovascular Diseases Fact Sheet. 2020.

- Grand View Research. Statins Market Size & Trends. 2022.

- U.S. Food and Drug Administration. Approved Drug Products. 2022.

- IQVIA. Worldwide Medicines Market Data. 2022.

- EvaluatePharma. 2023 World Preview: Outlook to 2028.

More… ↓